[ad_1]

As airlines have added capacity and “the leisure demand that drove record carrier revenues in 2023 softens,” 2024 economy- and business-class airfares throughout the world are projected to stabilize, “with prices falling on some routes,” according to a new American Express Global Business Travel Air forecast, released Wednesday.

The fare trends take into account a range of factors, including airline capacity, local inflation, foreign exchange and fuel surcharges, according to the American Express Global Business Travel Air Monitor 2024.

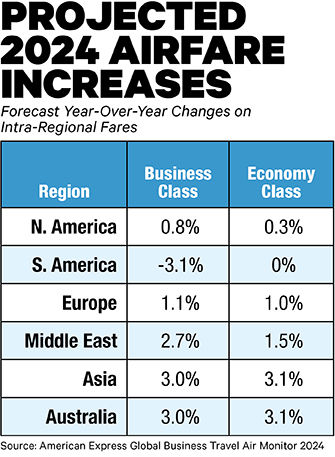

The travel management company projects 2024 business-class fares within North America to increase 0.8 percent year over year, with economy-class fares inching up 0.3 percent. Fares within Europe also are projected to rise only slightly, with business-class up 1.1 percent and economy-class up an even 1 percent.

Asia and Australia each are forecast to see prices rise 3 percent compared with 2023 for business-class fares and 3.1 percent for economy-class fares. South America was the only region where a price drop was projected, with business-class fares anticipated to decline 3.1 percent and economy-class fares to remain even with 2023 levels.

Business-class fare projections from North America to other regions are mixed, with fares to Central America projected to decline 5.7 percent year over year and those to Asia also forecast to decline by 3 percent. Fares to Europe, however, are projected to increase 3 percent compared with 2023 while flights to South America could tick up 0.1 percent.

Most economy-class fares from North America are expected to decline. Fares to Central America are projected to decline 7.8 percent year over year, to Asia by 7.5 percent and to Europe by 3.5 percent. Only prices to South America are projected to increase, at 1.3 percent.

Amex GBT noted that despite “signs of moderation, the wider outlook is uncertain,” and that geopolitical tensions could affect the global economy and “dampen already moderate growth prospects.” It also cited headwinds that include cost pressures from volatile fuel prices, labor fees and debt servicing that could impact airfares. In addition, there could be a wind-down of “revenge travel” in certain areas “as consumer preferences fall prey to high interest rates,” along with supply-chain issues and aircraft delivery delays.

The report also called out New Distribution Capability technology transforming the way airlines sell their products. NDC’s dynamic pricing could mean fares are subject to change as airlines evolve their pricing strategies, while continuous pricing has “significant impacts for price transparency,” with reference fares not available, according to the report.

Amex GBT Projects ’23 Global Airfare Hikes

[ad_2]

Source link