[ad_1]

Ad hoc announcement pursuant to Art. 53 LR

GENEVA, Switzerland, October 24, 2023 –Temenos AG (SIX: TEMN), the banking software company, today reports its third quarter 2023 results.

Annual Recurring Revenue

Income statement and Free Cash Flow

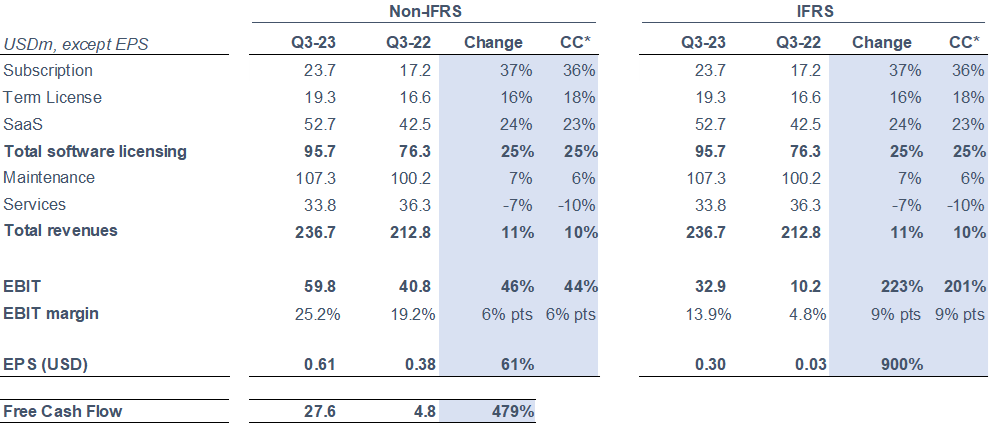

The definition of non-IFRS adjustments is set out below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II.

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q3-23 operational highlights

• Continued stable sales environment throughout Q3-23

• Positive pipeline development and progress made on large deals

• Acceleration in Europe driven by improving market conditions and strong sales execution

• Americas performance driven by additional consumption in SaaS customer base, new sales into existing customers and new logo signings

• 13 new client wins in the quarter, across SaaS and subscription

• Services revenue grew sequentially and has been profitable every quarter this year

• Temenos named trusted cloud provider by Cloud Security Alliance, reinforcing our cloud and SaaS credentials

• Received investment grade Long-Term Issuer Default Rating (IDR) of ‘BBB’ with a stable outlook, and a senior unsecured rating of ‘BBB’ from Fitch Ratings

• Issued CHF 200m 5-year bond maturing October 2028

Q3-23 financial summary (non-IFRS)

• Annual Recurring Revenue (ARR) of USD 687.5m, up 15% c.c.

• Non-IFRS SaaS revenue growth of 23% c.c.

• Non-IFRS total software licensing revenue growth of 25% c.c.

• Non IFRS maintenance revenue growth of 6% c.c.

• Non-IFRS product revenue growth of 14% c.c.

• Non-IFRS total revenue growth of 10% c.c.

• Non-IFRS EBIT growth of 44% c.c.

• Q3-23 non-IFRS EBIT margin of 25.2%, up 6% points c.c.

• Q3-23 operating cash flow of USD 55.1m, up 58% y-o-y

• Q3-23 Free Cash Flow of USD 27.6m, up 479% y-o-y

• Leverage at 1.8x at end of Q3-23

• DSOs at 124 days

Commenting on the results, Temenos CEO, Andreas Andreades, said:

“The momentum from the first half of the year continued in the third quarter, with strong sales execution across regions and in particular in Europe driving our revenue growth. We continued to benefit from a stable sales environment despite ongoing macro uncertainty, and grew our ARR 15% to reach USD 687m by the end of the quarter, which is now more than 80% of our product revenues. We are seeing strong take up of subscription contracts in our client base and are generating value uplift on both new subscription deals and renewals. This flowed through to an acceleration in our maintenance revenue which validates the quality of our licensing business, and future term contract renewals are expected to move to subscription or SaaS as standard.

Looking across our various regions, the Americas performed well with additional consumption in our SaaS customer base, and new sales into existing customers also contributing to the regional performance as well as notable new client logos. I was pleased to see an acceleration in Europe, where the performance was driven by several new logos signed, and further revenue contribution from the wealth deal we signed in Q1-23 with a tier one global bank headquartered in Europe.

With our ongoing investments in R&D and our focus on SaaS and cloud, we are planning for a number of exciting new product and SaaS services launches in January 2024.

We have raised our guidance for ARR, EBIT and EPS given the strong momentum in the business and visibility we have. We expect the sales environment to remain stable at least until year end and I am confident in delivering on our upgraded guidance.”

Commenting on the results, Temenos CFO, Takis Spiliopoulos, said:

“We have continued our strong growth in recurring revenue, with our ARR up 15% in Q3-23. This was driven by our SaaS revenue growth, our subscription transition and, in this quarter, an acceleration in our maintenance revenue growth. Maintenance was up 6% in Q3-23, from the growth in our subscription revenue which contributes to maintenance in the P&L, the value uplift we are achieving on contract renewals, and the positive impact of CPI clauses in our contracts.

