[ad_1]

After a brief dip below the $1,400 level for the first time in nearly two months earlier in the session, Ether (ETH) has managed to regain a modicum of composure in wake of the release of a mixed US jobs report for February.

ETH, the cryptocurrency that powers the smart-contract-enabled Ethereum blockchain, was last changing hands close to $1,425, after US wage growth came in cooler than expected and following a surprise jump to 3.6% in the US unemployment rate.

That still leaves Ether still down close to 1.0% on the session and close to 7.0% lower in the last 24 hours. The ETH price cratered from the mid-$1,500s on Thursday amid a combination of concerns relating to the collapse of crypto-friendly Silvergate Bank and a growing liquidity crisis at fellow crypto-friendly bank SVB Financial.

Sell pressure was exacerbated after the New York Attorney General referred to Ether as a security in its ongoing lawsuit against KuCoin. Crypto markets have been fretting about a regulatory crackdown from US authorities in recent weeks and some fear the US Securities and Exchange Commission may soon attempt a crackdown on Ether, claiming it to be an unregistered security.

Some have also cited the Biden administration’s latest budget, which would seek to crack down on crypto tax loss harvesting, as a headwind for prices.

ETH Liquidations Spike as Price Collapses

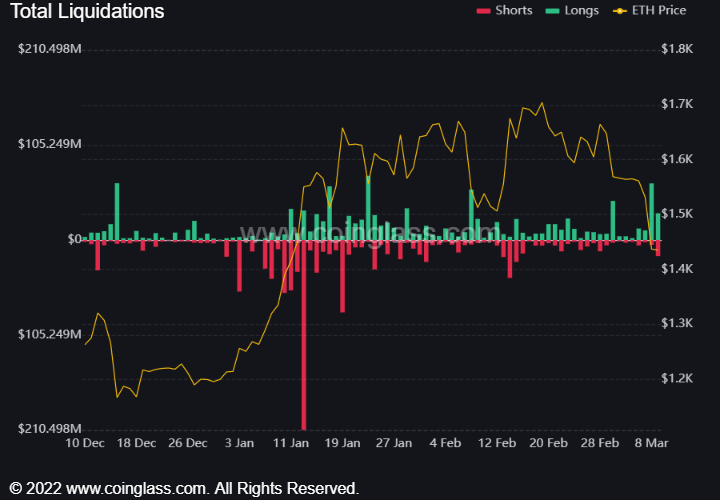

The latest tumble in the ETH price has unsurprisingly resulted in a spike in leveraged long-position liquidations. Long future’s positions worth nearly $63 million were wiped out on Thursday, according to data presented by coinglass.com, the highest since the 23rd of January.

Long liquidations on Friday are also already around $30 million, substantially higher than the average level of recent weeks.

