[ad_1]

Key trends:

- EU references prices have declined for 4 consecutive weeks, although the rate of decline is mixed across the region

- Weather over the summer has negatively impacted demand on the continent

- The UK vs EU price differential has grown, returning to a historical average

Market overview:

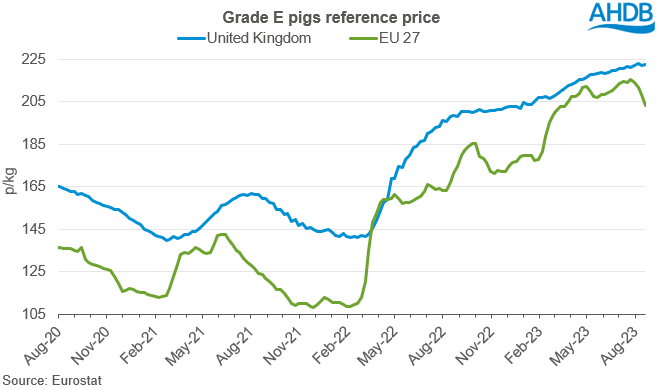

Since peaking at the record high of 215.47p/kg in the penultimate week of July, EU pig reference prices have been in steady decline, losing just over 12p/kg in four weeks. Pig kill remains low in the EU, suggesting the drop in prices is predominantly driven by easing demand. There have been some reports of over supply on the continent, as unfavourable summer weather in some regions has limited the BBQ market. Higher pig prices have also been driving up the unit value of exported product.

This has led the differential between the EU reference price and UK reference price to increase to 19.5p/kg in the week ending 20 August. This is a return to more normal trends seen over the last couple of years, with the price difference in recent months trending at historical lows.

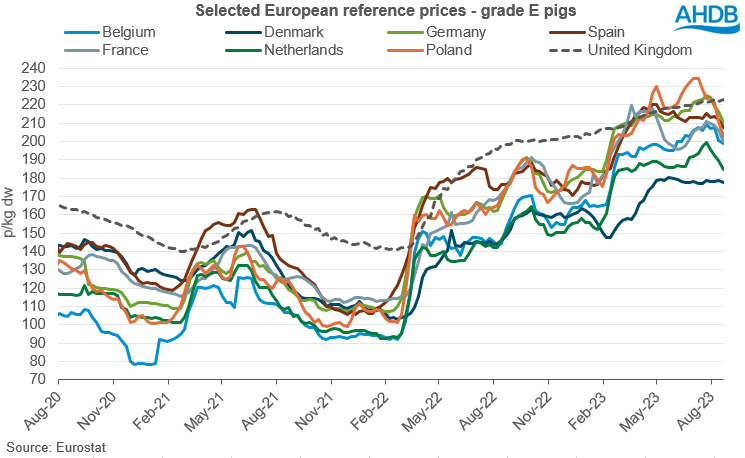

The rate of decline has been mixed across the region. The largest price decline has been recorded in Poland, where prices have fallen by 20.7p over the period (w/e 23 Jul – 20 Aug). Polish pig prices have been falling for seven consecutive weeks having peaked in early July. Meanwhile, Danish pig prices have been relatively flat since the beginning of June. Weekly movements have been both positive and negative in Denmark, resulting in the price only dipping by 1.3p/kg over the reporting period.

Belgium, France, Germany, and the Netherlands have all lost between 10 – 15 p/kg in the four weeks ending 20 Aug, with the most significant changes being recorded in the final week. Spain has seen slightly smaller movements, with prices moving downwards just shy of 8p in the last four weeks, over 4p of this occurred in the most recent week.

Although prices are easing, they remain significantly elevated from those seen a year ago. Pig producers on the continent have been suffering similar financial pressures to those in the UK with input cost inflation skyrocketing last year. The cost of key inputs has eased in recent months, relieving some of the pressure on farm margins, however costs are likely to remain historically high for the foreseeable with the global economy recovering after covid19 and geopolitical tensions continuing to run high. This also impacts processors, with many of their running costs having seen substantial increases, pair this with lower kill volumes and margins are tightened. This has led to some large adjustments in the industry structure, such as abattoir closures.

Impact on UK

There are some concerns that the UK market will start to follow the price trends seen in the EU, which are not unjustified with the two markets very closely connected. However, it appears that the UK market may be more balanced. Supplies remain tight and demand seems to be holding up, although purchased volumes vary by product, with the peak pork demand period of Christmas still a little way off.

But lower EU prices does increase the competitiveness of the region’s exports. If UK prices remain steady, easing EU prices could attract more import demand, both domestically here in the UK and from elsewhere in the world. A key factor will continue to be supply, with EU production forecast to end 2023 down year on year for the second consecutive year. This may limit EU value declines, especially when compared to key international producers such as the US and Brazil, who currently have prices well below the EU and UK.

[ad_2]

Source link