[ad_1]

The actions you can take to improve your employees’ financial wellbeing are highly varied and will depend on numerous factors, including:

- your organisation’s size and sector

- the profile and needs of your workforce

- the level of priority and resources available

- your organisation’s existing approach to health and wellbeing.

It is possible that the scale of the challenge identified by your assessment of need will be significant, but it is important to note that, if necessary, rather than implementing whole-workforce interventions, action can be taken to address the specific needs of a particular employee group, identified through your analysis and data collation conducted in Stage 2. For example, your lowest-paid employees may be a key area for focus in the current cost-of-living crisis. It may not be possible to implement the most obvious solutions to help lowest-paid workers, such as pay rises or one-off cost-of-living bonuses. However, provision of a fair and liveable wage should be a key ambition. You should help employees determine if they are eligible for any additional government support and should ensure that any additional financial benefits offered do not negatively impact anyone claiming such support, for example Universal Credit.

Other things you can do are:

- signpost employees to financial education sources and alert them to online financial scams

- consider offering benefits that help to stretch pay packets, such as travel season ticket loans, discount shopping vouchers, flexible working opportunities that could reduce commuting costs or help with childcare

- occupational sick pay

- crisis loans to help cope with unexpected financial shocks

- help with rental deposits.

Employees should also understand how they can progress within the organisation to increase their earnings potential. See the CIPD Tackling in-work poverty hub for further resources.

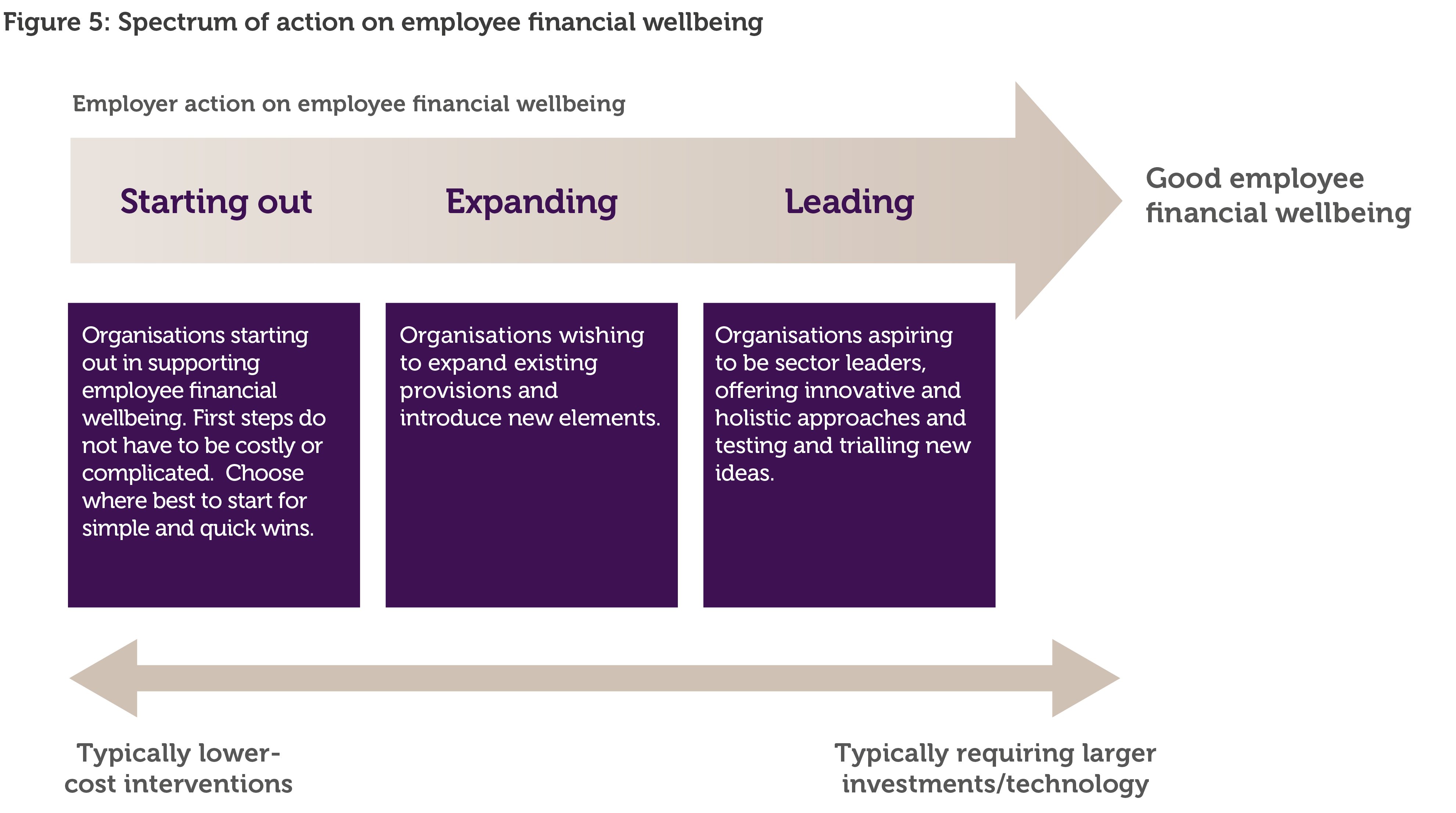

Organisations will be at different stages on their journey, and Figure 5 illustrates a typical spectrum of action on employee financial wellbeing. You should assess where you currently sit on this spectrum so you know where you need to focus.

