[ad_1]

Strategists at BlackRock Investment institute downgraded its tactical view on Chinese equities and their emerging-market peers to neutral from overweight, saying “China’s property sector remains a drag even with growth showing signs of stabilising.”

“Growth has slowed. Policy stimulus is not as large as in the past,” strategists including Jean Boivin and Wei Li wrote in a report published on Monday. “Structural challenges imply deteriorating long-term growth” [while] geopolitical risks persist. “We see growth on a slower trajectory” in emerging markets, they added.

New York-based BlackRock, which manages US$9.4 trillion of assets, last raised both asset classes on Febuary 21 from neutral to overweight, based on their conviction over the next six to 12 months, on “short-term opportunities from China’s restart” after Beijing abandoned its zero-Covid policy to save the economy.

The 1,421-member MSCI Emerging Market Index has fallen 1 per cent since the upgrade, according to Bloomberg data. Stocks from mainland China, Hong Kong and Taiwan made up almost 45 per cent of the weight in the gauge. Over the same period, the MSCI China Index slumped 11.8 per cent while the MSCI World Index advanced 7.8 per cent.

The Hang Seng Index has declined 9.1 per cent, the worst performer among major global equity benchmarks.

“Beijing is still not providing sufficient stimulus to reboot growth,” said Chen Zhao, global market strategist at Montreal-based Alpine Macro in a report on Monday. “There is no reason to expect an imminent turnaround in emerging-market relative performance because of Beijing’s policies.”

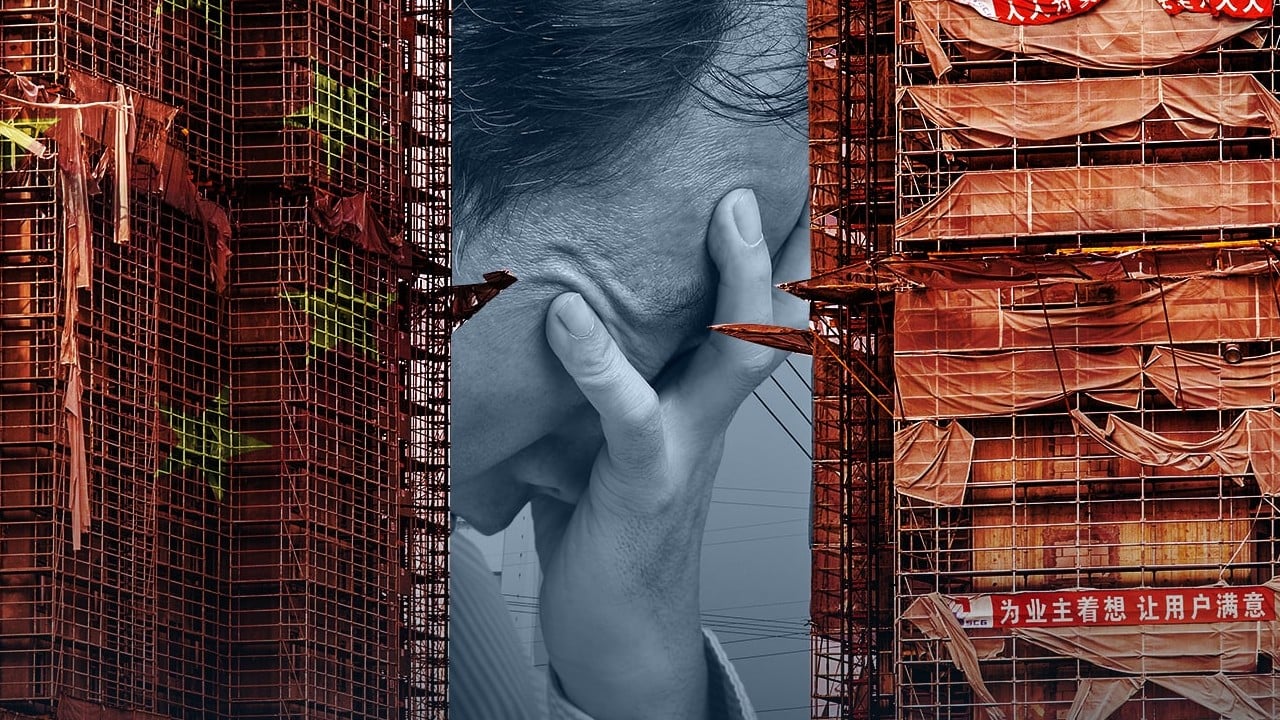

While China has been taking steps to shore up home purchases, Beijing’s policy actions have done little to address the credit crunch in the US$2.6 trillion domestic housing market. Since its crippling “three red lines” policy in August 2020, the nation’s biggest private developers have struggled for survival while fending off creditors.

Cracks in China’s property bonds push BEA to favour Macau, India and Indonesia

Cracks in China’s property bonds push BEA to favour Macau, India and Indonesia

From China Evergrande to Guangzhou R&F Properties and Kaisa Group, Chinese developers have defaulted on more than US$100 billion worth of bonds over the past two years, JPMorgan estimated at the end of 2022. Rating pressure and a funding squeeze suggest creditors could be on the hook for US$21.5 billion of capital losses this year, the US bank added.

Country Garden Holdings, once the nation’s biggest homebuilder, this month has reached out to bondholders to delay debt repayments, while state-linked Sino-Ocean group froze all offshore debt payments to reorganise its finances. China Evergrande’s US$20 billion debt workout still hangs in the balance as some creditors witheld approval.

“For the current setting, there can be more defaults among private developers,” Pheona Tsang, chief investment office of fixed income at BEA Union Investment in Hong Kong, said in an interview. China has mostly focused on propping up housing demand in big cities, instead of addressing developers’ funding squeeze, she added.

[ad_2]

Source link