[ad_1]

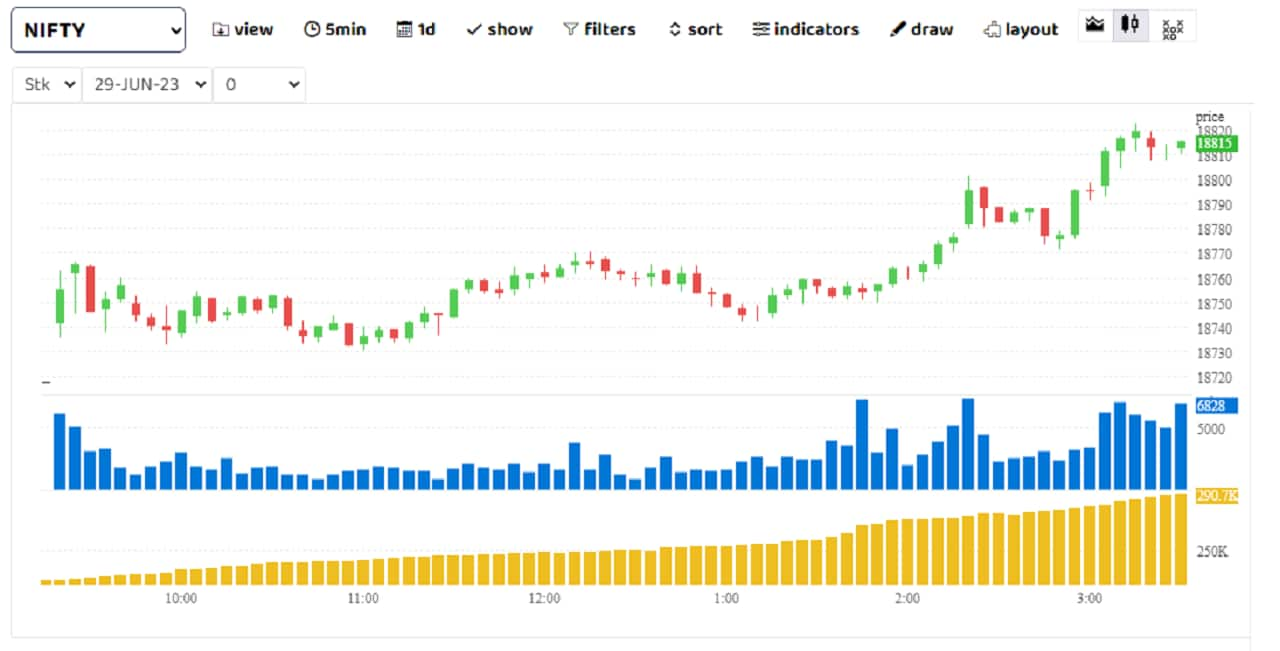

Markets extended rebound on June 27. After the initial uptick, Nifty drifted lower but gradual recovery in the heavyweights across sectors helped to settle around the day’s high. Among the sectoral indices, banking, financials and realty were the top gainers. The broader indices also edged higher and gained nearly half a percent each. The Nifty ended the day at 18,817.40, up 0.68 percent or 126 points. (Blue bars show volume and golden bars open interest (OI).)

Markets extended rebound on June 27. After the initial uptick, Nifty drifted lower but gradual recovery in the heavyweights across sectors helped to settle around the day’s high. Among the sectoral indices, banking, financials and realty were the top gainers. The broader indices also edged higher and gained nearly half a percent each. The Nifty ended the day at 18,817.40, up 0.68 percent or 126 points. (Blue bars show volume and golden bars open interest (OI).)

