[ad_1]

The Hang Seng Index, which tracks 82 blue-chip members, may climb to 19,000 points by midyear, according to Ka Liu, head of investment strategy and portfolio advisory at the US banking group’s unit in Hong Kong. His previous target, made in July, was 23,000.

“We revised the target mainly due to lower earnings growth forecasts”, as the broader economic environment remains weak, he said in a phone interview. At the same time, higher-for-longer interest rates could also weigh on stock prices, he added.

Investors have also pared back bets on rate cuts as Federal Reserve officials suggested borrowing costs would need to remain higher for longer to keep a lid on inflation in the US. The Hong Kong Monetary Authority follows the Fed’s policy in lockstep under the city’s linked exchange rate system.

The Fed has raised its key rate by 525 basis points since the policy lift-off in March 2022 in its most aggressive tightening cycle in more than 40 years. There is a 95 per cent chance the Fed will keep its rate on hold at the first meeting this year on January 30-31, according to Fed fund futures compiled by CME group.

To be sure, chances for a technical rebound cannot be ruled out given the significant sell-off. Besides, the market could rally as China stands ready to stimulate the economy after its piecemeal approach in 2023 failed to reignite growth or stem a fund exodus by global money managers.

Even so, other regional peers may offer better upside, Jason Lui, head of Asia-Pacific equity and derivatives strategy at BNP Paribas, said in a media briefing on Monday. Chinese stocks do not enjoy the kind of growth trajectory to attract meaningful fund inflows, like in the past, he added.

“The market is not necessarily factoring the same level of earnings,” he said. “If you look at the broader region, there are multiple examples of markets that can deliver even higher growth.”

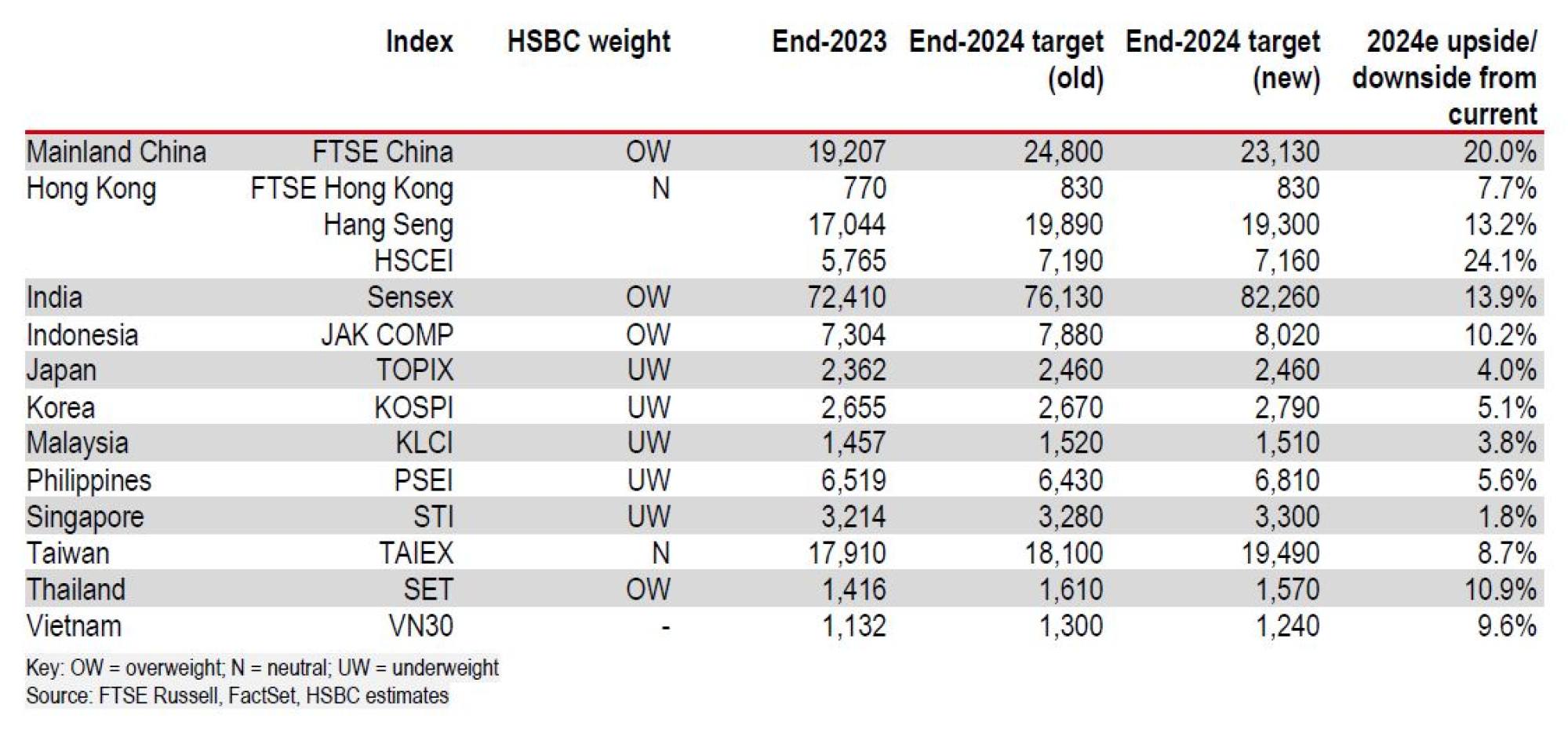

Liu at Citigroup is not alone. In a report on January 5, strategists at HSBC trimmed their 12-month target for the Hang Seng Index to 19,300 from 19,890, citing concerns slowing growth and the dampening effects of higher rates on local equity and property markets.

Both the financial and property sectors are likely to be a drag on the overall market’s performance, Raymond Liu, China offshore equity strategist in Hong Kong at HSBC, said in the report. Slower growth in China could weigh on the earnings potential of local stocks, he added.

“Investors still lack confidence in the market” as consumer sentiment in mainland China remains depressed amid the property downturn, Liu at Citigroup said. They might be reluctant to get back into the market before seeing Beijing’s supportive policies are working, he added.

[ad_2]

Source link