[ad_1]

By Richard Steiner, senior manager, business strategy, Pharmatech Associates

Pharmaceutical continuous manufacturing (PCM) is making its way into our regulated and risk-averse industry. In our last article (part 1 of the two-part article series), we outlined the PCM business cases that support adopting advanced manufacturing technologies, with specific considerations for innovators, generics manufacturers, CDMO organizations, and over the counter (OTC) suppliers. In part 2, we now introduce a useful financial equation to calculate amortization to develop the business case for PCM and provide a few real-world cases. We cover how PCM can support specific business needs and how to implement it.

There are two main topics to be discussed before talking about business case justifications. First, a detailed analysis of the value chain for the respective company or product portfolio must be performed to understand which cost centers or operational units are creating most of the value of the product. Secondly, the company’s long-term investment strategy should be evaluated in the case of a major strategic shift in the product portfolio, or if existing equipment is underutilized or inefficient and ready for replacement.

For the value chain analysis let’s refer to the fundamentals developed by M.E. Porter1 in 1985, summarized in the following chart that indicates the sphere of PCM influence:

Figure 1: Potential PCM influence area relating to the value chain within an organization

After a holistic cost analysis, it will become clearer in which value-adding process step PCM can be used to support operational excellence initiatives. During the same business case assessment, we can focus on the timeline to implement PCM. Any implementation of a new and advanced manufacturing technology will take time from early investment until the technology is ready to deliver the product to the market. The equation suggested below is based on cash flow projections over the years of the asset life cycle.

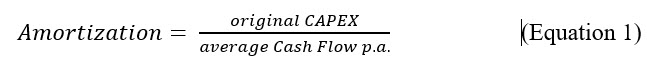

There are two main roads for calculating returns on investments.2 The first and most used methods compare costs and earnings before interest over the years of depreciation of the asset or calculate the amortization time by using the original capital invested divided by the average cash flow over the years of intended usage. In some industries and companies, the amortization is expected to happen in a year or less, after the asset is installed and used, as below:

Advantages: Simple to use and very little effort to collect the information needed to calculate.

Disadvantages: Does not consider the time and timely structure of the expected cash flow and only very limited capability to compare alternative investments.

Net Present Value (NPV) Equation

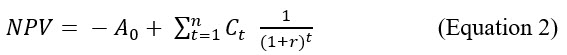

There are more sophisticated equations such as the net present value (NPV) calculation, which is a more dynamic method that allows for an investor-oriented focus based on the interest to be gained by investing in any asset such as PCM.

NPV = Net Present Value

A0 = Initial Investment at t0

Ct = Cash flow in the year t

r = Interest rate

t = number of the year

Advantages: As this equation is based on a cash flow plan, it is closer to reality and has a real-time component that is important for assets that are not ready to create a positive cash flow in the first years. Another important element is the ability to compare various investments to one another.

Disadvantage: Long-term projection of the cash flow estimation over many years (instead of near-term ROI).

This approach is a perfect method to show the effect of various investment scenarios without complex modeling algorithms. It indicates parameters with the highest impact to the NPV, and it can be used to determine the budget breakthrough point for any PCM investment.

This type of analysis should be performed for each case and each customer depending on their process, cost structure, and quality costs. Change your parameters and you will find out which changes the NPV is most responsive to.

