[ad_1]

Amidst ongoing issues in traditional markets, some view cryptocurrency as an investment option for retirement. We talked to experts to explore the pros and cons.

In all the noise and concerns surrounding cryptocurrency, especially after cases like the downfall of FTX, convincing people about its positive aspects has become increasingly challenging. In this chaotic environment, considering virtual currencies as a retirement investment option is a tough decision for anyone.

Presented with options like traditional Individual Retirement Accounts(IRA), bonds, stocks, mutual funds, or wealth preservation through precious metals, crypto could be the last thing on your mind.

This article dives into the ups and downs of investing in crypto as a retiree, discussing the risks and challenges that come with it and how Bitcoin ETFs would impact digital currency investments.

The rise of cryptocurrencies

When Bitcoin entered the market, capped at a supply of 21 million, it barely had any value. It, however, started to rise in popularity on May 22, 2010, when Laszlo Hanyecz paid 10K BTC valued at $25 in total for two Papa John’s pizzas, a day crypto stans know as Bitcoin Pizza Day.

By 2013, BTC had reached values as high as $1,242 despite receiving criticism from mainstream institutions and investors. It clocked its all-time high in late 2021, reaching a whooping $67K, approximately 75% more than its value a year before.

The rise encouraged investors to pour money into the digital currency market, but the price came down fast and has failed to return to those levels to date.

Surge in crypto interest from retirement savers

The current financial market is not at its best. The latest International Monetary Fund’s (IMF) world economic outlook report describes the global economy as experiencing persistent core inflation.

According to IMF analysts, while risks have become more balanced and the banking sector stress has reduced, the global economy remains “tilted to the downside.”

Earlier this year, a survey from Allianz Life Insurance Company showed that Americans are worried about inflation. Prices of commodities like food and housing have been going up at abnormal rates, and many people leaving employment think the steep rise will deny them a worry-free retirement.

The U.S. Senate only just managed to avert a government shutdown with a stopgap funding bill, as Washington flirted with defaulting on its $31 trillion debt.

Fuel prices are rising, and the conflicts between Russia and Ukraine, and Israel and Hamas are not doing the market any favors.

An economic environment constituting high-interest rates can make investors a little “anxious,” prompting them to look for better options. Also, with rising rates, lending conditions will likely get tighter and more stringent.

For instance, in the United Kingdom, since the rise of the crypto and stock market in 2021, interest rates have risen by about 5%. The Bank of England’s Monetary Policy Committee (MPC) cited the reason for the rise as high inflation.

Moreover, the MPC believes the rates may increase in the future if inflation pressures become more persistent

Cryptocurrency markets are not necessarily affected by such macroeconomic factors. Staking yields from digital currencies like Ethereum fluctuate because of parameters like network activity, validators, staking amounts, and market bull or bear runs.

Amid these issues, some have begun considering cryptocurrencies as investment options.

Why the Bitcoin ETF approval is important

For Gen Zs and a majority of Millenials, the “how to” invest in cryptocurrencies may seem quite simple. But digital currencies may seem like gibberish for Gen X, who are arguably the parties currently in their retirement phases. Crypto’s seeming complexity, coupled with the market’s risks and dangers, could push away retirees.

The prices of assets like Bitcoin, which is currently trading slightly above $37,000, might be a little more than a retiree is willing to risk. Moreover, regulatory concerns have clouded the feasibility of crypto investments, and the possibility of the market crumbling makes investors uneasy.

To bring in more people into crypto without them directly engaging with the assets, several entities are pushing for the approval of futures and spot exchange traded funds (ETFs), specifically those embedding BTC.

Bitcoin futures ETFs are investment products that consist of Bitcoin-related assets. These ETFs are made available on traditional exchanges by brokerages, allowing retail and other investors to gain exposure to cryptocurrencies without the need to own them directly.

This approach provides an accessible way for individuals to tap into the potential of digital currencies within a regulated environment.