Although not all support needs to cost money, you should confirm the available budget and resources for your financial wellbeing offering ahead of designing your approach, and give consideration to what can be effectively delivered internally and where external providers could be used. You could also trial some interventions ahead of a full rollout and almost certainly model and cost their operation; for example, how many people are likely to use a new service you introduce, how much will that cost, and what will be the value of the resulting benefits?

Currently only 32% of employers that have a workplace financial wellbeing policy back it with a budget; however, more employers have plans to do so. CIPD Reward Management Survey 2022

For those just ‘starting out’ on their journey, Table 2 provides some suggestions for actions. These are typically lower-cost and less resource-intensive interventions. For organisations further along in their journey, we include some suggested actions for the ‘expanding’ and ‘leading’ organisations in Appendix 3.

Whatever your ambitions, be realistic and targeted, using your data to ensure you are creating a financial wellbeing strategy that accurately reflects the needs of your workforce in order to maximise its impact.

81% of organisations hope to better retain employees with the financial wellbeing products and services they offer. REBA, 2022

Type of action Examples of actions

|

Creation of a financial wellbeing policy |

· Begin to build a cohesive financial wellbeing policy that brings together all your practices in this area. · Consider how your efforts on EFW align with your wider health and wellbeing, and business strategies. |

|

Paying a fair wage |

· Review basic compliance with pay policy; for example, changes to the National Minimum Wage and National Living Wage. · Consider becoming an accredited Living Wage employer, which research shows has business benefits despite increased payroll; for example, improved business reputation, employee motivation and retention. · Ensure pay policies and decisions are fair and do not disadvantage any particular groups. · Provide secure working hours to all staff. · Review your reward strategy – depending on affordability, consider offering a cost-of-living bonus, ensuring it would not adversely impact those who claim Universal Credit or Tax Credits. · Ensure payroll is accurate and promptly pay any expenses. · Review payslips to ensure they are accessible, clearly presented and simple to understand, and ensure that employees feel comfortable about raising any issues or mistakes. |

Case study: Getting low-paid student workers into the savings habit at University of Lincoln

Context

The University of Lincoln was an early adopter and enthusiastic practitioner of a total rewards approach, offering a wide range of fully funded and additional voluntary employee benefits, including an excellent pension plan and product discounts. This leading position has been maintained and enhanced since COVID, with a recent initiative to better address the savings needs of their younger, lowest-earning student employees, which was awarded the overall top prize at the Employee Benefits magazine annual awards in 2022.

Factors prompting action

The university has been offering over 80 different jobs to more than 1,000 students each year through its in-house employment agency, ‘Campus Jobs’. This helps to build their employability and financial skills while earning to help fund their studies.

These student employees are eligible, like all university staff, for a pension that the university contributes to. However, the vast majority earn less than the £10,000 lower-earnings limit set by the government for automatic enrolment into an employer pension plan, and/or are under the minimum qualifying age of eligibility of 22 years.

Rather than just accept these employees missing out on their pension contribution and pocketing the savings, the university considered alternative means of helping them to save for the future.

Actions taken

The university introduced an alternative individual savings account targeting these employees. This is operated on the same ‘opt-out’ basis as the university’s pension plan.

When an employee starts a role with ‘Campus Jobs’, they are automatically enrolled into this workplace savings scheme, contributing 3% of pay into it automatically. The university contributes an additional 6% of their pay on top.

Employees have a choice of ISAs and savings accounts to invest in. They can also increase their contribution, which the university will also match. And, as with a pension, they can choose to opt out at any time and not save.

Outcomes

In the first year, 1,105 students were automatically enrolled into the scheme. Just 7% of these opted out and took the cash immediately.This opt-out rate is similar to the rates for pension plans nationally, but totally unlike the national pattern of savings, with an estimated 50% of employees of all ages having no savings whatsoever outside of their pension or home (Cushon (2022) Building the financial resilience of the UK workforce).

Surveyed at the end of the year:

- Almost half of the student employees (46%) said they were saving for the first time; one student saved over £5,000.

- Two-fifths (42%) reported feeling more positive about their financial situation and wellbeing.

- 60% said that it made them feel more positive about their job and their employer.

Lessons learned

Traditional stereotypes, in this case of young people never wanting or being unable to save, were inaccurate in this particular situation and need to be challenged.

Making saving easy and encouraging employees to save through an ‘opt-in’ approach can have major benefits in terms of participation rates.

Communication is vital to building employees’ financial understanding and support. The scheme is accessible through a phone app and 40% of students reported using this to check on their savings regularly.

