[ad_1]

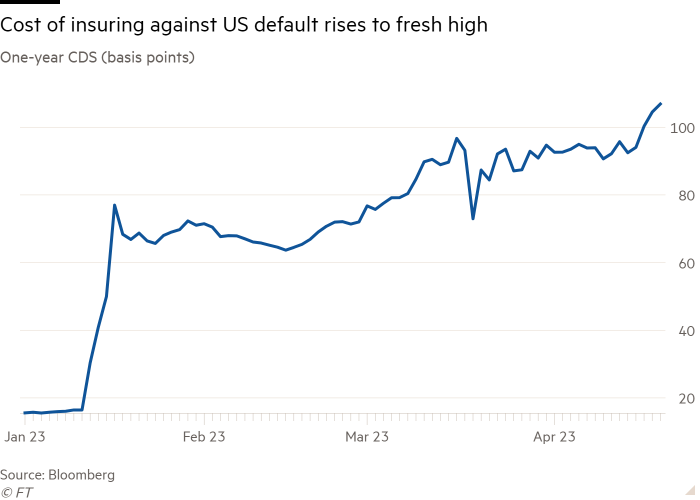

The price of insuring against a US government default rose to a fresh high this week as traders began pricing in their concerns that the world’s biggest economy might not meet its financial obligations.

One-year US credit default swaps — derivatives that act like insurance and pay out if a company, or country, reneges on its borrowings in the next 12 months — are trading at 106 basis points, Bloomberg data shows.

That is its highest level since at least 2008, up from 15 basis points at the start of the year, and far in excess of 2011 levels, when a stand-off in Washington over the US debt ceiling led to the country losing its top-notch triple-A credit rating. Negotiations this year in Washington over raising the federal borrowing limit are currently deadlocked.

The rise underscores how investors are moving to protect against, or profit from, a default even though it is still viewed as unlikely.

Analysts said the market for one-year swaps was relatively small and illiquid, rendering it difficult to use as a gauge of market expectations of a US default.

Even so, CDS for the most creditworthy countries typically trade between 25 and 50 basis points, according to analysts at ING. “The US is clearly considered a much higher default risk than most [other countries],” said Antoine Bouvet, the bank’s head of European rates.

He pointed out that equivalent CDS for Italy, the UK and Greece were currently trading at 39, 14 and 46 basis points, respectively. “Genuine” near-term default candidates see spread levels in the thousands. Even so, “markets aren’t relaxed about the risk of US default”, Bouvet said.

Indeed, the price of five-year credit default swaps — the most widely traded form of debt insurance — also reached its highest level in more than a decade this month, at 50 basis points.

Lower than expected April tax revenues have only heightened those concerns, dragging forward the so-called “X-date” when the US Treasury runs out of money.

Money market funds flush with cash after the collapse of three banks last month registered $69bn of outflows in the week ending April 19 as Americans rushed to meet the deadline to send payments to the Internal Revenue Service.

The Treasury cash balance now sits at roughly $250bn, meaning that the X-date could come as soon as early June, “significantly earlier” than the previous estimate of between July and September, said analysts at Danske Bank. “A suspension of the debt ceiling until the next round of budget negotiations next winter is beginning to look increasingly likely,” the bank added.

Asked about the potential ramifications of a default, President Joe Biden did not mince his words. Reneging on the country’s national debt would be “a calamity”, exceeding “anything that’s ever happened financially in the United States”, he said in January.

[ad_2]

Source link