[ad_1]

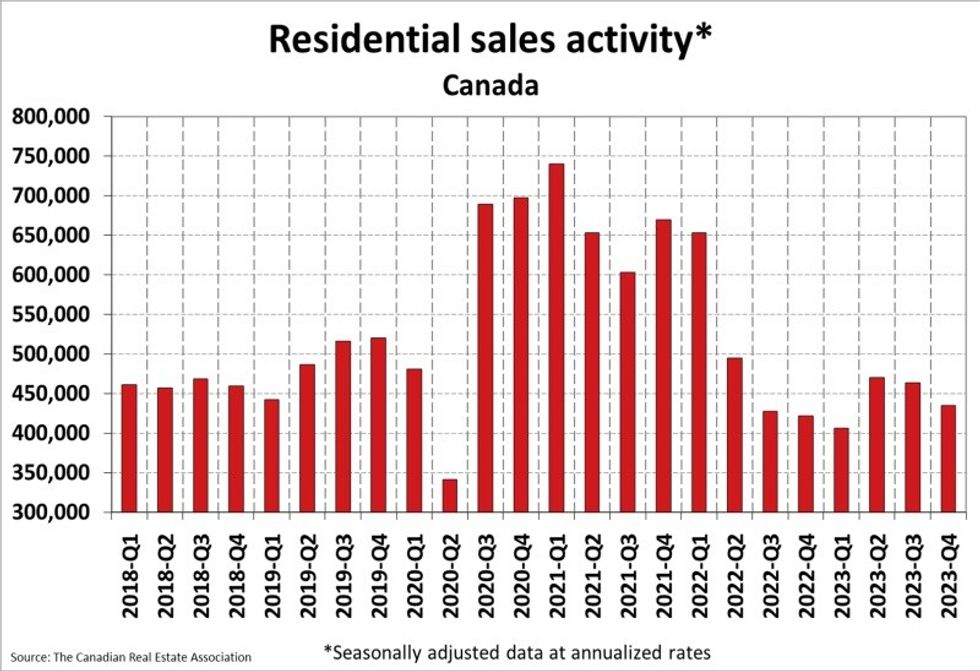

Despite an unexpected uptick in December, 2023 marked the worst year for Canadian home sales since the 2008 financial crisis.

According to new data from the Canadian Real Estate Association (CREA), 38,135 homes were sold across the country in December, an 8.7% increase from November. The actual (not seasonally adjusted) number of transactions was up 3.7% from December 2022, the largest annual gain since August.

While the year-end bump put an end to what had been three consecutive months of slipping sales, it doesn’t mark a turning point for the market, noted Larry Cerqua, Chair of CREA. The true test of the markets’ resilience will come in the spring.

“Was the December bounce in home sales the start of the expected recovery in Canadian housing markets? Probably not just yet,” added Shaun Cathcart, CREA’s Senior Economist.

“It was more likely just some of the sellers and buyers that were holding onto unrealistic pricing expectations last fall finally coming together to get deals done before the end of the year. We’re still forecasting a recovery in housing demand in 2024, but we’ll have to wait a few more months to get a sense of what that ultimately looks like.”

December’s resurgence was also not enough to remedy what had been a rocky year for Canadian home sales. Just 443,511 homes changed hands nationally in 2023, an 11.1% decline from 2022 and the lowest annual level for national sales activity since 2008.

CREA noted, though, that the figure was “very close” to activity levels seen in the five years following the financial crisis, as well as the first year after the uninsured mortgage stress test was introduced in 2018.

The Canadian Real Estate Association

The Canadian Real Estate Association

The number of newly listed homes fell 5.1% on a monthly basis in December, pulling them to the lowest level since June. As such, the national sales-to-new listings ratio tightened to 57.8%, up from 50.5% in November. The long-term average for the measure is 55%.

Nationally, there were 3.8 months of inventory at the end of December 2023, down from 4.2 months at the end of November and falling further from the long-term average of five months.

