[ad_1]

With Arm slated to start trading on the Nasdaq on Thursday, investors are considering the potential upsides — and downsides — of investing in the company.

The British chip designer itself flagged several risks in its IPO prospectus, ranging from its China business to geopolitics, but one potential threat has gained traction as its listing nears.

It’s called RISC-V, pronounced “risk five” — a rival chip design that is backed by some of Arm’s own customers.

While analysts told CNBC it’s not an immediate threat, Arm itself warned that if it gains traction, it could pose a competitive risk.

What is RISC-V?

To understand RISC-V, let’s consider what Arm actually does. Arm designs what’s known as an instruction set architecture (ISA) for chips known as processors or central processing units (CPUs). These chips can be thought of as the brain of an electronic device.

Arm’s ISA is effectively the blueprint for processors that other companies, from Apple to Qualcomm, base their chips on.

Arm charges these companies licensing fees to use its technology to build their own chips. It also gets royalties when these chips are produced and go into end devices. Arm’s designs underpin processors in 99% of the world’s smartphones.

RISC-V, meanwhile, is an entirely different instruction set architecture. RISC stands for reduced instruction set computer.

The main difference is that RISC-V is open-source, meaning it’s free to use.

“If RISC-V-related technology continues to be developed and market support for RISC-V increases, our customers may choose to utilize this free, open-source architecture instead of our products,” Arm said in its IPO prospectus.

Is RISC-V gaining traction?

RISC-V in recent years has gained support from some of the world’s biggest technology companies, many of which are also Arm customers.

Google, Samsung, Qualcomm and Nvidia, for instance, are part of a consortium formed in 2020 to develop RISC-V-based technologies.

Arm warned that if this development is successful, there could be a viable alternative to its architecture.

“Although the development of alternative architectures and technology is a time-intensive process, if our competitors establish cooperative relationships or consolidate with each other or third parties, such as the recently announced joint venture focused on RISC-V, they may have additional resources that would allow them to more quickly develop architectures and other technology that directly compete with our products,” Arm said in its IPO prospectus.

Support for RISC-V was “galvanized” after Nvidia proposed to buy Arm for $40 billion in 2020, according to technology researcher Richard Windsor, founder of Radio Free Mobile.

He suggested that other players were worried that if a major customer like Nvidia controlled Arm, it could be a disadvantage to some of Nvidia’s rivals.

The proposed takeover “raised a lot of hackles in the industry” and some Arm customers are “starting to think twice” about their dependency on the company, Windsor told CNBC this week.

“Maybe we should have a second source just in case things start not going in our direction, or we have problems with Arm,” he added, in reference to the thinking among some Arm customers.

Is RISC-V a threat to Arm?

The general consensus is that, right now, RISC-V doesn’t pose a major threat to Arm. That’s because the technology is currently far inferior to Arm’s offering.

“The issue with RISC-V is it’s much more immature. It doesn’t have the same level of support for more advanced designs,” Peter Richardson, research director at Counterpoint Research, told CNBC.

“RISC-V is quite far away from being at that leading edge, but for some workloads not at the cutting edge, then RISC-V can work quite well.”

One of Arm’s big successes is its huge customer base of major tech players. This has allowed Cambridge, England-based company to build an “ecosystem” of companies that rely on its technology — an advantage that RISC-V doesn’t have.

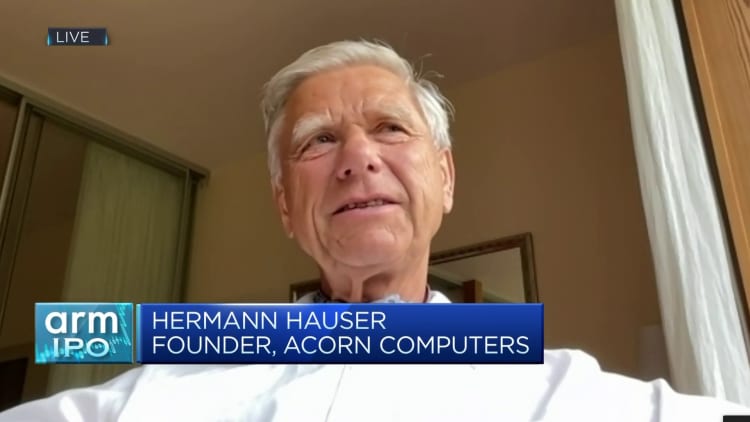

“Whenever you devise software that runs on one Arm, it will run on all the others as well,” Herman Hauser, founder of Acorn Computers, the company behind the first Arm chip, told CNBC’s “Squawk Box Europe” on Thursday. “So I think Arm will continue to retain its dominant position.”

However, there are fears that Chinese companies in particular could view RISC-V as a cheaper — and more appealing — alternative, particularly if Arm increases its prices.

“If Arm raises its prices, what are chip designers in China going to do? They’re probably going to go for the free version. I wouldn’t be surprised if China really scales up on RISC-V,” Cyrus Mewawalla, head of thematic intelligence at Global Data, told CNBC this week.

[ad_2]

Source link