Our Services revenue grew sequentially from Q2-23 to Q3-23 as expected and has also remained profitable in all quarters this year. Whilst our total non-IFRS cost base this quarter was only up 2% as we continued to benefit from lower Services costs, our product related costs increased by 7% as we make targeted investments in particular in R&D and S&M in preparation for 2024.

We had another good cash quarter, with Free Cash Flow of USD 28m, up 479% against one of our lowest cash quarters last year. Our SaaS revenue and deferred revenue growth is more than offsetting the impact from subscription. Looking at the balance sheet, we ended the quarter with leverage of 1.8x net debt to EBITDA and expect this to trend down from this level by year end. I was pleased that we received a BBB investment grade rating with stable outlook from Fitch in September and were able to issue a new bond at attractive rates on the back of this, reflecting the quality of our business and strength of our balance sheet and cash flow.

We have raised our full year guidance for ARR, EBIT and EPS. We now expect ARR to grow 13%-15%, EBIT to grow at least 8% and EPS to grow at least 7%. We have reconfirmed our other FY-23 guidance metrics.”

Update on CEO search

In January 2023, the Board of Temenos announced a series of management changes and a succession planning process. As part of these changes, Andreas Andreades agreed to become CEO until the end of 2023. An external firm of consultants has been assisting the Board in assessing internal and external candidates for the position of CEO.

This process is still ongoing with both external and internal candidates evaluated and the Board of Directors has resolved to extend the period during which Andreas Andreades will maintain his duties as CEO from the end of 2023 until a new CEO is appointed to provide stability through the transition to take the company forward in its next stage of growth.

Commenting on this, Thibault de Tersant, Non-Executive Chairman of the Board, said:

“I am delighted with the progress of the business in the last 12 months. Under the leadership of Andreas, the business has continued to perform strongly, and the Board is fully supportive of the company strategy which the management team is executing well. I am leading a Board committee of independent directors to find our next CEO and we have retained a tier 1 executive search firm.

We are focused on securing the best possible successor to lead the business, with the right mix of skills to deliver on our strategic growth plan. We have a strong management team in place that is performing well. I am pleased that Andreas is willing to continue as CEO until his successor is appointed and the Board and the Executive management team are committed to a seamless succession for the benefit of all stakeholders.”

Q3-23 financial summary (IFRS and non-IFRS)

Revenue

IFRS and non-IFRS revenue was USD 236.7m for the quarter, an increase of 11% vs. Q3-22.

IFRS and non-IFRS total software licensing revenue for the quarter was USD 95.7m, an increase of 25% vs. Q3-22.

EBIT

IFRS EBIT was USD 32.9m for the quarter, an increase of 223% vs. Q3-22.

Non-IFRS EBIT was USD 59.8m for the quarter, an increase of 46% vs. Q3-22.

Non-IFRS EBIT margin was 25.2%, up 6% points vs. Q3-22.

Earnings per share (EPS)

IFRS EPS was USD 0.30 for the quarter, an increase of 900% vs. Q3-22.

Non-IFRS EPS was USD 0.61 for the quarter, an increase of 61% vs. Q3-22.

Cash flow

IFRS operating cash was an inflow of USD 55.1m in Q3-23, an increase of 58% vs. Q3-22, representing an LTM conversion of 107% of IFRS EBITDA into operating cash. USD 27.6m of Free Cash Flow was generated in Q3-23, an increase of 479% vs. Q3-22.

FY-23 non-IFRS guidance

The guidance for FY-23 is non-IFRS and in constant currencies. Guidance for FY-23 ARR, EBIT and EPS has been raised, other guidance items have been reconfirmed:

• ARR growth of 13-15% (up from 12-14%)

• Total software licensing revenue growth of at least 6%

• EBIT growth of at least 8% (up from at least 7%)

• EPS growth of at least 7% (up from at least 6%)

• FCF growth of 12%-14%

Currency and other assumptions for FY-23 guidance

In preparing the FY-23 guidance, the Company has assumed the following:

• EUR to USD exchange rate of 1.08;

• GBP to USD exchange rate of 1.24; and

• USD to CHF exchange rate of 0.90

The Company has also assumed the following:

• Expected FY-23 tax rate of 19-21%

• Cash conversion expected to remain at 100%+ of EBITDA into operating cash flow

Mid-term targets

The mid-term targets are non-IFRS and in constant currencies, except Free Cash Flow which is reported:

• ARR of at least USD 1.3bn

• EBIT of at least USD 570m

• FCF of at least USD 700m

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of 24 October 2023. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST, today, October 24, 2023, Andreas Andreades, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance if at all possible to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial-in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition/investment related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the FY-23 non-IFRS guidance.

• FY-23 estimated share-based payments and related social charges charges of c.5% of revenue

• FY-23 estimated amortisation of acquired intangibles of USD 50m

• FY-23 estimated restructuring/M&A related costs of USD 14m

Restructuring / M&A related costs include costs incurred in connection with a restructuring programme or other organisational transformation activities planned and controlled by management, or cost related mainly to advisory fees, integration costs and earn out credits or charges. estimates do not include impact of any further acquisitions or restructuring programs commenced after October 24, 2023. The above figures are estimates only and may deviate from expected amounts.

Other definitions

SaaS ACV is Annual Contract Value which is the annual value of incremental business taken in-year. This includes new customers, up-sell and cross-sell. It only includes the recurring element of the contract and excludes variable elements.

[ad_2]

Source link