[ad_1]

Hong Kong, China – German entrepreneur Joseph loved his life in Hong Kong. When not tending to his logistics company, he would enjoy strolls along the waterfront promenade, weekend brunches in the upscale Soho district and foot and back massages to relieve the daily stresses of life.

But less than two years after setting up his business in Hong Kong, Joseph in January decided he could see no future in the city and relocated to Singapore.

“Many potential investors are hesitant to invest in Hong Kong as they don’t think it is a safe location to start a company any more,” the 28-year-old professional, who asked to be referred to by his first name, told Al Jazeera.

“I can see that the city changed in front of my eyes. Hong Kong has been one of the most cosmopolitan cities but the protests and COVID restrictions mean that advantage is fading…Investors don’t feel legally safe because they don’t know if there’s still neutrality in Hong Kong’s judicial system, while the legal system in China is full of grey areas. There are enough uncertainties in businesses, why do we want more?”

As Hong Kong marks the 25th anniversary of its return to Chinese sovereignty on Friday, the city’s status as an international financial and business hub is in doubt like at no point since the handover.

Tens of thousands of residents have exited the former British colony as Beijing’s tightening authoritarian control and strict pandemic restrictions aimed at aligning with China’s “zero-COVID” strategy dramatically reshape life in the city.

More than 120,000 people, locals and expatriates alike, departed in 2020 and 2021, with tens of thousands more expected to follow this year.

In a survey carried out by the American Chamber of Commerce of Hong Kong last year, more than 40 percent of expats said they were planning to leave or considering it, mostly due to concerns over a draconian national security law imposed by Beijing in 2020, stringent COVID restrictions that limit international travel and a bleak outlook for the city’s future competitiveness.

At the same time, fewer professionals are moving to the territory, with the number of applications for work visas dropping from 41,592 in 2018 to 14,617 in 2020, according to government data.

From humble beginnings as a fishing village, Hong Kong transformed into an international business hub with a vibrant stock market often ranked alongside Singapore, London and New York.

After Hong Kong was ceded to Britain under the Treaty of Nanking that ended the First Opium War in 1842, the territory became a regional centre for financial and commercial services.

During the 1970s and 1980s, the city transitioned away from manufacturing to financial services as factories, initially staffed by cheap labourers from mainland China, sought cheaper labour overseas.

Under the “Open Door” economic reforms initiated by Chinese President Deng Xiaoping in 1978, the city’s integration with China deepened, spurring vigorous international investment and trade.

Five years later, the Hong Kong dollar was officially pegged to the US dollar, after uncertainty over the then colony’s future resulted in a sharp depreciation of the currency.

Under the terms of Hong Kong’s return to China in 1997, Beijing promised to preserve the city’s way of life, including civil liberties and political freedoms not available in mainland China, for at least 50 years under the principle of “one country, two systems”.

Those freedoms, however, have rapidly declined amid a sweeping crackdown on dissent that has practically wiped out the city’s pro-democracy opposition and forced the closure of independent media outlets and dozens of civil society organisations.

Incoming Hong Kong Chief Executive John Lee has pledged to strengthen Hong Kong’s reputation as a global financial centre, without offering a timetable for reopening the city to the world.

Lee, a former security chief who ran unopposed in an election tightly controlled by Beijing, has hailed the national security law for restoring order and stability and described the implementation of “one country, two systems” since the handover as “resoundingly successful”.

But for international companies, the uncertainty created by the law, which has resulted in more than 200 arrests and instituted significant changes to the city’s feted British-inherited legal system, has become a major source of anxiety, according to Michael Davis, a former law professor at the University of Hong Kong.

“The vague national security law causes considerable uncertainty about acceptable behaviour for international companies,” Davis told Al Jazeera.

“The pressure on the courts that has accompanied enforcement has likely reduced confidence in the rule of law, which has historically been the city’s distinguishing characteristic to attract international business.”

Davis said international firms also face pressure to support Beijing’s policies “while at the same time these companies face pressure in democracies where they operate to not support such repressive policies, at the risk of market exclusion”.

For Joseph, who led the Asia operations of a logistics firm before setting up his own company, Hong Kong’s fading appeal is undeniable.

“Hong Kong had many advantages like easy cash inflow and outflow, and the law system is close to Britain’s common law system,” he said. “It was politically and judicially stable. At the time my former company could choose [to set up the Asia headquarters] between Singapore and Hong Kong, and we chose Hong Kong as it was the gateway to China.”

Hong Kong’s strict COVID restrictions, which once included 21 days of mandatory hotel quarantine for incoming travellers, have further damaged the city’s allure.

Despite branding itself as “Asia’s World City”, the territory remains one of the few places outside China to quarantine arrivals, while its “circuit-breaker” policy of suspending flight routes linked to COVID cases regularly leaves travellers stranded overseas.