The importance of the approval of Bitcoin ETFs can’t be overstated; analysts think it may open doors for more businesses and individuals to get into the crypto market in a safer and more controlled manner.

Jonathan Rose, co-founder of Genesis Gold Group, and an experienced professional in the commodities market, avers that there is potential for crypto as an alternative asset for retirement savings. However, the feedback from clients, according to him, revolves around the lack of an established history for digital assets.

“Cryptocurrencies have really only been mainstream in the investment world for less than a decade, as compared to alternative assets like real estate or gold & silver which have been proven stores of value for thousands of years.

We have also yet to see how cryptocurrencies perform during a recession, which is a major concern for retirees as their main priority at this stage is simply preservation of their wealth.”

Jonathan Rose, co-founder Genesis Gold Group

How ETF approval could impact crypto

According to Galaxy Digital head of firmwide research Alex Thorn, Bitcoin ETFs may witness a minimum inflow of $14.4 billion in the first year, which could escalate to $38.6 billion by the third year.

If these levels are sustained, market watchers estimate BTC/USD might experience a substantial 75% appreciation in the year subsequent to regulatory approvals.

They also think more people are likely to dive into the crypto market if these vehicles get the approval, as it will be easier to access Bitcoin. ETFs will simplify crypto investments by saving investors the hassle of handling wallets with seed phrases.

Moreover, with spot ETFs being regulated, they can enable retirees to push for institutions handling 401(k) accounts to include Bitcoin as part of their portfolios.

CoinShares Ethereum research associate Luke Nolan believes the traditional method of institutional exposure to Bitcoin involves utilizing futures ETFs.

These exchange-traded funds allow investors to gain exposure to BTC by investing in futures contracts. However, they bear additional costs since these vehicles have to roll over futures contracts.

Spot ETFs may address the cost issue because, unlike futures ETFs, they can provide investors with direct exposure to the underlying asset, eliminating the need for rolling over futures contracts.

As a result, spot ETFs are expected to offer lower expense ratios, making them more cost-effective for investors, which is why players in the sector are pushing for their approval.

Jonathan Rose concedes that a Bitcoin ETF approval would solidify the crypto market’s status. However, his biggest worry is in what capacity it would exist and for whom it would be advisable to invest in crypto.

Different retirement investors have different risk tolerances, with some being willing to take risks in hopes of a big win, while others might opt for the relative safety and familiarity of more traditional asset classes.

He further pointed to the ongoing debate in government circles regarding regulation around digital assets, which are in constant flux. In his opinion, there can be no accurate judgment on the state of the crypto market in the next few years.

Potential of cryptocurrencies for retirement savings

How much savings does one need in retirement? The answer to that question is relative and dependent on where one would like to spend their days as a retiree.

After hanging up the boots, you may find yourself a little short on finances to fund the dream life you wanted. If that is the case, keeping your money away from the market is ill-advised; crypto investment may be one creative way to diversify your portfolio.

Currently, with inflation and interest hikes, making some profits from the digital currency market can help retired persons keep up with the economy.

