[ad_1]

Eurozone inflation rose slightly in April, but most analysts predicted the European Central Bank would still slow the pace of its interest rate rises this week due to a sharp retreat in bank lending and a dip in underlying price pressures.

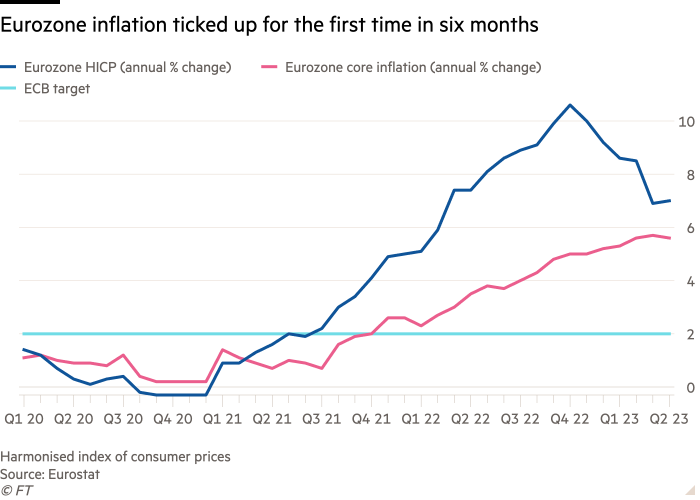

Eurostat, the EU’s statistics agency, said the headline rate of eurozone inflation increased for the first time in six months to 7 per cent in the year to April. That was up from 6.9 per cent in the previous month and above the flat reading forecast by economists in a Reuters poll.

However, analysts said ECB rate-setters, who target 2 per cent inflation, were likely to be swayed by a slowdown in core inflation — which strips out energy, food and other highly volatile items — to give a better impression of underlying price pressures.

The core inflation reading, which rate-setters have focused on in recent months, dipped to 5.6 per cent in the year to April, down from a eurozone record of 5.7 per cent in March — its first decline since June 2022.

The ECB has increased its deposit rate from -0.5 per cent last summer to 3 per cent in March. Policymakers have said they expect to agree another increase this week, while adding that incoming data will determine whether they stick to a half-percentage point rise or slow to a quarter-point move.

Ludovic Subran, chief economist at German insurer Allianz, said that after weaker than expected growth of 0.1 per cent in the eurozone economy, the latest data would give “more weight” to a quarter-point rate rise by the ECB on Thursday, followed by a couple more before the summer.

Analysts said the other factor likely to convince rate-setters to opt for a smaller rate rise this week was the publication of the ECB’s quarterly survey of banks, which showed eurozone lenders tightened their credit standards by the most since the region’s debt crisis erupted in 2011.

Holger Schmieding, chief economist at German investment bank Berenberg, said the data supported the arguments of both hawks and doves at the ECB, but he thought a quarter-point rate rise was “a bit more likely” with guidance that more hikes were still to come.

The euro fell against the dollar after the ECB lending survey was published on Tuesday morning and lost more ground after the inflation data was released. Germany’s rate-sensitive two-year borrowing costs also lost some early gains, indicating investors think the ECB will opt for a smaller rate rise.

“We have strong conviction the ECB . . . is close to the end of its tightening cycle,” said Annalisa Piazza, a fixed-income analyst at investor MFS Investment Management.

The ECB said its quarterly survey of lenders, carried out in the final week of March and first week of April, showed that demand for loans from businesses has fallen at the fastest rate since the 2008 financial crisis. Loan demand from households also fell, at a rate only slightly slower than the unprecedented pace of the previous quarter.

The behaviour of banks is being watched by central bankers because of the recent turmoil in the sector that started with the collapse of Silicon Valley Bank in the US and continued when Credit Suisse was forced into the arms of rival UBS.

Economists say the tumult — which continued with the seizure of First Republic and sale of the US lender’s assets to JPMorgan Chase on Monday — will intensify the contraction of lending, squeeze demand and cool price pressures, reducing the amount of rate rises needed by the ECB.

The survey found the main drivers for banks’ retreat from lending were “higher perceptions of risk” and “lower risk tolerance”. The ECB’s unprecedented increase in borrowing costs and its reduction of liquidity in recent months pushed up funding costs for banks and tightened credit standards.

The withdrawal of liquidity from the banking sector is set to accelerate in June when €480bn of ultra-cheap ECB funding to eurozone banks matures and the central bank is expected to accelerate the pace of shrinking its €5tn portfolio of bonds.

There was a further outflow of deposits from eurozone banks in March, putting an extra squeeze on their funding, separate ECB data showed on Tuesday. Overall deposits declined €62bn, slightly less than the record €68bn of outflows in the previous month.

Depositors are paying off debt or moving cash into bonds and money market funds that offer better returns than keeping it in banks. Eurozone household deposits fell €25bn, the largest fall since that data started to be collected in 2003.

[ad_2]

Source link