[ad_1]

New figures released by the Cayman Islands Monetary Authority (CIMA) show that the regulatory agency issued 33 new licences for firms in the insurance and reinsurance industry last year.

At this level, the figure represents the highest number of new licenses issued in a single year since 2013, CIMA notes.

At this level, the figure represents the highest number of new licenses issued in a single year since 2013, CIMA notes.

The regulator also reported a total of 670 insurance licenses in Cayman at the end of 2022, the fourth year in a row of growth in the total number of insurance licenses.

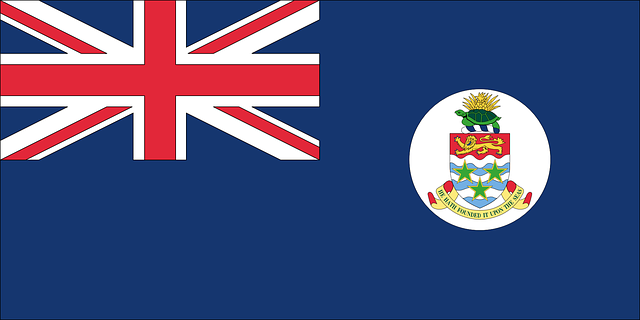

“Continued strong growth of the insurance/reinsurance sector in Cayman, in supporting captive owners and insurers navigate tough ongoing direct and reinsurance market conditions, demonstrates the confidence investors have in the fundamental features that make the Cayman Islands a leading insurance/reinsurance jurisdiction,“ said Lesley Thompson, Chair of the Insurance Managers Association of Cayman (IMAC).

“Cayman’s exceptional combination of experienced professionals, a responsible yet proportional regulatory regime and tax neutrality continue to make it the domicile of choice for international insurance/reinsurance.”

IMAC is focused on supporting growth in the re/insurance sector through expanded engagement to market the industry and the jurisdiction internationally.

“Our significant growth in 2022 is a strong motivator to enhance our efforts to engage global investors with the story of the Cayman Islands insurance/reinsurance industry and push for even greater growth in 2023 and beyond,” concluded Thompson.

[ad_2]

Source link