[ad_1]

Key points

- Production of beef and lamb hindered in 2023 by poor grass growth and high feed costs

- Beef production expected to fall by 3.1% from last year, with a 1% fall forecast for 2024

- Sheep meat production expected to decline by 1.8%, with a 1% decline anticipated for 2024

- Consumption limited by cost of living cutbacks and inflationary pressures

- Trade is hampered by high domestic prices

Beef

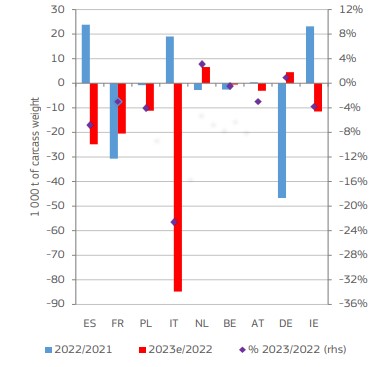

For the remainder of 2023, beef production is expected to recover from its poor performance in the first half of the year to some extent, thanks to lower feed prices and higher carcase weights. This is expected to leave production at -3.1% versus 2022 levels for the full year. This recovery could continue in 2024, with a smaller, 1% fall in production anticipated for the full year, if feed prices continue to fall. This is closer to the general trend of structural decline seen in previous years.

Per capita beef consumption is predicted to fall to just under 10kg – a fall of 3.5% – as consumers face multiple cost of living challenges and may switch to cheaper proteins. Per capita consumption is expected to fall again in 2024, but to a lesser extent (-1%).

EU trade is expected to be impacted by higher domestic prices. Exports are less competitive on the international stage, potentially contributing to reduced volumes sent to markets such as Japan and the USA. EU beef imports fell in the first half of the year despite lower domestic production. Lower imports from the UK have not been outweighed by growth from South America. High domestic prices are expected to make the EU an attractive marketplace for imports in 2024, with the European Commission forecasting growth of 5%.

Jan – June change in EU beef production

Source: DG Agriculture and Rural Development, based on Eurostat.

Sheep meat (includes goat meat)

The EU sheep flock is expected to contract for the remainder of 2023, due to lower grass availability, higher feed costs, and outbreaks of disease. As a result, production is expected to fall by 1.8% for 2023 compared to last year, with a lower drop of 1% for 2024.

Sheep meat is one of the most expensive types of red meat and is likely to suffer from inflationary pressures similar to beef. However, sheep meat has the advantage of its position for consumption at religious events throughout the year. As a result, consumption is expected to remain relatively stable at +0.8% for 2023.

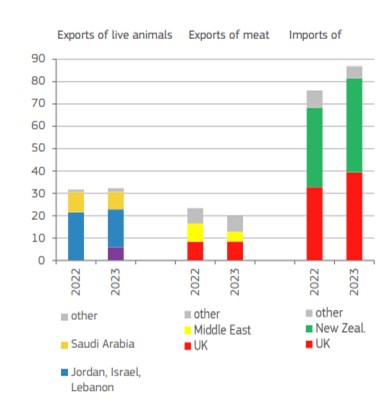

High prices for sheep meat are expected to limit its export potential for the remainder of 2023, as prices are less internationally competitive, and product stays on the domestic market. Volumes exported to key Middle Eastern countries fell by 13% in the first half of the year and are not expected to pick up for the remainder. Export volumes are therefore predicted to decline by around 10% compared to last year, with slight recovery in 2024 to -6% from 2023 levels if prices ease.

Looking at imports, growth in production and competitive prices in New Zealand are expected to boost import volumes into the EU. Volumes could grow by 10% by the end of 2023 from last year, with a further boost of 4.5% for 2024, as Oceania countries look for other outlets for their product given sluggish Asian demand.

Jan – June EU sheep and goat trade by main partners (1Kt)

Source: DG Agriculture and Rural Development, based on Eurostat.

[ad_2]

Source link