[ad_1]

Weather still has a hold on markets as the Midwest is in the grip of an

oncoming heat wave.

That and the possibility of cool weather to follow were topics of the Agweek Market Wrap on Friday, Aug. 18, with Randy Koenen of the Red River Farm Network and Randy Martinson of Martinson Ag Risk Management.

Koenen noted that the weather and war premiums seemed to come into play and out of play during the week. It wasn’t until the end of the week that Ukraine strikes on Moscow had more of an influence in the news.

“That I think helped bring some support into the markets,” Martinson said. He added that corn and wheat hit contract lows, which seemed early for all the unknowns about the upcoming harvest.

Koenen mentioned the high heat that’s expected. He said the big concern may be just how long it will last.

Martinson was recently in Chicago and said that they are preparing for intense heat with expectations of seven to 10 days where the heat index reaches into the 90 degree range.

“They are taking this a little bit serious,” Martinson said.

A high heat index can impact corn in the northern Plains but it would affect the soybeans across the board at a time where beans are making their big push to fill out pods.

Koenen said another concern is that while the region could be swimming in 100 degree temperatures, it’s than expected to be followed by temperatures in the 60s. A shift that could signal a chance at an early frost.

“That’s the other part we need to worry about,” Martinson said. “We need to get as much heat and as much growing degree days as we can to get us to maturity.”

“It’s a tale of two regions, where up here in the northern Plains, where we’re more worried about the first frost date, then what they are in the Corn Belt, which is the heat,” Martinson said.

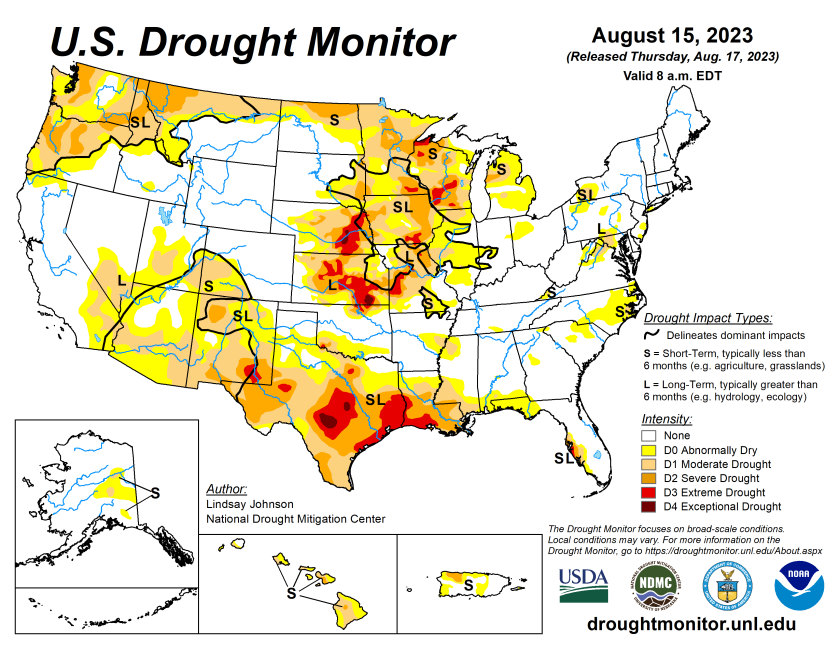

Koenen noted that the most drastic heat appears to be in a region of Nebraska and Missouri, which remains in severe drought conditions.

Contributed by U.S. Drought Monitor

Martinson and Koenen both talked about the

fast advance of corn.

While Labor Day weekend can be a start of chopping silage corn, there’s talk of custom cutters chopping in Nebraska and Kansas.

The warm, dry conditions are negative for wheat, because the combines are able to keep rolling.

Koenen said rumors have it that China is looking at buying more corn and soybeans. Martinson said that the drop in prices has the attention of China as prices are more competitive with Brazil.

It’s a more quiet week for cattle. Cattle traded to new contract highs and then drifted off. The Cattle on Feed report should be an important one as it is the last one before spring calves start to hit feedlots. Southern calves might be heading to feedlots earlier than normal because of the heat and dry weather.

Demand for pork and beef has held fairly constant. With one more major grilling holiday left, demand will likely lull for the big barbecue meats after that.

“We are starting to get into the time where domestic consumption starts to wane a little bit,” Martinson said.

Looking ahead, Martinson is keeping an eye on crude oil, which is still holding over $80. Biofuel is also seeing demand up.

“That’s helping to support the vegetable oil markets,” Martinson said.

(The Agweek Market Wrap is sponsored by Gateway Building Systems.)

Michael Johnson is the news editor for Agweek. He lives in rural Deer Creek, Minn., where he is starting to homestead with his two children and wife.

You can reach Michael at mjohnson@agweek.com or 218-640-2312.

[ad_2]

Source link