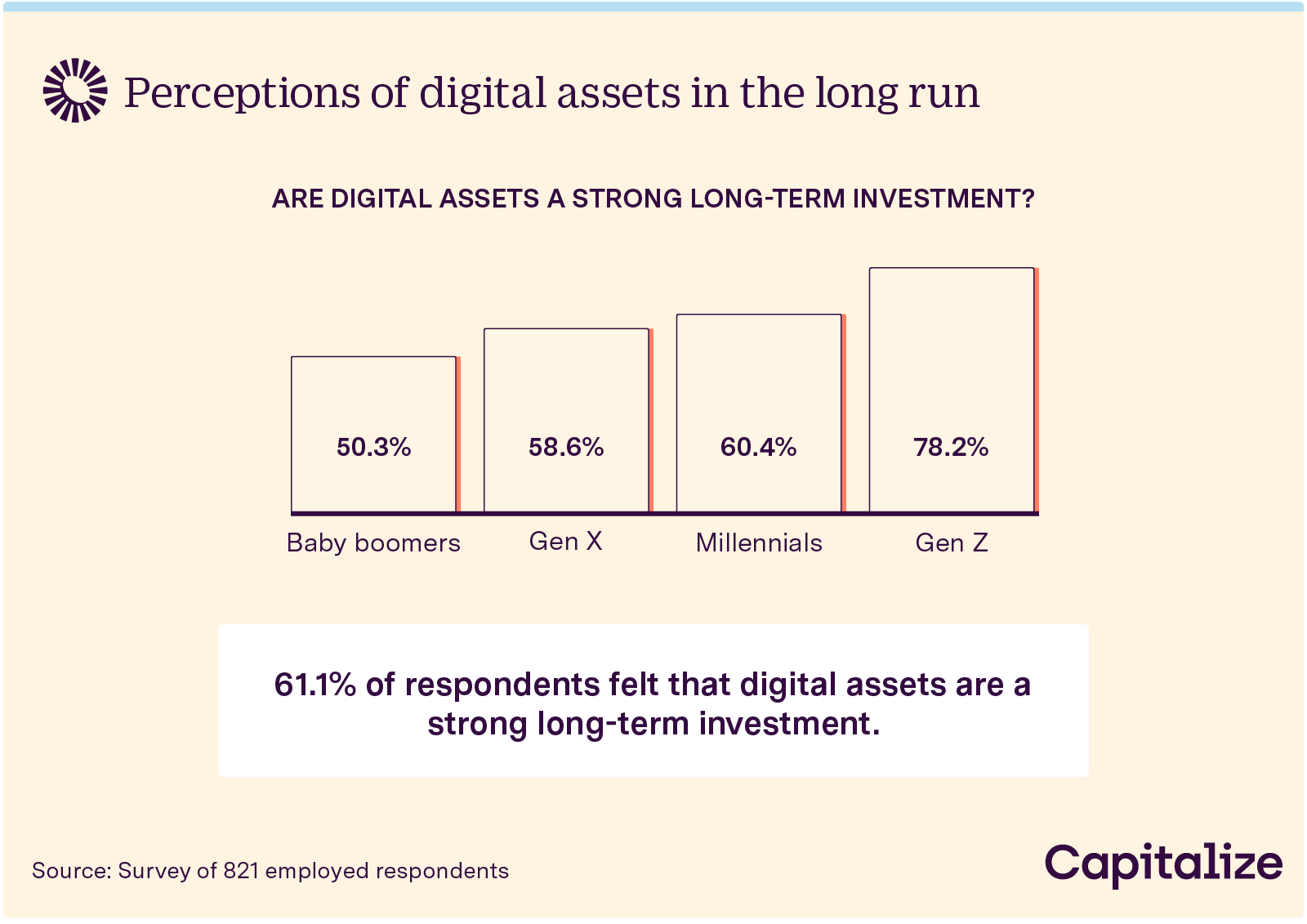

A survey by Capitalize, a 401(k) market consolidator fintech company, showcased how employed persons think positively about crypto as a retirement investment.

According to the fintech firm, retirement investors prioritize volatility when considering their investment choices.

When investors have ample time to save, they have the potential to take greater risks. Workers generally opt for more conservative investment allocations as retirement approaches and avoid volatile strategies that can quickly diminish account balances.

Based on the survey conducted on 821 employed individuals, approximately 57% perceive cryptocurrencies as a highly volatile investment vehicle, while 45% consider them risky.

Navigating risks and challenges

Cryptocurrencies have been dubbed risky investments due to high losses from scams, hacks, bugs, and volatility. Despite the fundamentals of digital currency, like cryptography and blockchain emphasizing safety, the technical difficulty of using and keeping crypto assets can be a major problem for retired investors.

