[ad_1]

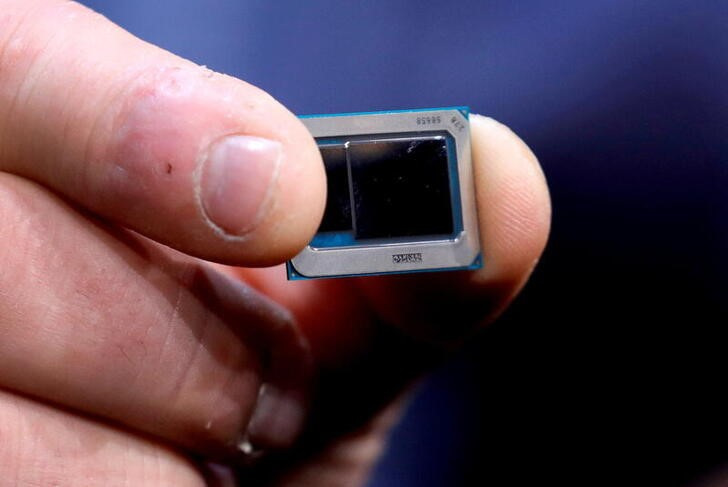

An Intel Tiger Lake chip is displayed at an Intel news conference during the 2020 CES in Las Vegas, Nevada, U.S. January 6, 2020. Acquire Licensing Rights

NEW YORK, Sept 5 (Reuters Breakingviews) – Call it conscious uncoupling. On Tuesday, $155 billion chip giant Intel (INTC.O) inked a new partnership with Tower Semiconductor (TSEM.TA), which Intel boss Pat Gelsinger recently gave up on acquiring for $5 billion. The deal will see Tower spend $300 million on equipment at Intel’s New Mexico campus, bolstering Gelsinger’s nascent chip-manufacturing-for-hire services. It’s a smart way to get around regulatory knockbacks that killed the two companies’ planned merger, and makes more sense than that deal.

Intel ended its year-and-a-half-long quest to acquire Tower in August, after failing to win sign-off from Chinese antitrust enforcers. Signed in February 2022, the deal was aimed at strengthening Intel’s pivot into manufacturing chips designed by others by bringing in Tower’s know-how. But weak profitability and sagging results made the acquisition look questionable.

By signing up Tower as a partner, Gelsinger wins a chunk of its business without the trouble of competition roadblocks. Plus there’s a twist. Tower is paying to build up its former suitor’s facilities to build the chips, but squint and the funding really comes from Intel: The company paid Tower a $353 million break fee after their tie-up fell through. Still, better for Intel that the money is used on its own business than someone else’s. Gelsinger has salvaged a minor victory from the jaws of defeat.(By Jonathan Guilford)

(The author is a Reuters Breakingviews columnist. The opinions expressed are their own. Refiles to fix typo in editing byline.)

Follow @Breakingviews on X

Capital Calls – More concise insights on global finance:

Shelved L’Occitane buyout is no win for Hong Kong read more

Singapore’s central bank boss faces a tough start read more

Lithium miners’ $4.3 bln dance is a two-way hedge

read more

Fewer US temp jobs may flag longer lasting concern read more

India’s twin growth engines face turbulent weather read more

Editing by Lauren Silva Laughlin and Sharon Lam

Our Standards: The Thomson Reuters Trust Principles.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

[ad_2]

Source link