[ad_1]

(CNS): Government will continue to press local banks to reduce interest rates, and it has accepted a motion by McKeeva Bush MP (WBW) to look at creating a local interest rate-setting body and allow the government-funded Cayman Islands Development Bank to accept deposits. But the local retail banks have defended their refusal to delay or lower interest rates, saying they are helping clients, which is reflected in the low home loan delinquency levels.

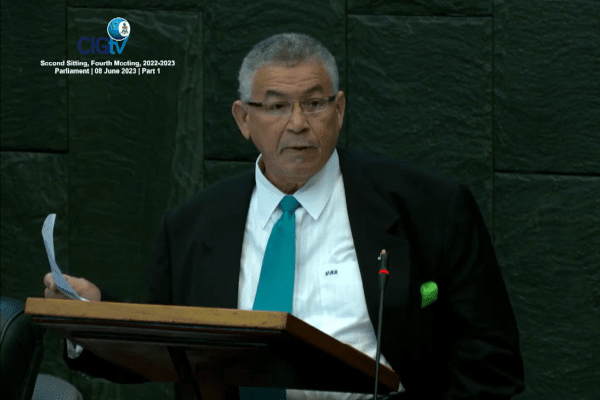

The private member’s motion, brought by Bush and supported by Chris Saunders (BTW), was debated in parliament Thursday. Most MPs agreed that government must do something to deal with the hikes in interest rates that, in some cases, have led to mortgage payments doubling over the last year.

Premier Wayne Panton was not in full agreement with Bush’s motion, but he accepted the proposal, acknowledging the “unenviable situation” in this jurisdiction navigating the problem of inflation and the decision by local banks to follow the US Federal Reserve as it raises rates to take the heat out of the US economy.

He said that the ten rate increases in just over a year had created a real problem and an “absolute challenge” for many people, but the government would continue to do what it could to help and support people who were struggling. But he argued that the issues relating to bank rates were complex and there wasn’t an easy fix. Trying to legislate a rate cut would have repercussions, he warned.

Panton noted that the Law Reform Commission was still working on new legislation that would offer more protection to those with home loans.

However, the motion goes much further, calling on the government to continue pressing the banks to cut rates, pause future hikes and review how the whole system works. When the vote was taken, the motion was supported by all the members present.

Bush argued that the banks here did not need to follow US rates and accused them of cartel-like practices. He said he wanted to see CIMA become the interest rate-setting body, even though the premier said this would be too costly for the authority.

Bush said the government was spending millions on consultants for an EIA for the East-West Arterial when it didn’t need to, and it should be spending money where it is needed. He said that many families were really struggling to pay the significant increase in their mortgages while having to deal with increased CUC bills, higher-than-ever insurance premiums, gas for the car and the high cost of living.

He said that many people believe that the members of parliament are not doing enough to help them. “That’s not just one or two people; it’s a widespread feeling across this country. People just cannot take any more. The whole cost of living is destroying families.”

In the wake of the debate, the Cayman Islands Bankers’ Association issued a statement claiming the local banks were trusted stakeholders with a vested interest in the success of the Cayman Islands and its people and had contributed to the high standard of living here. CIBA stated that the banks were “seeking to help customers with sound advice, support and solutions” through the interest rate increases.

“Banks have proactively responded by offering a variety of fixed-rate loan options, often below the Prime Rate, thus providing the opportunity of stability and predictability for borrowers,” CIBA said, noting that more people had taken fixed-rate loans over the last year as many customers have chosen to mitigate their risk.

However, the premier said that the majority of local mortgages are not fixed and remain impacted by rate hikes. He noted, too, that only those with a very good credit rating and are not struggling to meet their financial obligations and needs tend to get the favourable rates, not those who need them the most.

Nevertheless, CIBA said the banks had all worked closely with customers experiencing financial difficulty, exploring possible solutions and loan restructuring to provide support during challenging times. “As a result of ongoing dialogue and support of customers, delinquency levels to date remain low and stable across the country,” CIBA said.

However, the premier revealed that the Credit Union is dealing with a growing portfolio of defaulting loans.

CIBA justified the banks’ decision to remain in line with the Federal Reserve’s rates, saying that this position helps mitigate potential imbalances in the financial system and ensures consistency and continued stability throughout market cycles.

“Any change to the current rate setting convention could create an imbalance between funding costs and borrowing rates,” CIBA said. “Such an imbalance could potentially result in banks deploying capital elsewhere and as a consequence, access to credit locally could tighten.”

See the full CIBA statement and the debate in parliament on CIGTV below.

[ad_2]

Source link