[ad_1]

BHP has been setting and achieving operational greenhouse gas (GHG) emissions reduction targets since the 1990s. Our current target is to reduce operational GHG emissions (Scope 1 and Scope 2) by at least 30 per cent from FY2020 levels by FY2030, with a long-term goal of net zero operational GHG emissions by 2050.

In FY2023, we reduced our operational GHG emissions by 11 per cent from the previous year (FY 2022), and to a level that is 32 per cent below FY2020 levels. This has caused some to ask whether BHP’s target is ambitious enough. After all, on the face of it, we are currently tracking ahead of our FY2030 target.

BHP’s key products are expected to play a vital part in enabling the world’s response to climate change, and we plan to grow our production to meet this demand while simultaneously working to decarbonise our operations. BHP has multiple growth projects in execution and further growth options being studied, collectively supporting 13 per cent production growth to 2030. The challenge of decarbonisation at BHP is compounded by this growth in production, which can only be delivered by increased activity at our operations. And while a range of GHG emissions abatement solutions are available and deployed at BHP today, the technology to abate our largest remaining operational GHG emissions sources (diesel and fugitive methane) is not yet developed or commercially available. Analysis of business growth, technology development, commercialisation and deployment timelines indicate that BHP’s future emissions reduction pathway will not be a straight line – there will be times of rapid emissions decline and some temporary periods of emissions growth. We refer to this path as non-linear.

So, let’s look more closely at BHP’s operational emissions reduction target and goal and how we are progressing towards it.

To date, BHP’s GHG emission reductions have been achieved primarily by changes to our electricity supply. Most of BHP’s operated assets are grid-connected, enabling a rapid decrease in emissions by leveraging mature technology options such as wind and solar through signing renewable Power Purchase Agreements (PPAs). Renewable electricity PPAs for our operated assets have supported Scope 2 emissions reductions of 70 per cent since FY2020 (adjusted for methodology changes and divestments). When signing PPAs, we aim to prioritise and incentivise new generation where commercially feasible, with eight out of nine of our current PPAs wholly or partially enabling new generation. All executed PPAs to date have been commercially attractive and operationally low risk, enabling reductions to our operational GHG emissions at low or no additional cost.

To counter growth in business activity, we plan to deploy additional renewable energy before FY2030. While competition for lower-carbon electricity will increase, we remain intent on increasing the proportion of renewable electricity supply for our operations.

But how are technology solutions shaping up to drive emissions reduction in areas other than renewable electricity? With the reduction in electricity emissions, combustion of diesel for use in resource extraction and material movement now represents our largest source of operational GHG emissions. Our preferred pathway is to eliminate this diesel by electrification through battery electric equipment. This technology does not yet exist at scale, so we are collaborating with equipment manufacturers and others across the industry to accelerate development. When equipment is available, we will run trials at our sites to validate assumptions. We expect to have our first Caterpillar truck for on-site trials in 2024 and will move to trial Komatsu soon after. Following successful trials, current estimates are that commercially available battery electric equipment will be available at scale by the end of the decade.

The availability of battery electric technology is only part of the solution. With the move from diesel to electricity, the amount of power we need at our mines will significantly increase and we cannot start implementing electric equipment until this power can be reliably delivered. This will require additional renewable generation and battery storage as well as upgrades to electrical transmission and distribution systems. This means electric trucks and other equipment will be deployed in a site-by-site approach as we optimise the roll-out. Due to these variables, the transition towards full diesel displacement will not be linear nor easily predicted. But we are doing the right work now, collaborating with others and learning from trials to accelerate where we can and create certainty for the future.