Let’s Look At Two Example Scenarios

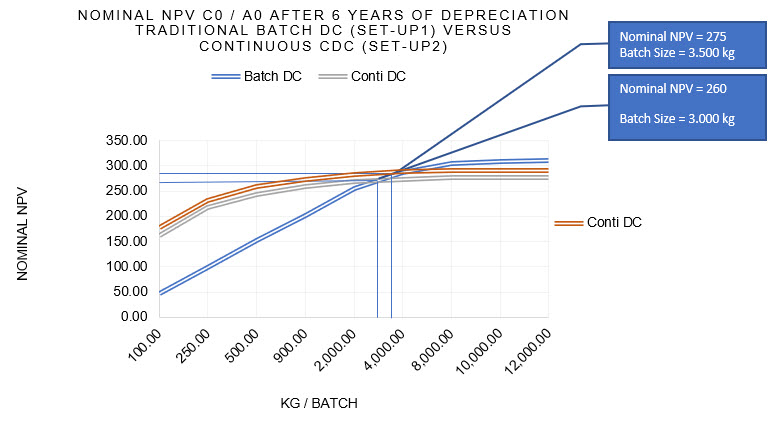

Let’s compare a traditional batch direct compression line with a continuous loss in weight feeding and continuous dry blending system integrated to a compression machine. As an example, a multi-component recipe that was formerly blended three times before release to the compression machine is now directly compressed in one process. This case #1 in Figure 2 is about the transfer of an existing product from a batch (Batch DC) to a continuous direct compression (Conti DC) process.

For the given drug formulation, there is an interception point where both alternatives deliver the same NPV. This means that there is a certain batch size where both alternatives generate the same return. For anything above this batch size, the traditional process remains the preferable solution unless you recognize that both graphs are flattened down. This means that for any batch size above the breaking point the process train is too small and not efficient enough.

In case #2, a similar drug formulation was processed with multiple sub-processes and 10 excipients. Due to the more efficient continuous dry blending steps, three excipients and sieving steps could be saved. This led to a significant reduction of complexity and a much leaner process and consequently a higher NPV. The NPV graph showed as follows:

Figure 2: NPV comparison Batch DC versus Conti DC as an example (by the author)

As this is an example of simplifying a marketed product, the main question is if the product owner can convince the regulator to accept these modifications without bioequivalence/bioavailability (BE) studies. Looking at the components commonly added to those recipes, their functionality is mostly not related to pharmacokinetics but is for process support. Some additives are only used to provide easier blending and better flowing capabilities. Since the NPV surplus is considerably high, it can drive the ROI for the investment in PCM and funding for regulatory affairs around those changes.

Applying the NPV method might be more suitable for innovators with their focus on a faster route to the market. For these organizations it is more interesting to compare technologies based on cash flow and yearly distribution of the NPV over the time of depreciation rather than using batch sizes as a variable. If they can sell their new drug product earlier by employing PCM, generating better cash flow over a longer time, management can justify the investment in the new technology.

Each of the above cases needs to be tailored for a specific company and product, but the process to develop a boardroom proposal remains the same.

With experts on both sides of the aisle, the implementation strategy can be developed in a very short time. Consensus within the execution arm might take longer as change management involves people management, and factoring in those costs is the art of management and leadership. Implementation of any new technology is a C-level decision.

Conclusion: PCM And Competitiveness

What can PCM bring to the equation of competitiveness and business success? Here are, in six steps, the business strategy, business case, and engineering solution in one approach:

- Define a holistic business strategy before arriving at a conclusion about the immediate business needs.

- Identify business needs to develop the business case.

- Use a dynamic NPV calculation to describe different scenarios for the business case and to find out the most influential factors to the business case.

- Establish and execute engineering solutions, i.e., product + process + facility design.

- Develop a compliance and regulatory strategy.

- And never forget to develop your change management process at the same time.

Finally, no sophisticated business strategy, nor any well-reasoned business case assessment, can change the simple fact that it remains a deeply entrepreneurial decision whether to implement PCM or not. Each level in the organization and each step in the value-adding process is involved or touched upon during the successful execution. So far, change management is the most important factor to consider based on companies that have established PCM technologies.

References

- Porter M.E. Competitive Advantage: Creating and Sustaining Superior Performance [Book]. – NYC : Free Press, 1985.

- M. Kleinaltenkamp and W. Plinke Cost-effectiveness study as basis for industrial capital investment decision [Book]. – Berlin: Springer Verlag, 1995

About The Author:

About The Author:

Richard Steiner is senior manager, business strategy, at Pharmatech Associates. He has extensive experience in the high-end equipment industry, working in global business networks. He has engineering expertise in continuous processing/manufacturing of oral solid dose pharmaceuticals, hot melt extrusion of pharmaceuticals, and twin- and single-screw extrusion of thermoplastic materials.

[ad_2]

Source link