[ad_1]

Central Garden & Pet Company CENT has been strengthening its position as a frontrunner in the competitive landscape of pet supplies and lawn and garden products in the United States. The company has been advancing its digital capabilities, optimizing its supply chain, expanding data analytics capability and focusing on marketing activities to better engage with customers. It has also been making progress on its Central-to-Home strategy.

The company has been witnessing strength across its Pet segment of late. For instance, in the fourth quarter of fiscal 2023, the Pet segment’s net sales increased by 10% year over year to $483 million. Sales rose in the pet consumables business across all categories. The transition to e-commerce is evident, with online sales experiencing significant growth compared with brick-and-mortar outlets. In the quarter, e-commerce business grew in low double-digits, representing about 25% of the overall Pet segment’s sales.

Central Garden & Pet has been progressing on its multi-year journey to simplify its business structure and boost efficiency across the organization. This is carried out by rationalizing the company’s footprint, streamlining the portfolio and enhancing the cost structure. In April 2023, it completed the sale of its independent garden center distribution business. This sale is expected to simplify the garden business and drive margins.

The company is actively engaged in initiatives spanning procurement, logistics, manufacturing, portfolio optimization and administrative expenses, all geared toward facilitating more streamlined operations. It remains focused on developing differentiated products, improving sales capacity and becoming more cost-effective in order to gain market share.

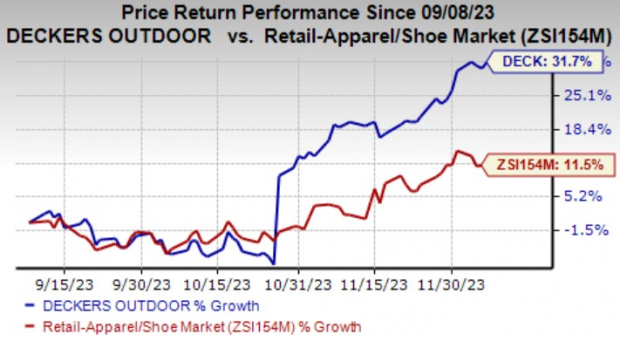

Image Source: Zacks Investment Research

In the past six months, this Zacks Rank #3 (Hold) stock has gained 8.3% against the industry’s decline of 12.3%.

Despite the positives, CENT has been encountering softness across most of its Garden portfolio amid persistent inflationary pressures. For fiscal 2024, Central Garden & Pet estimates adjusted earnings to be $2.50 per share or better compared with $2.59 reported in fiscal 2023.

Escalating costs and expenses have been hurting its margins and profitability lately. In the fiscal fourth quarter, the company’s cost of goods sold increased by 8.8% year over year, while its selling, general and administrative expenses increased by 0.7%. In the reported quarter, the company’s adjusted gross margin shriveled 160 basis points to 26.6%. The contraction was due to inflation and lower volumes, resulting in unfavorable overhead absorption.

3 Key Picks

Some better-ranked stocks are The Honest Company, Inc. HNST, The RealReal, Inc. REAL and Accel Entertainment, Inc. ACEL, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Honest Company is a provider of personal care, household and wellness products. The Zacks Consensus Estimate for HNST’s current financial-year sales suggests growth of 7.7% from the year-ago reported figure. The company had an earnings surprise of 25% in the last reported quarter.

RealReal is an online marketplace for the resale of luxury products in the United States. The Zacks Consensus Estimate for REAL’s current financial-year earnings suggests 39.9% growth from the year-ago reported figure. The company had an earnings surprise of 42.3% in the last reported quarter.

Accel Entertainment is a distributed gaming operator in the United States. The Zacks Consensus Estimate for ACEL’s current financial year sales suggests growth of 19.4%, while earnings are likely to increase by 3.5% from the prior-year reported numbers. The company had an earnings surprise of 37.5% in the last reported quarter.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

Central Garden & Pet Company (CENT) : Free Stock Analysis Report

The RealReal, Inc. (REAL) : Free Stock Analysis Report

Accel Entertainment, Inc. (ACEL) : Free Stock Analysis Report

The Honest Company, Inc. (HNST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Source link