[ad_1]

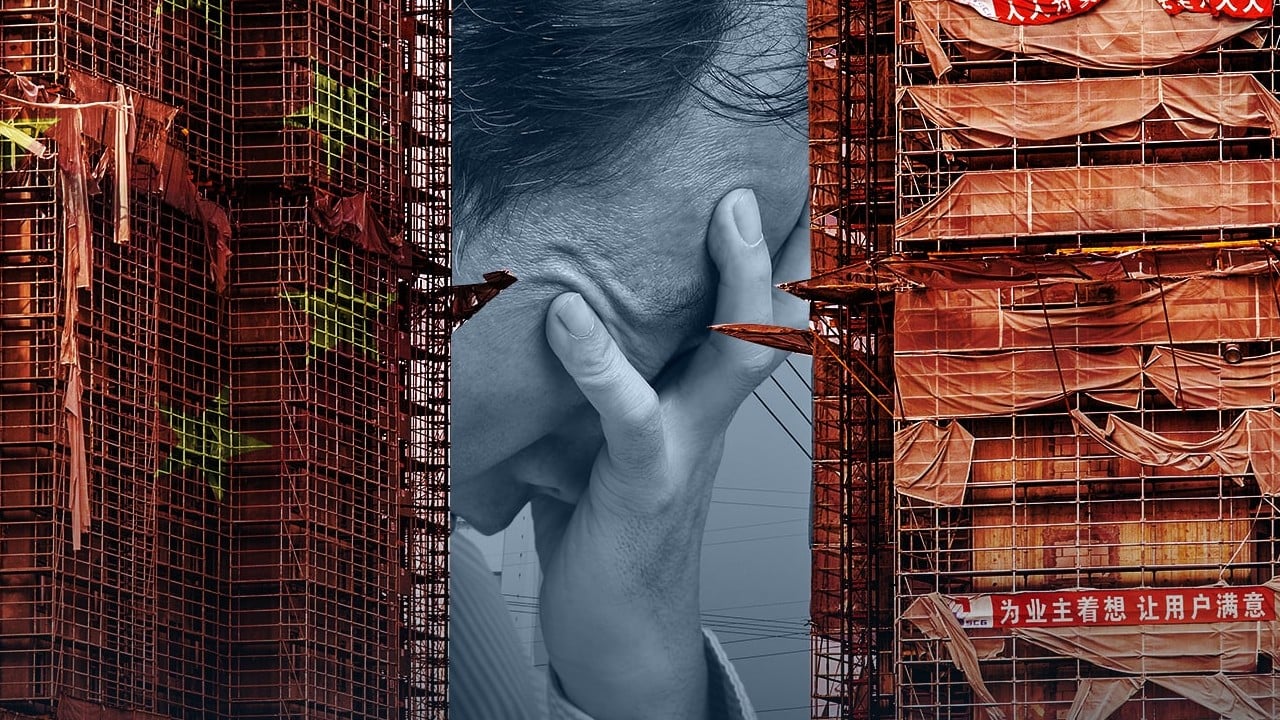

China’s share of Asia’s dollar junk bond market is shrinking fast after three years of a real estate slump, prompting investors to search for yields outside the debt-plagued sector and the country, according to BEA Union Investment.

The onshore property market is yet to bottom out as Beijing’s policy moves have mostly focused on propping up demand in big cities, instead of addressing developers’ funding squeeze, said Pheona Tsang, chief investment officer of fixed income at the Hong Kong-based money manager. More property debt defaults cannot be ruled out, she added.

“There are still a lot of choices within the Asian high-yield market that we can diversify into,” Tsang said in an interview with the Post. “Macau gaming is one of our overweight sectors as it benefits from China’s reopening. We like [credit in] major countries including India and Indonesia.”

BEA Union is the Asia-focused joint venture of Bank of East Asia and Union Investment, a unit of Germany’s second-largest lender, DZ Bank. The firm had US$7.6 billion of assets under management on March 31.

Once Asia’s largest such market, snowballing defaults since 2020 have reduced the Chinese junk-rated bond universe by 85 per cent in an index compiled by Intercontinental Exchange and Bank of America (BofA), as the pool of bonds issued by mainland Chinese developers has dried up.

China’s shadow banking crisis could threaten the broader economy, analysts warn

China’s shadow banking crisis could threaten the broader economy, analysts warn

The index currently has 48 constituent bonds worth US$18.4 billion, including 32 property bonds valued at US$4.8 billion. Back in February 2020, the index tracked 238 bonds worth about US$126 billion, including 187 bonds worth US$100 billion issued by Chinese developers.

Tsang manages the US$182 million Asian Bond and Currency Fund, which had 43 Chinese property bonds in its portfolio on August 30, according to Bloomberg data. It had 105 of them in the first quarter of 2020, including those issued by Sunac China, Kaisa Group and CIFI Holdings, just before the Covid-19 pandemic and Beijing’s industry-crippling “three red lines” policy kicked in.

Moody’s downgrades China property sector outlook, Fitch trims GDP forecast

Moody’s downgrades China property sector outlook, Fitch trims GDP forecast

“For the current setting, there can be more defaults among private developers,” said Tsang, given the fresh financial struggles at Country Garden Holdings and Sino-Ocean, and recent fears about a possible blow-up in China’s shadow-banking industry.

Her view resonates with market concerns about the state of China’s property market, which have arisen despite state-driven measures to spur home purchases in many mainland cities. Global funds have singled out the sector as the most likely source of a global credit risk event, a recent BofA survey showed.

Chinese property stocks, bonds regain favour as global funds rue credit risk

Chinese property stocks, bonds regain favour as global funds rue credit risk

The fund has had a high cash level over the past two years to preserve its capital, but it is now “quite fully invested”, Tsang added.

Asian credit from issuers in India and Indonesia is now presenting attractive opportunities, she said. She also favours Macau’s gambling industry, “which is in a good position”, as its mass-market revenue has recovered to 90 per cent of pre-Covid-19 levels and generated enough cash flow to help casino operators trim their leverage.

MGM China is turning Macau hotels into ‘vehicle for culture and art’: Pansy Ho

MGM China is turning Macau hotels into ‘vehicle for culture and art’: Pansy Ho

India’s renewable energy sector is very attractive with stable, recurring cash flow for the next 20 years, Tsang said. Indonesia’s oil and gas sector could also provide good returns from the commodity boom, she added. The fund’s top 10 holdings included Greenko Solar, India Green Energy and Medco Energi, according to its July fact sheet.

Elsewhere, bonds issued by Chinese technology companies and state-backed entities remain in demand as the appetite for Chinese investment-grade credit is strong, she added. South Korean financials are also attractive because of cheap valuations.

High-grade bonds could also perform with the US Federal Reserve seen approaching the end of its policy tightening, after boosting its target rate for Fed funds from near zero in March 2022. Some economists are forecasting the Fed will start cutting its key rate from next year.

“If we look at history, Asian investment-grade bonds really performed when the Fed finished hiking rates,” Tsang said. The returns can reach 8 to 12 per cent and investors should buy before the Fed rolls back some of the rate increases since its lift-off in March 2022, she added.

[ad_2]

Source link