Options Markets Turn Bearish

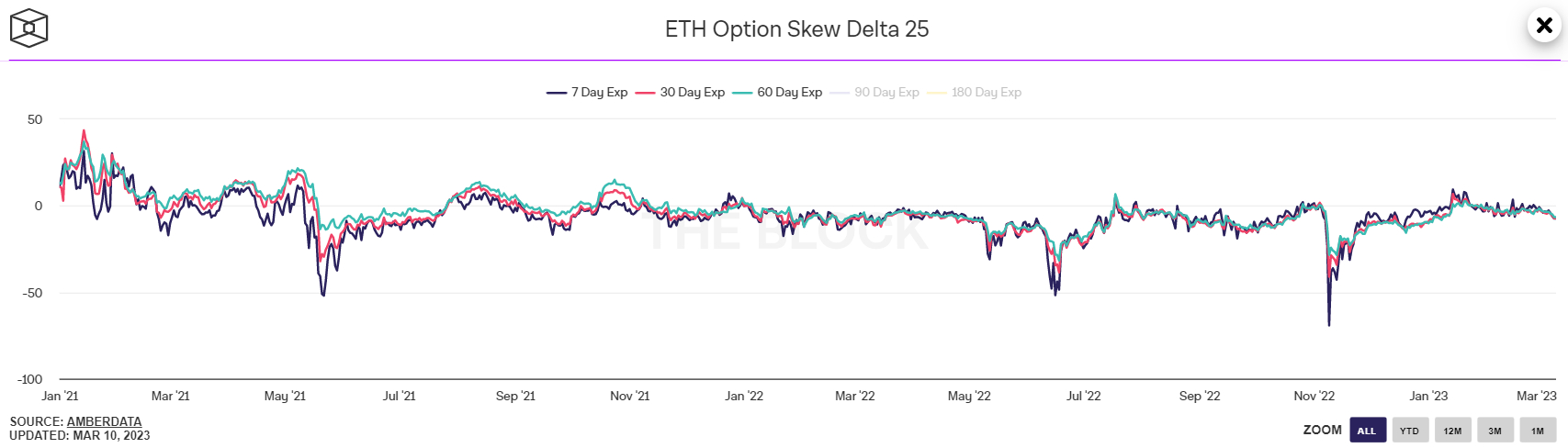

Investors are increasingly positioning for the risk that the latest downturn in the ETH price extends, according to options market data presented by The Block. The 25% delta skew of Ether options expiring in 7, 30 and 60 days have each fallen to new two-month lows in the -7 area.

The 25% delta options skew is a popularly monitored proxy for the degree to which trading desks are over or undercharging for upside or downside protection via the put and call options they are selling to investors. Put options give an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta options skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies there is higher demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

Where Next for Ether (ETH) as Bulls Hold $1,400 Level?

The fact that ETH has been able to hold above the $1,400 level, for now, means that there hasn’t yet been a sustained, convincing break below the key 200-Day Moving Average level at $1,423. The 200DMA acted as strong resistance in 2022 and has been touted as a key support level for 2023.

A break below it would be a massive blow to the medium-term bullish ETH thesis, as a sustained break above the 200DMA (as seen earlier this year) is seen as a key indicator of a positive shift in the market’s medium-term momentum. If ETH falls back under $1,400, this momentum would have arguably evaporated.

Eyes will be on next week’s key US CPI inflation data release. ETH bulls will be hoping that the data surprises to the downside, resulting in markets further pricing out the risk of a 50bps rate hike from the Fed later this month. Bulls will also be hoping for some calm relating to the troubles faced by crypto-friendly US banks.

Key resistance to keep an eye on if ETH does bounce is around $1,460 in the form of the February lows. Meanwhile, to the downside, bears will be eyeing a retest of support at $1,350. A break below here could open the door to a retest of last November’s lows under $1,100.

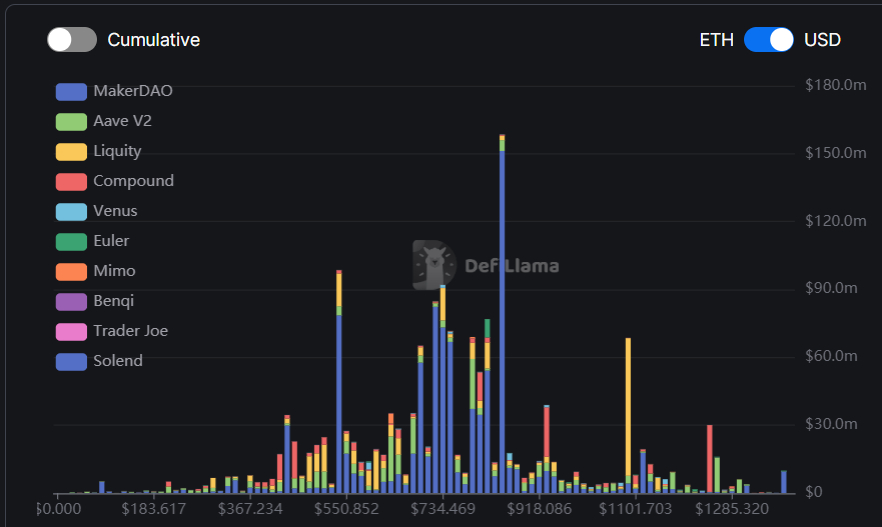

According to DeFi Llama citing on-chain data, this is a key area of support given that a break below it would spark a massive $68 million in liquidations in long positions taken out on decentralized exchanges (DEX). Another level to watch, according to DeFi Llama, is around $1,240, where $30 million in DEX long are at risk of being wiped out.

[ad_2]

Source link