[ad_1]

After seven years, Capitec will end its funeral policy deal with Sanlam next year. The bank has been selling Sanlam-backed funeral policies to its clients as part of a joint venture.

But Capitec now has its own licensed insurer, Capitec Life, which can sell policies directly to its clients and will assume the administration of the current policies.

On Monday, Sanlam announced that Capitec gave notice that the agreement between them will come to an end on 31 October, 2024.

Some 2.4 million funeral policies (covering more than 11 million lives) have been signed as part of the agreement, according to a Capitec presentation in August this year. The group earned almost 4% of its total income from operations from the deal.

The announcement has been expected as Capitec long flagged that its agreement with Sanlam expires next year, says Kokkie Kooyman, a director at Denker Capital and the portfolio manager of the Denker Global Financial Fund. While the ending of the joint venture will have an impact on Sanlam, as a percentage of the Sanlam Group’s income it is very small, Kooyman added.

In a statement, Sanlam said the deal had been “mutually beneficial and successful”.

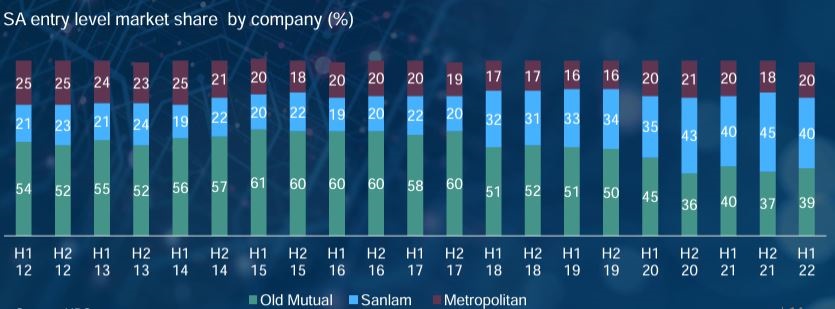

Research by UBS shows that Sanlam’s share of the “entry level” market grew from 20% before the Capitec agreement to 40% by the first half of its 2022 financial year.

Capitec will pay Sanlam R1.9 billion as part of a “reinsurance recapture amount”, which represents the loss to Sanlam for its 30% participation in the joint venture.

By Monday afternoon, Sanlam’s share price was marginally higher at R68.47, while Capitec was down more than a percent to R1 931.95.

[ad_2]

Source link