[ad_1]

Shares of some of the world’s largest banks fell on Friday as the failure of California’s Silicon Valley Bank reverberated around financial institutions across the US and in Europe.

Several of the biggest US banks were lower for a second day following sharp losses on Thursday. Bank of America closed down 0.9 per cent, having opened nearly 5 per cent lower, while Citigroup slipped 0.5 per cent.

In Europe, Deutsche Bank stock closed down 7.4 per cent, Société Générale gave up 4.5 per cent and HSBC ceded 4.6 per cent. Credit Suisse shares ended 4.8 per cent lower.

The jitters stemmed from Silicon Valley Bank, a technology-focused lender, which earlier this week revealed a $1.8bn loss on the sale of a portfolio of securities and sought to raise a further $2.25bn from capital markets, but its shares cratered. On Friday US bank regulators took it over.

Trading in banking groups PacWest, Western Alliance and First Republic — all of which are seen to have similar depositor profiles — experienced pauses after sharp falls triggered volatility “circuit breakers”. First Republic shares ended the day off almost 15 per cent while its smaller rivals tumbled 38 per cent and 21 per cent respectively.

Shares of New York-based Signature Bank, known for its services to the cryptocurrency industry, dropped by almost a quarter.

Analysts have attributed the sell-off to investors’ fears over the value of banks’ bond portfolios and falling deposits. Banks have been telling investors that they expect deposits to drop between 2 and 5 per cent this year, according to research house Autonomous, and there are concerns they will either have to sell bonds at a loss to cover outflows or pay higher interest rates to retain customers.

State Street’s S&P US regional banks exchange-traded fund lost 4.4 per cent after falling almost 8 per cent on Thursday. Utah-based Zions saw the biggest drop among the larger banks, but its initial fall of 10 per cent moderated and it finished 2.4 per cent lower. The KBW US banks index, which includes the larger lenders, ended down 3.9 per cent.

Bank of America analysts described the sell-off as “likely overdone” and saw little link between idiosyncratic issues at individual banks and the broader sector.

“However, the sell-off also highlights a belated realisation among investors that higher for longer interest rates are negative for the sector’s [earnings] outlook,” they added.

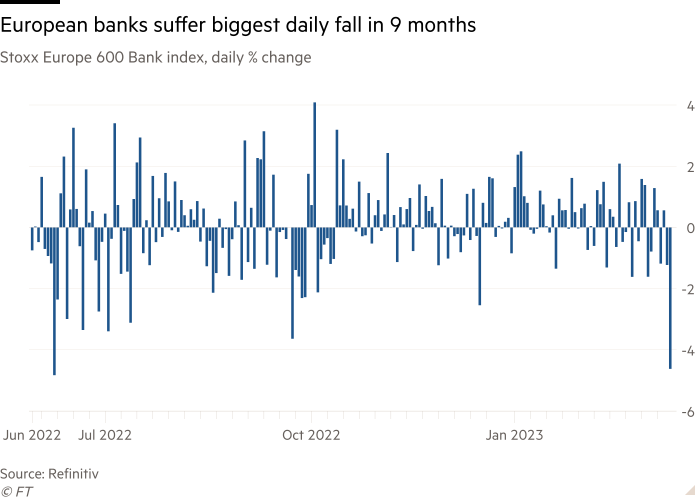

The Stoxx Europe 600 Banks index fell as much as 4.5 per cent on Friday, hitting its lowest point for more than a month. The broader Stoxx 600 index closed down 1.4 per cent while the bank-heavy FTSE 100 slipped 1.7 per cent.

Banks have been one of the strongest-performing sectors in Europe, with shares up 20 per cent over the past six months. Lenders have reaped the rewards from rising interest rates, as their profits increase from the difference between what they pay out in deposit rates and what they earn from lending.

Robert Alster, chief investment officer at Close Brothers Asset Management, described the situation as “a storm in a teacup” and said a direct read across from SVB to large European banks was “unwarranted”.

But Alster said the fact that short-term interest rates were higher than long-term interest rates would “put pressure on margins” at big banks and “higher interest rates tend to lead to tougher lending standards which can slow down the economy”.

[ad_2]

Source link