Whatever the regulatory restrictions and rules, innovative employers can still address their reward aims and the needs of their different employee groups, in this case to help ensure fair rewards for all employees and to support their future financial wellbeing.

Case study: The Children’s Society

Background and context

The Children’s Society is a 140-year-old national charity working to transform the hopes and happiness of young people facing abuse, exploitation and neglect. In 2021 they supported more than 50,000 children with over 70 different services. The Society employs just over 700 people, mostly in direct support, fundraising and retail activities; and staff costs of £25 million represent around half of their annual income.

Pay was last restructured in 2016, with a general cost-of-living-style award and discretionary supplements made each year until COVID hit. Some staff were furloughed as the Society pivoted its services online, and the Society topped up the 80% of government support to ensure their pay levels were maintained. The pandemic, however, forced a financial and structural reorganisation, with the Society taking the opportunity to reimagine and create an operating model, strategy and goal that would work hard to overturn the damaging decline in children’s wellbeing over the next 10 years.

Executive director of diversity and talent Michelle Clark joined the Society in 2020. She has been building a more modern, human-centred, integrated HR function and set of services. External market pressures on the competitiveness of pay in the sector have been evident and the Society lost one of its executive directors to a larger, well-known charity in early 2022. 2022 also saw the pressures of the cost of living emerging, and after negotiation with the trade union, a higher-than-usual 3% annual pay award and a further 2% uplift application to grades was made. It was also determined that a deeper review of pay and grading would need to be instigated in the latter half of 2022.

Fair pay is a key objective of the Society’s reward policy, and the Society tracks and maintains as a minimum the Living Wage Foundation’s real Living Wage level.

Actions

The Society’s benefits package has historically been a good if fairly traditional one, with generous annual leave and good pension and sick pay schemes. COVID provided the opportunity to update the package and the Society invested in a wellbeing centre platform provided by Reward Gateway. This is filled with hundreds of videos, articles, courses, tips and other resources from wellness experts to support employees’ health in four key pillars: physical, mental, emotional and financial wellbeing.

The platform was well received and used by staff, and the Society continues to enhance and improve its content and accessibility, particularly in regard to financial wellbeing as the cost-of-living pressures on staff have intensified. Recent additions include access to a salary financing/early payment scheme, as well as setting up a staff savings scheme.

COVID highlighted the health and wellbeing of staff as a vitally important issue, and the Society ran ‘soundbites’ – online discussions and advice on financial, emotional, mental and physical wellbeing – during the pandemic. But, as with many employers, this also drove the recognition that the Society wasn’t clear about what exactly those employee financial wellbeing needs were.

So the Society carried out an independent financial wellness survey in 2022, which around a third of employees completed, provided by an independent company ‘Secondsight’. As well as providing the HR function with much better data about employees’ health and wellbeing, and initiatives that might best support them, this also gave each employee a financial wellbeing rating and tailored advice to help improve it. In addition, HR asked their managers what they thought the key needs of their staff were and how they might be better addressed.

The findings pointed, perhaps not surprisingly, to the Society’s lower earners particularly struggling in the current difficult, highly inflationary climate. More broadly employees wanted support to budget and manage their monthly income and expenditure more effectively – hence the widening of the financial wellbeing information and provisions on the Reward Gateway platform. Secondsight also recently ran a well-attended ‘Make Money Count’ webinar.

The Society had an existing EAP that is now being transferred to Reward Gateway and the range of its services expanded, including financial support helplines and counselling. The Society is considering opening up access to it to its volunteer supporters as well as employees.

And to address the financial pressures especially being felt by its lower-paid staff, the Society is in the process of agreeing a one-off cash lump-sum payment to be made at the beginning of 2023. The board of trustees has been keen that the Society responds fairly to all employees, and while a consideration was made to make this payment to all employees earning below the basic rate of income tax earnings limit of £50,270, which is the vast majority of them, it was decided that this should be made available for all.

Change to outcomes and learning

Michelle Clark describes the Children’s Society as being on a reward and financial wellbeing journey, based on its original core values and caring approach to its employees, which is now being modernised and extended to recognise the current requirements of a more diverse workforce and, particularly, the impact of COVID and the UK’s current high inflation and cost-of-living crisis. Despite the financial pressures evident across the charity sector, her chief executive and board have been wholly supportive of work in this area throughout this period.

Their initiatives have evolved from initially focusing on advice and information to more tangible forms of support, and while the competitiveness of pay levels remains a concern, staff reaction to these services and provisions has been overwhelmingly positive. The employee financial wellbeing survey has provided excellent information to help target and tailor these benefits. The Society plans to run it again after two years, hopefully to show improvements in people’s perceived wellbeing as a result.

Michelle Clark’s advice is that while money and pay are obviously vital to staff, especially in a cost-of-living crisis, the importance of lower-cost information and advice, for example in helping staff to budget effectively, should not be underestimated. It’s also important to seek voice and input, responding carefully to what people are saying rather than taking a broad-brush, albeit well-intentioned, approach. The needs of staff will be different and continue to be in an ever-changing landscape.

[ad_2]

Source link