“This [policy] escalates the cost for expatriates to visit their family in foreign countries,” Vera Yuen, a lecturer of economics at the University of Hong Kong, told Al Jazeera.

“The quarantine requirement has been later modified to seven days, but the circuit-breaker policy has been upheld. It was too late to keep these people in Hong Kong, especially when compared with much of the rest of the world, in which quarantine measures are no longer in place. As uncertainty prevails, another outbreak can lead to stricter measures again. They decided to relocate to a place that gives them more personal freedom.”

Many local residents, too, have lost hope in the city.

Ip, a 30-year-old financial worker, said he plans to move to the UK in the near future due to the “increasingly undesirable environment”.

“I am working in a British company, but many British and European coworkers resigned and returned to their home countries,” Ip told Al Jazeera, asking to be identified by her surname only. “I think Hong Kong companies will lose their international nature.

“In the long run, the asset management industry might see lower demand due to less asset inflows. Coupled with a questionable [national] education here for my future kids and the city’s lack of innovation in the past 25 years, I do want to leave Hong Kong,” Ip added.

Whatever Hong Kong’s future holds, there is little doubt it will be more closely bound to China. Already, more than half of the companies listed on the Hong Kong Stock Exchange (HKEX) are from the mainland.

Yuen, the economics lecturer, said China hopes to use Hong Kong to achieve economic goals including the internationalisation of the renminbi (Chinese currency) through “hosting RMB-denominated bonds and being an off-shore centre of RMB exchange”.

“Hong Kong’s stock market is increasingly dominated by mainland companies,” she said.

In 2014, the Shanghai-Hong Kong Stock Connect was launched to provide mutual equity access between the Hong Kong and mainland markets, followed by an expansion two years later to include Shenzhen, allowing mainland investors access to smaller companies in Hong Kong.

In 2018, a change in the rules for weighted voting rights led to a wave of mainland Chinese company listings, including e-commerce giant Alibaba Group in November the following year. Last year, Wealth Management Connect was launched to provide access to investment products among Guangdong province, Hong Kong and Macau.

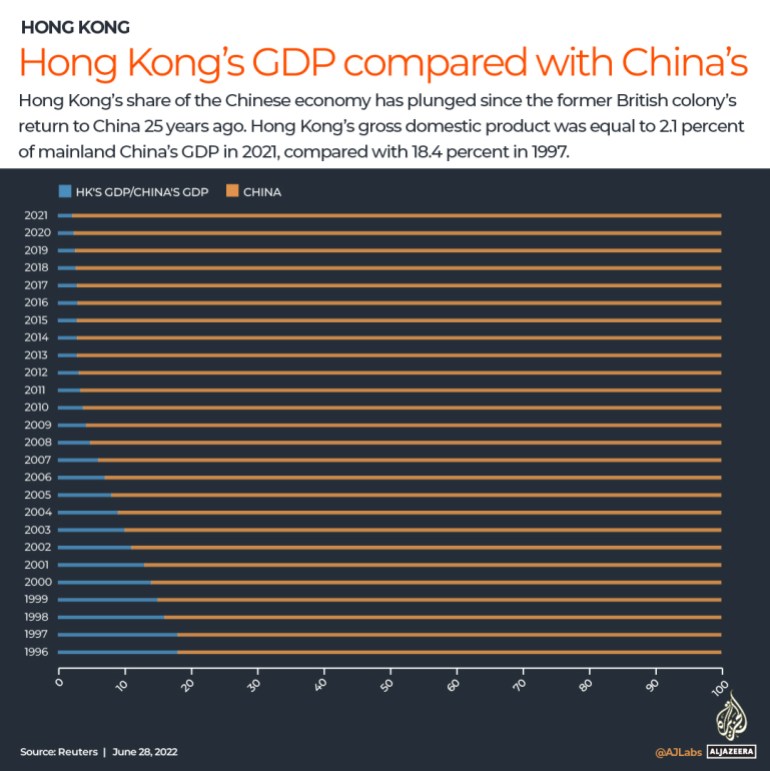

While Hong Kong’s freedoms and international character have suffered, the city’s increasing alignment with China has been accompanied by growing wealth. Since 1997, the city’s economy has more than doubled, with gross domestic product (GDP) reaching $368bn in 2021 – although GDP shrank 4 percent in the first quarter percent year-on-year as pandemic restrictions weighed on growth.

Davis, the law professor, predicted that Beijing would pour investment into Hong Kong in order to create a “dominant position” for mainland companies and “undermine the traditional prominence” of local and international businesses.

For Joseph, the days of Hong Kong as a gateway for foreign businesses to access China are in the past.

“If I want to set up a company to do Chinese business, I’d start one in Shanghai instead,” he said.

[ad_2]

Source link