[ad_1]

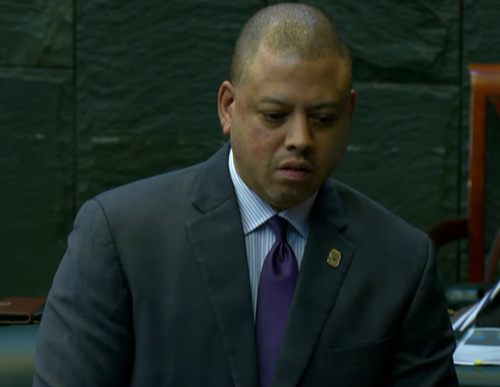

(CNS): Financial Services Minister André Ebanks has steered several bills through parliament, including a stand-alone Beneficial Transparency Ownership Act to improve the current regime on how information relating to who benefits from financial entities registered here is shared and to stay ahead of changing standards and rules.

Explaining the law during last week’s special parliamentary meeting, Ebanks said the bill consolidated the framework into a single act.

Ebanks said it was important to get ahead of standards on the international stage rather than being behind them and having “to scramble before the next assessment to push through legislation”, as this puts too much pressure on drafting and those involved.

The Cayman Islands has been collecting beneficial ownership for over two decades. After an exchange of notes agreement with the UK in 2016, some laws were introduced to require information to be shared with the register of companies. The issue has evolved over the last six years, and in 2019 Cayman was found to be only partially compliant over beneficial ownership because of inadequate sanctions over non-compliance and difficulties of verifying the information being submitted.

Since Cayman first rolled out relevant legislation on this subject, the rules and standards on the international stage continue to evolve, and Ebanks said this streamlining of the legislation would help the jurisdiction keep one step ahead.

However, he said that the commitment Cayman made in 2019 relating to the publication of public registers to the UK when open access becomes the global standard would not be adopted yet.

Ebanks explained that the European Court of Justice had ruled last year that the publication of ownership information was disproportionate and interfered with privacy rights. In light of this, his ministry took legal advice and as a result the general public register is unlikely to go ahead because it may not be constitutionally sound.

Nevertheless, the law provides a window for that to happen in the future or to give information to those that have a legitimate need. But the law also requires a resolution of the parliament, so it has ringfenced that situation until it becomes a global standard. Ebanks said there would be plenty of time next year for the public to consult and legislators to wrestle with that more controversial element of the evolving standards in relation to international finance and the offshore sector.

Alongside the new streamlined legislation on ownership transparency, Ebanks steered through another nine amendment bills to change existing financial sector related acts to tie in with the new BO act. The minister also said that the industry had been widely and extensively consulted over the law and helped shape the act.

“This is a bill that sets out a new vision for the Cayman Islands to be a step ahead, to not have to grapple with these issues on the back foot and capitalise on the success that we all share in being removed from the FATF grey list,” he said. “I would not like to see any other minister in that position again,” he added.

See the full debate on CIGTV here:

[ad_2]

Source link