And what about fugitive methane emissions from coal mining? Even accounting for current methane emissions, our BMA asset is one of the lowest carbon intensity emitters among our competition, positioned around the lowest quartile for GHG emissions per unit of metallurgical coal production. To continue progress, we must pursue options to reduce methane emissions. While methane can be captured and flared for underground mines, reducing emissions in open cut mines is not as straightforward. Methane is currently released as the coal seams are broken up. So, in the future we will consider pre-draining to extract this before we mine. There are current technologies, that have yet to be trialled at scale in open-cut contexts, that provide the possibility for around 50% of methane at sites such as BMA to be pre-drained and used, however this requires major technological and planning advancement and further investment. Adding further to the complexity, there is a naturally occurring variance in methane concentration in different parts of an operating mine.

It is clear, like GHG emission reductions from the displacement of diesel, that the path to reducing methane emissions at BHP will not be linear over the next three decades and will depend on several realities that are reflective of mining operations, technology availability, production, and gas content.

So, what does all this mean for our FY2030 target? While the deployment of mature renewable electricity technology has delivered year-on-year emissions reduction at BHP’s operations and will continue to contribute over the coming years, we are entering into a period of less predictability, particularly for our largest remaining emissions sources of diesel combustion and fugitive methane. As a result, progress towards our FY2030 target is expected to be non-linear for some time to come as we implement new technologies and integrate the timing with our mine plans and their respective fleet replacement cycles, contract termination dates, and other key inflection points.