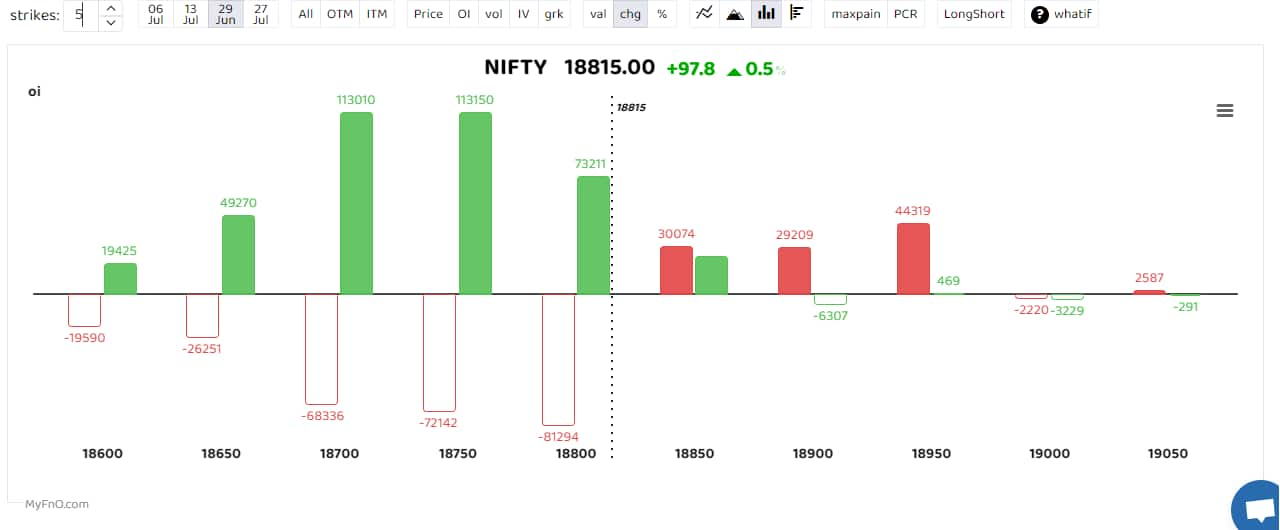

Analysts said the shift in expiry from Thursday to Wednesday may have triggered short covering in the Index today leading to rapid movement in it, post the announcement. “Put writing for both tomorrow’s expiry and the July expiry saw significant OI build up. The 18900 and 19000 puts as well saw build up indicating that the all-time high level could be achieved this week itself. What is more important to note is that, Bank Nifty also saw participation in this move to the upside and saw equally large put writing,” said Rahul Ghose, Founder & CEO – Hedged. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

Analysts said the shift in expiry from Thursday to Wednesday may have triggered short covering in the Index today leading to rapid movement in it, post the announcement. “Put writing for both tomorrow’s expiry and the July expiry saw significant OI build up. The 18900 and 19000 puts as well saw build up indicating that the all-time high level could be achieved this week itself. What is more important to note is that, Bank Nifty also saw participation in this move to the upside and saw equally large put writing,” said Rahul Ghose, Founder & CEO – Hedged. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

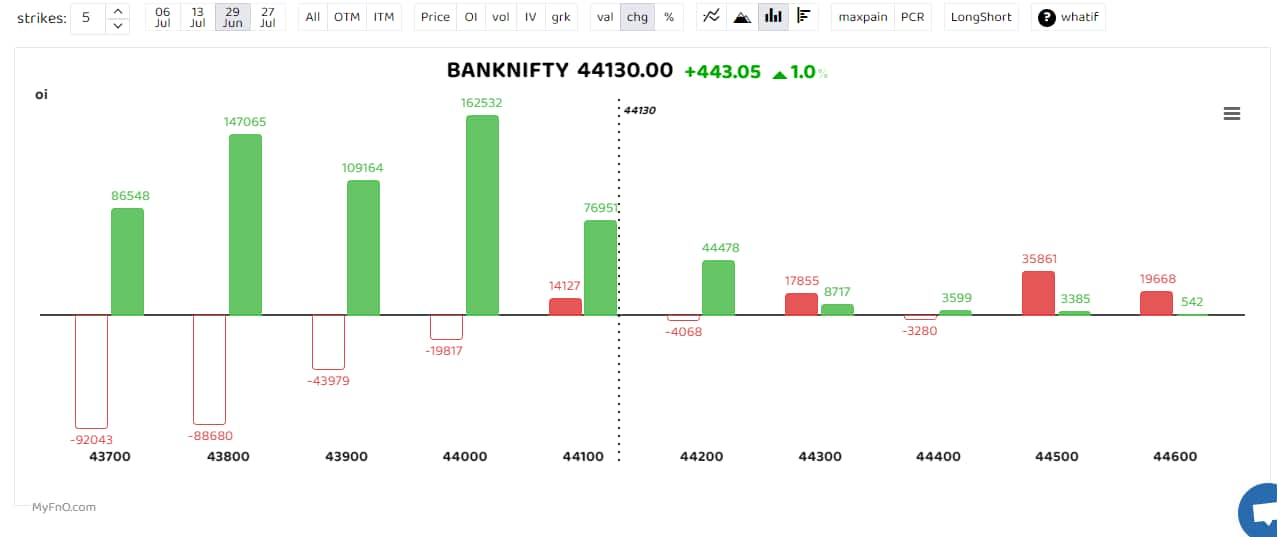

The Bank NIFTY index witnessed a strong bullish move as the bulls took control and surpassed the hurdle of 44,000. “This breakout occurred following the announcement of the merger date of HDFC twins. The surge in buying pressure forced the writers of 44000 call options to cover their positions. If the index manages to sustain above the 44000 level, it is likely to continue its upward momentum towards the 44500 level,” said Kunal Shah, Senior Technical & Derivative analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

The Bank NIFTY index witnessed a strong bullish move as the bulls took control and surpassed the hurdle of 44,000. “This breakout occurred following the announcement of the merger date of HDFC twins. The surge in buying pressure forced the writers of 44000 call options to cover their positions. If the index manages to sustain above the 44000 level, it is likely to continue its upward momentum towards the 44500 level,” said Kunal Shah, Senior Technical & Derivative analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

