[ad_1]

The Bank of Canada

published a detailed summary of its Governing Council deliberations for the first

time last month, joining nearly two dozen other central banks in regularly

releasing detailed information on monetary policy decisions.

Economic and financial turbulence calls for greater transparency from policymakers. As central banks raise interest rates to curb inflation,

stakeholders increase their scrutiny. In some countries policymakers face

growing calls to reign in their autonomy. To maintain public trust,

safeguard independence, and enhance policy effectiveness in the face of

such challenges, monetary authorities must focus on transparency and

accountability.

Stefan Ingves, who stepped down in December after 17 years as

governor of Sweden’s Riksbank, said it best:

“Independence demands transparency,” he said in a January

interview with Central Banking. “If you’re independent, it’s vital that people can

understand what you are doing. If you are independent and you tell the

general public ‘It’s none of your business,’ independence will be taken

away from you, sooner or later.”

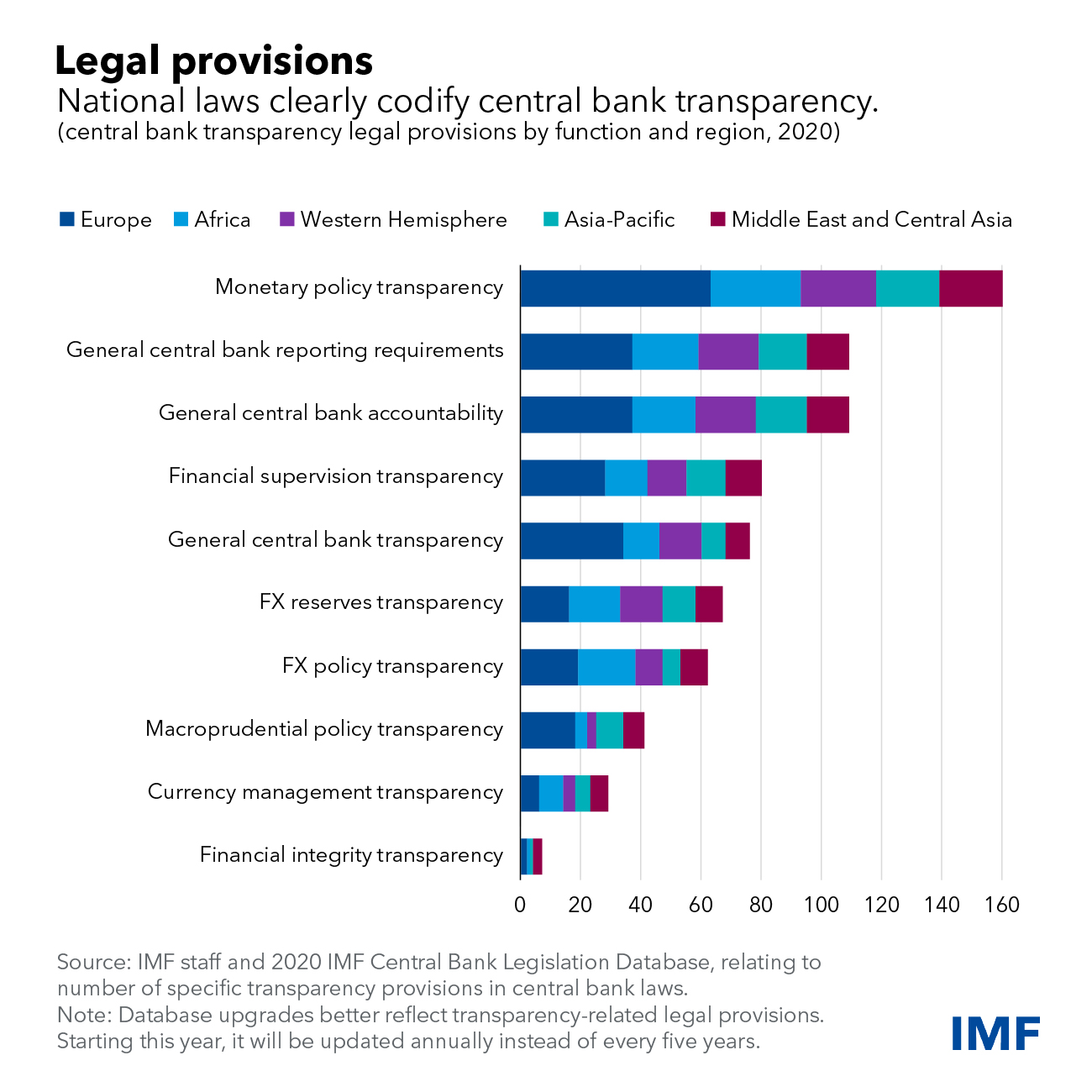

Many laws already include explicit transparency provisions, especially for

monetary policy, as the IMF’s Central Bank Legislation Database shows.

