[ad_1]

Even as investor interest in exchange-traded funds, or ETFs, that promote higher environmental, social and governance (ESG) standards fades globally, Asia is seeing strong growth in new ETFs linked to climate action being rolled out.

This week, asset manager BlackRock launched a new Asia-focused climate action fund in Singapore – one that has attracted over US$426 million from investors so far, making it the city-state’s largest equity ETF on record.

The climate action ETF launched on the Singapore Exchange (SGX) on Thursday is backed by a consortium of investors like British insurer Prudential, Singapore’s state-owned investor Temasek and insurer Singlife.

It is the third ETF offering by the world’s largest asset manager – with about US$9 trillion under management – that tracks MSCI Climate Action Indexes, coming three months after launches in the United States and Japan. An ETF is a basket of assets or stocks that track a specific index. By holding multiple assets, it can give investors more diversification compared to investing in individual stocks.

According to BlackRock, the fund offers investors access to “best-in-class” companies across Asia Pacific that are committed to reducing carbon emissions. These are usually large companies that have been assessed to outperform their peers based on factors including approved science-based targets, management of climate risks and green business revenue.

SGX Group, in its press release, said that as Asia manages growing climate risks, this can present a “substantial investment opportunity”, and climate action instruments such as the newly-listed ETF can play a crucial role by directing funds towards companies and projects focused on climate transition.

Michael Syn, senior managing director and head of equities at the stock exchange shared that SGX Group have been working with BlackRock and MSCI, a leading global provider of equity indexes, to create a new ecosystem of climate-related tools to support investors in building a diversified portfolio of climate-conscious assets.

Gillian Tan, chief sustainability officer of the Monetary Authority of Singapore added that the new index “adds to the suite of innovative products in Singapore that supports transition and decarbonisation efforts in Asia.”

“Looking ahead, Singapore welcomes the development of solutions that facilitate decarbonisation, while meeting the investment and risk management needs of issuers, asset owners and investors in the region,” she said.

BlackRock’s latest ETF falls under a suite of transition investing products worth over US$100 billion that it began to roll out last year. The shift to such instruments comes amid increasing politicisation of ESG investing – which the firm’s chief executive Larry Fink had championed – in the United States.

Media reports also point to how there has been a surge in the closures of sustainable ETFs globally, while debuts have decreased. In Asia, however, the move to index investing and an enduring focus on ESG factors have seen climate-related ETFs evolve as an attractive instrument for investors.

Commenting on BlackRock’s new climate fund, Sasja Beslik, chief investment strategy officer at asset manager SDG Impact Japan, noted that it still neglects to support decarbonisation efforts of mid-cap companies which account for about 70 to 80 per cent of listed companies in Asia, given how it has an outsized focus on top-tiered large-cap companies.

Mid-cap companies typically have a market value between US$1 and US$10 billion, compared to large-cap companies which exceed US$10 billion in market value. Asia, excluding Japan, is estimated to be home to more than 19,000 listed companies in the small- and mid-cap space.

There are currently around three to five actively managed mid-cap funds in all of Asia, which is insufficient, said Beslik. “All efforts in this space make a huge difference.”

BlackRock’s new fund is one of the many climate-related ETFs that have come to market in Singapore in the past two years. Last April, Lion Global Investors and OCBC Securities – both related to OCBC Group – debuted Singapore’s first low-carbon ETF, which aims to give investors exposure to the 50 largest Singapore companies with lower carbon intensity values and fossil fuel involvement that their sector peers.

Five months later, Singapore-based broker CGS-CIMB Securities debuted another low carbon ETF – then the largest ETF at launch at S$150 million (US$110.3 million) – which tracks the FTSE Asia Pacific Low Carbon Select index.

Since their inception, Lion-OCBC Securities Singapore Low Carbon ETF has reaped 3.5 per cent in returns, while the CGS-CIMB Securities FTSE Asia Pacific Low Carbon Index ETF has gained 16.93 per cent in returns.

Based on data prior to its launch, the MSCI Asia ex Japan Climate Action Index’s annual returns would have been -20.47 per cent last year, about 0.8 percentage points below the returns the parent index fetched at -19.67 per cent.

Performance of MSCI Asia ex Japan Climate Action Index compared to its parent index. Source: MSCI Asia ex Japan Climate Action Index

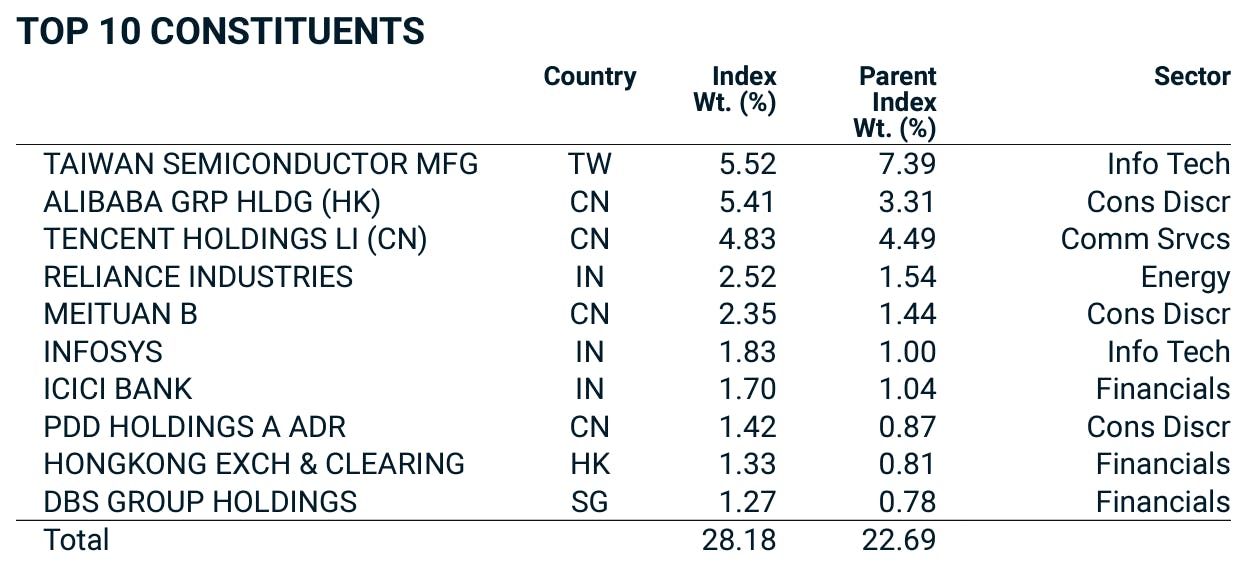

The index has 605 constituents and its top ten holdings – which include the world’s largest chip maker Taiwan Semiconductor Manufacturing Company (TSMC), Chinese e-commerce giant Alibaba and gaming behemoth Tencent Holdings – make up over a quarter of the index, according to its August factsheet.

The top ten constitutents of the MSCI AC Asia ex Japan Climate Action index are largely the same as the parent index, with the exclusion of South Korean conglomerate Samsung Electronics and Asia’s largest insurer AIA Group. Source: MSCI AC Asia ex Japan Climate Action Index

[ad_2]

Source link