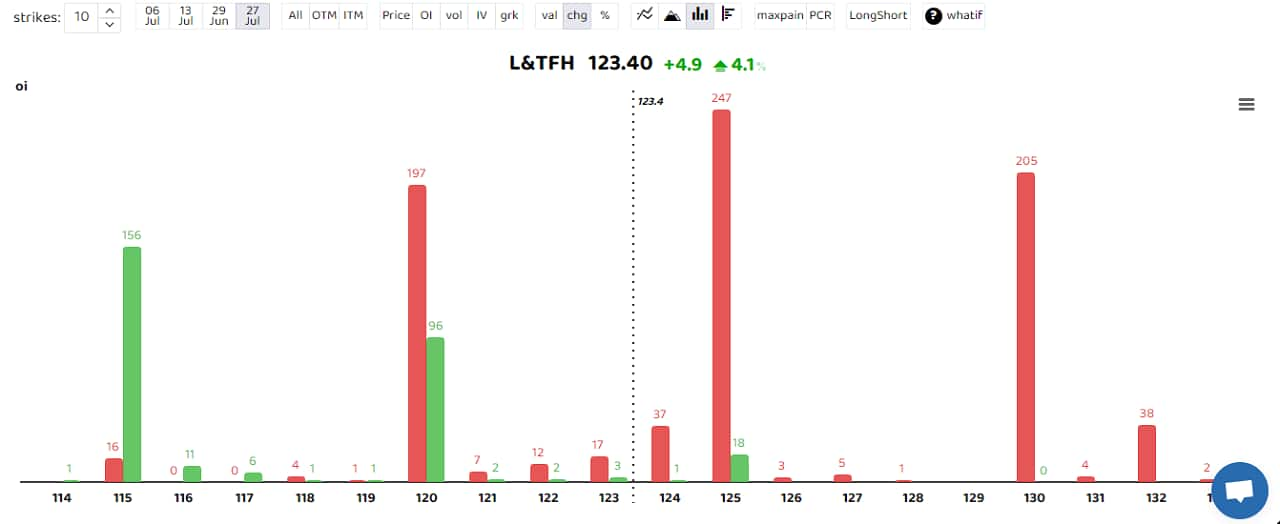

L&T Financial Holdings saw a long buildup with open interest rising 111 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Max Financial, AB Capital and CanFin Homes were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

L&T Financial Holdings saw a long buildup with open interest rising 111 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Max Financial, AB Capital and CanFin Homes were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

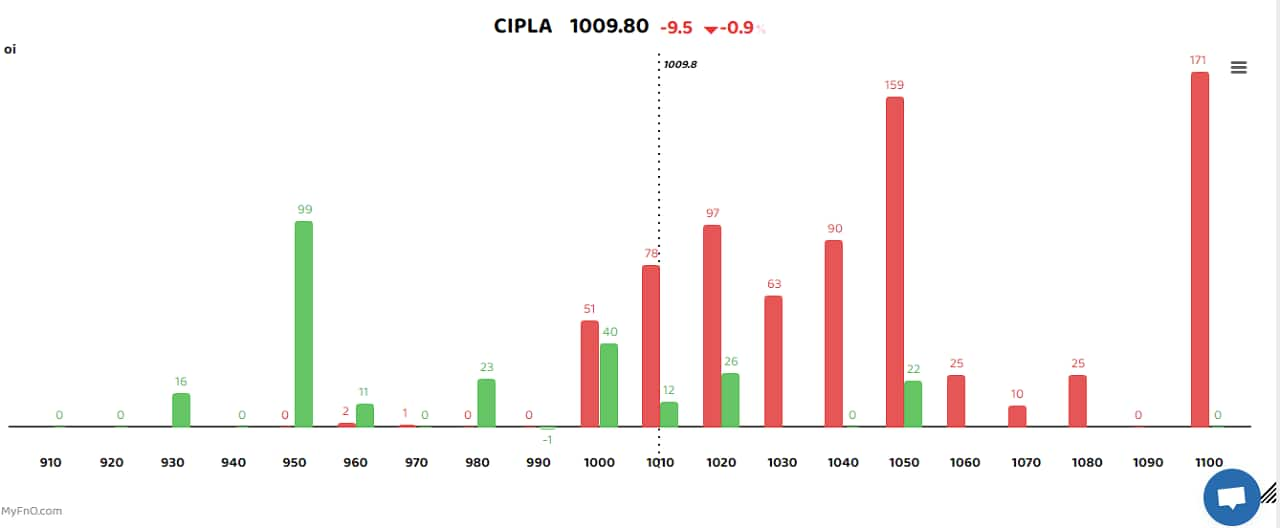

Cipla was among those that saw short buildup with open interest jumping 46 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Cipla was among those that saw short buildup with open interest jumping 46 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

[ad_2]

Source link