[ad_1]

* Tap Muslim lifestyle apps 2.8mil registered users, up to 240k daily active users

* Bank CEO is confident TheNoor is on the road to becoming a global super app

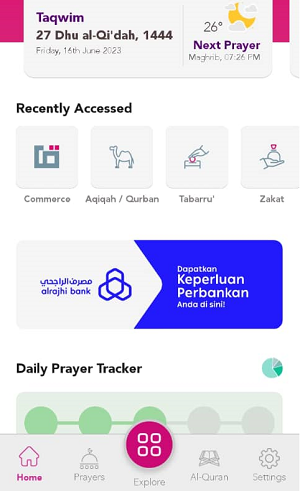

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd (alrajhi bank Malaysia) has announced a strategic partnership with Noor Luminous Sdn Bhd, the developer of the Muslim lifestyle app, TheNoor.

Alrajhi bank Malaysia’s digital bank, Rize, is the official Digital Bank Partner of TheNoor for a 1 plus 1 year contract, reaching the app’s 2.8 million registered users across 197 countries with an exclusive landing page to promote its shariah-compliant Islamic banking and finance services to the 180,00 to 240,000 daily active users.

The collaboration gives alrajhi bank Malaysia, a small player in Malaysia with an urban footprint, a leg up in the competitive market for shariah-compliant financial services especially with the star power of TheNoor co-founder and executive director, Noor Neelofa with her 6 million over Instagram followers.

At a press conference to announce the collaboration, alrajhi bank Malaysia CEO, Arsalaan (Oz) Ahmed declined to share commercial terms of the arrangement, saying, “I think it would be not quite cricket as they say in the UK, to reveal those details.”

Suffice to say the terms will help TheNoor grow in terms of what it offers and financially, Arsalaan said.

DNA understands that there will be a percentage cut for TheNoor from any revenue that Rize makes from TheNoor’s users with a higher cut kicking in when an agreed upon threshold has been hit.

“This partnership is timely as digitalisation drives today’s economic landscape. The growing demand for Shariah-compliant products and services are growth areas that we are keen to explore, and with this strategic relationship with alrajhi bank Malaysia, TheNoor can deliver on the banking and finance aspect of that,” said Neelofa.

Focus is to grow together, start slow and iterate based on user feedback

The focus now is for alrajhi bank Malaysia to work and grow together with TheNoor rather than form similar partnerships with others. “We’re not looking to do the scattergun approach,” stressed Arsalaan.

In sports Al Rajhi has a similar partnership with the Malaysian Football League.

For this partnership, the bank is starting off with lead generation around current account, personal financing and home financing. Arsalaan describes this as working with TheNoor to understand its users needs and then start to offer products based on the feedback.”But we also want to go further and integrate our products more into TheNoor but it’s important to take slow steps and then iterate, not force something on to the ecosystem.”

Expressing confidence that great things are in store for TheNoor, Arsalaan said, “I’m confident that with the speed and the changes on their app, it’s on the road towards becoming a super app that will not only be recognized in Malaysia but also around the world.”

TheNoor had in 2021 partnered with Bank Islam Malaysia for one with a similar partnership. “We welcome working with any banks, especially those that are fully-fledged Islamic, and also insurance companies like Takaful,” said Izzairi Yamin, co-founder and executive director of TheNoor.

“In terms of gender, there are 57% female and 43% male users, and the majority of the users within the age groups of 18-35 years old while some are within the 60 to 70 age range as well,” Izzairi said.

Malaysia contributes the largest user base followed by Australia, Singapore, Indonesia with TheNoor targeting to expand its base and digital footprint to Europe and the US said Izzairi.

All it takes is their Malaysian IC for a user of TheNoor to register for their Rize account and the promise is that within minutes of the eKYC process, the user will have an account with RM20 credit deposited and entry into a draw with Apple products as prizes.

[ad_2]

Source link

.JPG)