A massive chunk of the global population has access to the internet, which has allowed scammers greater access to people. Such fraudsters usually attract new investors by promising safe settlements with lucrative, assured returns over a short period, which is sometimes told in hours or days instead of months or years.

Rose believes there is a huge difference in the risk factors between cryptocurrencies and more traditional investment commodities like precious metals. He claims studies have shown BTC is up to five times more volatile than gold, giving an example of how the cryptocurrency made nearly 100% gains in 2021 only to lose more than 70% of its value in the following 12 months.

In that same period, according to the commodities investment expert, gold maintained its value even as it went through “tough economic times.”

Despite the challenges, and in the face of the asset’s speculative nature, some investors have made significant earnings by choosing to take the risk of investing in crypto, so the digital currency market is not all gloom and doom.

Even Rose acknowledges that with risk comes the potential for reward.

“The same volatility that can be punishing if timed incorrectly can be very rewarding if managed properly. For that reason, these choices are up to the individual whose hard-earned money is in question.”

Jonathan Rose, co-founder Genesis Gold Group

Volatility and security concerns

Most investors maintain that crypto, with its prospects of significant returns and recognition as an advanced investment, is still a good way to create a retirement plan. However, there are some risks in the crypto market, which include:

- Volatility: Cryptocurrencies are unstable, and their worth can change daily. The volatility makes it a hazardous investment, mainly for investors dependent on their retirement savings for intraday utilities.

- Regulatory concerns: The crypto market is hugely unmonitored, meaning there is little safety to protect the investments. The unregulated environment has opened doors for scammers to execute rug pulls, as it is highly unlikely for investors to identify projects that are scams, leading to huge losses.

- Slow adoption: Despite the unforeseen growth in the cryptocurrency market, the general public and businesses haven’t fully welcomed digital currencies as a form of payment. The skepticism limits the options of retirees to add crypto to their investments.

Conduct research before investing

We’ve all encountered the acronym DYOR at some point in our financial endeavors. DYOR means do your own research, a highly encouraged activity for any investor, irrespective of what asset class they plan to delve into.

The main purpose of DYOR is to help investors grasp knowledge about certain firm information, like its growth, stocks, and technological advancement. The information will help you as an investor have a clearer image of an asset’s performance and whether buying is the right way to go.

Research and reviews increase the precision of business evaluations, helping you assess assets and make informed decisions accurately.

You will almost always get agitated when making investment decisions on instincts, guesswork, or “influencers” advice. A good investment is a calculated risk, so you need to familiarize yourself with the risks and rewards of each asset class in your portfolio.

Diversifying a retirement portfolio with cryptocurrencies

The cryptocurrency market bears several risks; putting all your eggs in one basket can either work exceptionally well or leave you dismayed.

Given the volatile nature of the market, it is advisable to consider mixing up strategies to spread the risk within your investment portfolio.

Some tips you can try out when investing in crypto include:

Buying cryptocurrency stocks

Crypto stocks are shares from companies affiliated with digital currencies or blockchain technology, usually through development, storage, usage, or mining. Such entities include crypto exchanges, mining startups, blockchain technology companies, and trust funds.

If you are looking for a more secure and regulated way to invest in crypto, you can research the best crypto stocks to buy. These stocks expose you to digital currencies without buying, selling, or storing them.

Buying different tokens

Purchasing different sets of virtual currencies is the most popular way expert traders invest in the crypto market. It is an effective way to “spread the risk” when the market experiences a downturn or to maximize profits when a bull run occurs.

Add stablecoins, staking, utility, and governance tokens to your portfolio. This way, even when the market slumps, you can make subtle profits from different blockchain networks.

Decentralized finance projects

Decentralized finance (defi) projects are unique platforms that offer various investment option packages, including yield farming, crypto lending, and decentralized exchanges (DEXs).