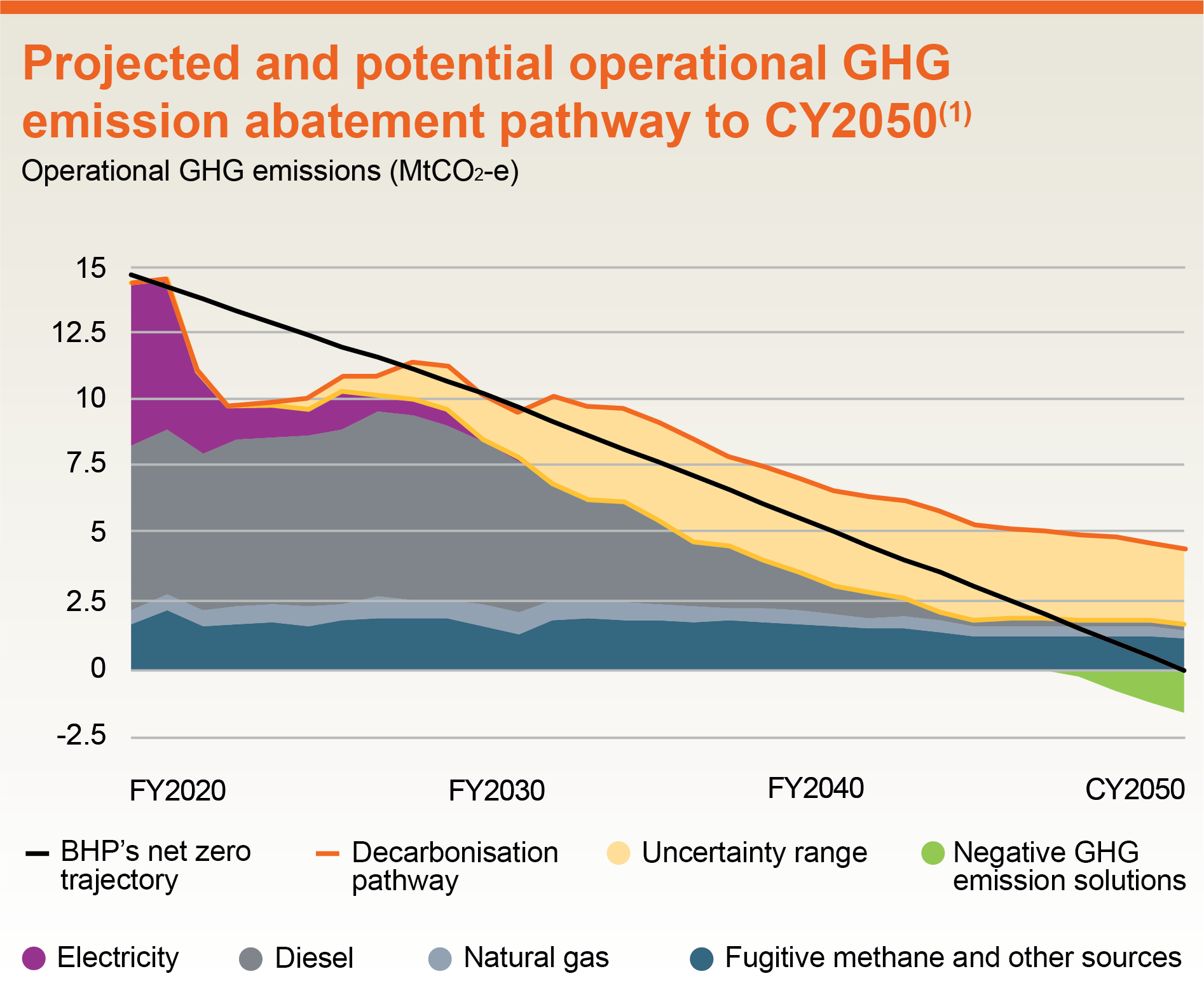

BHP’s projected and potential operational GHG emissions abatement pathway to CY2050 is shown in the chart below. This decarbonisation pathway aggregates all planned structural abatement projects and incorporates planned business growth, excluding former OZ Minerals assets for now. To move faster than our decarbonisation pathway, we will be reliant on the availability of technology still under development, and related factors, as discussed above. We have labelled this potential abatement the “range of uncertainty”. And we can see a conceptual pathway to our goal of net zero in 2050.

In an ideal world, the emissions reduction successes we’ve seen to date would continue, year-on-year. But BHP’s decarbonisation path is based on our actual mining plans. Our path is founded on a realistic acknowledgement that the roadmap for such a journey is dependent on emerging technology and will be neither linear nor easy. And we continue to transparently hold ourselves to account as we progress towards our FY2030 target and 2050 goal.

Footnotes:

(1) Future GHG emission estimates are based on latest annual business plans. Excludes acquired OZ Minerals assets and plans. FY2020 to FY2022 GHG emission data has been adjusted for methodology changes and divestments; for more information refer to Metrics, targets and goals, in BHP’s Annual Report 2023 OFR 6.12. ‘Decarbonisation pathway’ represents planned decarbonisation activities to reach BHP’s operational GHG emission reduction target and goal. ‘Uncertainty range’ refers to higher-risk options currently identified that may enable faster or more substantive decarbonisation, but which currently have a relatively low Technology Readiness Level, higher operational integration risk and/or are not yet commercially available and includes projects that may require changes to recognition of carbon sequestration such as mineral carbonation. ‘BHP’s net zero trajectory’ refers to a hypothetical straight line between our FY2020 baseline and FY2030 medium-term target and another hypothetical straight line between our FY2030 medium-term target and CY2050 long-term goal. ‘Negative GHG emission solutions’ include carbon credits (avoidance, reductions or removals) or other technologies that result in emission reductions. This shows the requirement in order to reach net zero if decarbonisation at the lower line of the ‘Uncertainty range’ were achieved (but does not reflect probability). ‘Fugitive methane and other sources’ includes (as part of ‘other sources’) other feedstocks and heat sources, such as coal, coke, fuel oil and LPG, and use of self-generated carbon credits. GHG emission calculation methodology changes may affect the information presented in this chart. ‘Fugitive methane and other sources’ is estimated in accordance with the Australian National Greenhouse and Energy Reporting measurement methodology and does not reflect the tendency for methane density to increase as coal mines deepen, due to current uncertainty with respect to future opportunities to manage methane at our BMA mines. Forecast information is subject to change due to technical, operational or commercial risks that may impact future outcomes.

[ad_2]

Source link