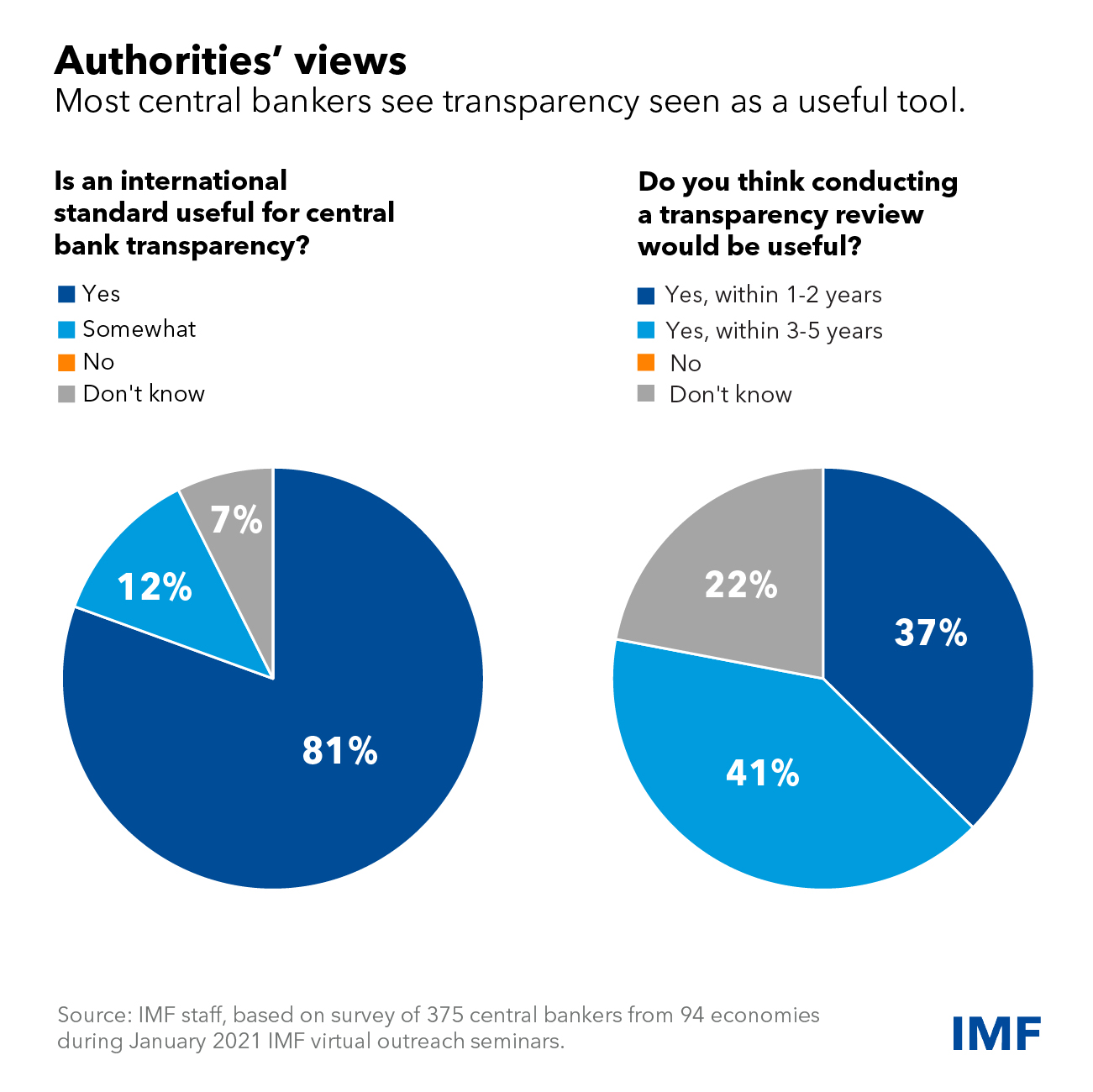

The IMF has recognized the importance of transparency and actively promoted

it. The Executive Board in 2020

adopted a new voluntary Central Bank Transparency Code, a comprehensive set of

principles covering mandates, functions, and operations. Based on the code,

the Fund offers central banks the opportunity to participate in a review of

their transparency practices.

The reviews help central banks gauge their transparency and accountability,

facilitating more effective communication and better-informed dialogue with

lawmakers, investors, and individuals.

To date, the IMF reviewed the central banks of

Canada,

Chile,

Morocco,

North Macedonia,

Seychelles,

Uganda, and

Uruguay, covering governance, policies, operations, outcomes, and relations with

other official stakeholders, such as government and financial regulators.

We summarize experience of pilot reviews in a new

policy paper.

The reviews spotlight the importance of transparency in facilitating

accountability, as well as detailing central bank performance and

compliance with mandates. They also help facilitate more effective

communication between central banks and their various stakeholders,

including lawmakers, news media, academics, and the public. This helps them

to adjust their communication tools, channels, and messages to the needs of

the targeted audiences, reducing uncertainty and contributing to better

policy choices.

How did central banks react to the recommendations? Beyond the Bank of

Canada’s decision to release summaries of policy deliberations, the Central

Bank of Chile approved a new transparency

policy based on the IMF’s transparency review and created a special

section on its website to provide the additional information on the way it

operates.

The Central Bank of Seychelles began publishing a

Monetary Policy Report, while the National Bank of the Republic of North Macedonia

disclosed audit and risk management details. The central banks of Morocco,

Seychelles, and Uganda used review findings to boost the effectiveness of

their communications by developing institutional strategies and

strengthening communication units.

Behind every central bank are dedicated professionals. And the reviews

helped raise their awareness about the need for clearer and more

understandable communications. Consequently, as one central bank official

noted in response to the survey conducted by the IMF after the pilot phase,

it helps “build more effective and client-driven communication systems.”

What’s next?

As central banks face mounting challenges, it is critical that they improve

transparency because, ultimately, their independence and policy

effectiveness will be at stake.

Future transparency reviews will be available to all IMF members as a

voluntary tool to improve transparency and accountability. The Fund will

also build a repository of transparency practices, based on information

documented during the reviews, to facilitate peer-learning among staff at

different central banks. The new tool will help reinforce trust in central

banks, as well as their credibility and effectiveness in an increasingly

complex world.

[ad_2]

Source link