[ad_1]

This came a day after its FPO had scraped through with non-institutional investors, including HNIs and family offices of industrialists, chipping in. And hours after Swiss lender Credit Suisse Group AG, according to a Bloomberg report, had stopped “accepting bonds of Adani Group companies as collateral for margin loans to its private banking clients.”

Explained | Adani Group calls off FPO: What exactly has happened?

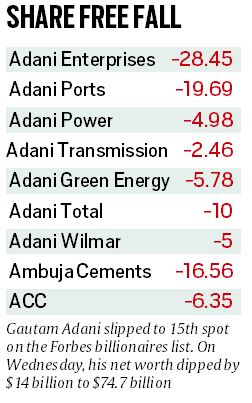

At the end of the day, Adani Group chairman Gautam Adani’s personal net worth was down $14 billion to $74.7 billion pushing him to No. 15 on the Forbes billionaire list – down from No. 3 barely days ago. All Adani Group stocks were down with Adani Ports falling 19.7%. (see box)

In its statement, AEL said: “Given the unprecedented situation and the current market volatility, the company aims to protect the interest of its investing community by returning the FPO proceeds and withdrawing the completed transaction.”

It quoted its chairman Gautam Adani: “Today the market has been unprecedented and our stock price has fluctuated over the course of the day… Given these extraordinary circumstances, the company’s board felt that going ahead with the issue will not be morally correct. The interest of the investors is paramount and hence to insulate them from any potential financial losses, the board has decided not to go ahead with the FPO.”

The FPO was oversubscribed 112 per cent on the last day of the issue (January 31).

“We are working with our Book Running Lead Managers (BRLMs) to refund the proceeds received by us in escrow and to also release the amounts blocked in your bank accounts for subscription to this issue,” Adani said.

Adani group companies have lost market capitalisation of over Rs 7 lakh crore after US-based Hindenburg Research report accused the group of “brazen stock manipulation and accounting fraud.” Bank stocks were also hit following the plunge in Adani stocks. Markets are worried about further fall in Adani stocks and there was pressure from investors who put money in the FPO for the withdrawal of the issue, said a market source.

Corporates and high networth individuals bid for 1.66 crore shares worth Rs 5,438 crore and FIIs applied for 1.24 crore shares worth Rs 4,127 crore in the FPO. Abu Dhabi-based International Holding Company Monday invested $400 million, or close to Rs 3,300 crore. In the anchor investor category, around 33 investors, including Maybank Securities Pte and Abu Dhabi Investment Authority had put in bids worth Rs 5,984 crore.

Adani claimed its balance sheet is healthy with strong cash flows and secure assets and the group has an impeccable track record of servicing our debt. “This decision will not have any impact on our existing operations and future plans. We will continue to focus on long term value creation and growth will be managed by internal accruals. Once the market stabilizes, we will review our capital market strategy. We are very confident that we will continue to get your support,” Adani said.

Full text of the statement by Adani Group

The Board of Adani Enterprises Ltd., (AEL) decided not to go-ahead with the fully subscribed Follow-on Public Offer (FPO).

Given the unprecedented situation and the current market volatility the Company aims to protect the interest of its investing community by returning the FPO proceeds and withdraws the completed transaction.

Gautam Adani, Chairman, Adani Enterprises Ltd said, “The Board takes this opportunity to thank all the investors for your support and commitment to our FPO. The subscription for the FPO closed successfully yesterday. Despite the volatility in the stock over the last week, your faith and belief in the Company, its business and its management has been extremely reassuring and humbling. Thank you.

However, today the market has been unprecedented, and our stock price has fluctuated over the course of the day. Given these extraordinary circumstances, the Company’s board felt that going ahead with the issue will not be morally correct. The interest of the investors is paramount and hence to insulate them from any potential financial losses, the Board has decided not to go ahead with the FPO.

We are working with our Book Running Lead Managers (BRLMs) to refund the proceeds received by us in escrow and to also release the amounts blocked in your bank accounts for subscription to this issue.

Our balance sheet is very healthy with strong cashflows and secure assets, and we have an impeccable track record of servicing our debt. This decision will not have any impact on our existing operations and future plans. We will continue to focus on long term value creation and growth will be managed by internal accruals. Once the market stabilizes, we will review our capital market strategy. We are very confident that we will continue to get your support. Thank you for your trust in Us.

[ad_2]

Source link