They may offer high returns because of their capability to yield profits from high interest rates and rewards from staking tokens.

The upside with defi assets is they do not correlate with the state of the traditional financial markets. So, when there’s a slump in your bonds and stocks investments, your income may not be affected on the defi side.

Crypto market predictions: potential for long-term growth

The general sentiment around the crypto market currently is that the long bear market spell is coming to an end. Several crypto commentators believe BTC will charge upwards, with some, like Gemini Exchange Chief Strategy Officer Marshall Beard saying it could reach $100,000 soon.

Tether CTO Paolo Ardoino said Bitcoin will retest its all-time high and will likely go above $69,000. Nonetheless, traders will be eying the next Bitcoin halving event, scheduled to take place in 2024, for the cryptocurrency to rally.

Despite the fall of FTX and the subsequent trial of its founder and CEO Sam Bankman-Fried, the Silicon Valley Bank incident, and several hacks, including the infamous Ronin breach, the crypto market seems to be holding up.

Digital currencies are emerging as an alternative to traditional currencies as fears of recession and banking system failures continue clouding traditional financial markets.

Traditional retirement savings vs. crypto

Cryptocurrencies offer some convenience compared to traditional investment options, such as making trades 24 hours a day.

Digital currency markets, unlike stocks, do not close at any given time, so you can freely make transactions and execute trades to your liking. Here are the major differences between traditional retirement savings options and crypto:

Risk tolerance and volatility

Digital currencies offer the potential for significant returns but are also notorious for their volatility. The value of cryptocurrencies can sharply fluctuate within short periods, resulting in substantial potential losses.

Conversely, conventional retirement savings alternatives such as 401(k)s and IRAs generally invest in a diversified range of stocks and bonds, which tend to exhibit less volatility over the long run.

Crypto IRAs and Roth IRAs

The diverse nature of crypto has birthed the ideology of flexible and customizable IRAs created to hold virtual currencies like Bitcoin. Certain firms provide these cryptocurrency IRAs, where the tax benefits of an IRA are merged with the potential growth of digital currencies.

This approach allows individuals to explore the world of cryptocurrencies while enjoying the advantages of a traditional retirement account.

Roth IRAs, on the other hand, are tax-free retirement accounts that offer retired investors more control over their portfolio, where they can mix stocks, mutual funds, and bonds.

Although they are a much “safer” option than crypto IRAs because of their low volatility, the latter offers higher returns.

Regulations

Retirement accounts mostly adhere to traditional regulation laws and are safeguarded by government agencies, offering protection against instances of fraud and theft.

On the flip side, cryptocurrencies operate with less regulation, and even though blockchain technology is secure, even regulated cryptocurrency exchanges are susceptible to hacking attempts.

Is crypto good for retirement investments?

Cryptocurrencies could be viable options as a retirement investment option, but they may pose risks and challenges to your savings. Given their volatile nature, you can lose all your savings in seconds. However, the same price fluctuations could also boost your profits. Just as in any investment, you have to calculate if the risk is worth it by DYOR.

Investing in crypto and diversifying your portfolio could help you increase your retirement benefits package and, in the long term, help you achieve the kind of retirement life you dreamed about in your working days.

Jonathan Rose believes there is a future where crypto can co-exist with more traditional investments in a retirement portfolio. However, he suggests that physical assets such as precious metals make for better hedges against market volatility and can provide greater peace of mind for retirees.

In his opinion, crypto assets do not have enough of a track record to allow for speculation regarding their worth as proper hedges.

The financial advisor with 20 years of practice under his belt advises investors contemplating integrating crypto into their retirement savings strategy first to consider their risk tolerance.

He believes investors in earlier stages of life, or who are still actively working, are better placed to allocate some of their funds to a more volatile asset class like crypto.

However, according to him, the people he speaks with are simply looking for stability in their retirement, which could best be found elsewhere in the alternative asset space.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

[ad_2]

Source link