[ad_1]

Chinese exports surged in March, defying economists’ expectations of a contraction, as the world’s second-largest economy recovered after months of falling trade.

Customs data released on Thursday showed dollar-denominated exports expanded 14.8 per cent compared with the same period a year earlier, after falling 6.8 per cent in January and February. Analysts polled by Reuters had forecast a contraction of 7 per cent.

Imports also strongly beat forecasts, declining just 1.4 per cent year on year last month, compared with expectations of a 5 per cent contraction following a 10.2 per cent fall at the beginning of the year.

Hao Zhou, an analyst with Chinese securities group Guotai Junan International, said the unexpected export data suggested “some upside risk” to China’s first-quarter gross domestic product figures, due next week.

Shipments to south-east Asia were resilient, and those to the US and Europe also improved. But he said the “most important” gains came from a surge in “so-called new exports” including electric vehicles, lithium and solar batteries.

The March trade data represented the first export growth since September last year, as a global slowdown in demand has weighed on China’s economy.

Export strength that had previously provided an economic lifeline during the coronavirus pandemic — when Chinese policymakers were battling a rolling liquidity crisis in the property sector and weak domestic consumption — weakened as global inflation rose and outbreaks of the virus spread across the country.

Last week, Li Qiang, China’s premier, chaired a meeting of the State Council, the country’s cabinet, focused on promoting stability in foreign trade. Li called on officials to “try every method” to stabilise exports to developed countries, according to state media.

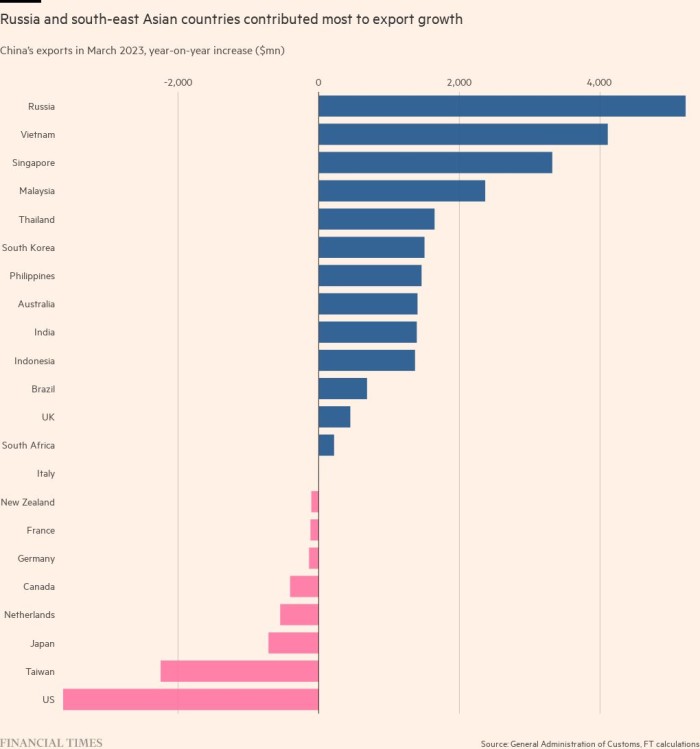

Trade growth in steel and clothing was also strong, while exports of personal computers, mobile phones and integrated circuits declined. Russia and south-east Asian countries, particularly Vietnam, Singapore and Malaysia, contributed the most to the gains.

The customs office said that while trade data at the start of the year “showed relatively strong resilience”, geopolitical risks, protectionism and inflation remained a concern.

China set a growth target of just 5 per cent for 2023, its lowest in decades, after its economy expanded just 3 per cent last year.

Analysts at economic research group Capital Economics wrote that a weaker outlook for global demand meant any export rebound was likely to be shortlived, given a weak outlook for foreign demand, recent turmoil in the banking sector and the delayed impact of interest rate increases.

“We expect most developed economies to slip into recession this year and think that the downturn in Chinese exports still has some way to run before it reaches a bottom later this year,” they wrote.

Analysts from CICC, a state-run investment bank, also cautioned that despite rapid growth in shipments of electric vehicles and their components this year, China is still likely to face a 3 per cent year-on-year decline in exports.

“Overseas demand remains in a downward trend, while financial risks also bring uncertainties,” they said.

[ad_2]

Source link