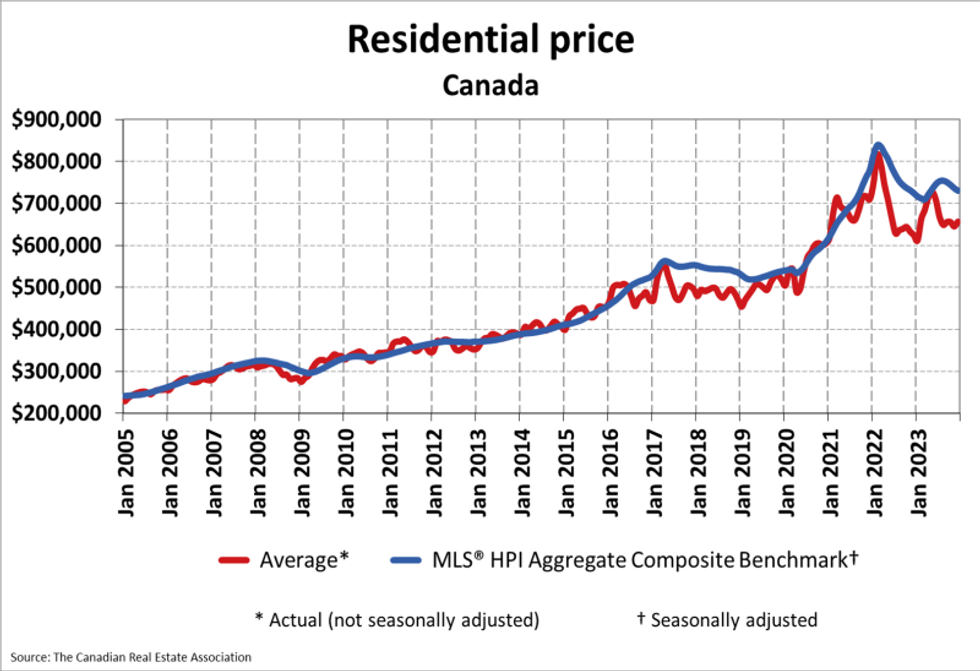

Despite the sales gains seem in December, the Aggregate Composite MLS Home Price Index (HPI) experienced a third-straight month of decline, falling 0.8% from November to $730,400. On an annual basis, the MLS HPI jumped 0.7%.

Recent price declines have been largely concentrated in Ontario markets, particularly the Greater Golden Horseshoe. Some declines have been recorded in British Columbia markets, while Alberta, New Brunswick, and Newfoundland and Labrador continue to see prices climb. CREA noted that price trends are “becoming more of a mixed bag,” and regional differences are less clearly defined as of late.

The actual (not seasonally adjusted) national average home price was $657,145 in December 2023, up 5.1% from December 2022.

The Canadian Real Estate Association

The Canadian Real Estate Association

With the full breadth of housing market data from 2023 now in its grasp, CREA has updated its forecast for sales activity and average prices for 2024, and released its outlook for 2025.

As they have for the last several years, interest rates will continue to have a “major” influence over real estate markets. Moving forward, though, it’s a story of cuts, not hikes. Predictions surrounding when the Bank of Canada will begin cutting rates have been pulled forward over the last several months, and the expected number of cuts has increased as well.

Combined with heightened pent-up demand, CREA now expects 489,661 homes to change hands across Canada in 2024, a 10.4% annual increase. Activity will be focused in provinces with the strongest demand, such as Alberta, and those that are expected to see a rebound from historically low sales levels, including Ontario, BC, and Nova Scotia.

As interest rates continue to fall, national home sales are forecast to climb a further 7.3% annually in 2025, to 525,498 units. The figure will still remain well below the long-term trend, though.

Price-wise, the national average is forecast to jump 2.3% annually in 2024, to $694,173. Larger increases are expected in Alberta, Quebec, New Brunswick, Nova Scotia, and Newfoundland and Labrador, while BC and Ontario will see prices remain relatively flat in the year ahead.

Come 2025, strong demand and ongoing supply issues will propel the national average home price up 4% annually to $722,063. Again, Alberta and the east coast will see prices rise in excess of the national increase.

[ad_2]

Source link