[ad_1]

Few companies love buzzwords as much as those engaged in public relations (PR). Investors who are interested in the sector, therefore, must chew through ‘game-changing insights’, ‘mission-critical digital assets’ and ‘cutting-edge technology’ in order to figure out what different businesses actually do. Every now and then, however, it is worth the effort.

Bull points

- Digital expertise

- Excellent profit growth

- Robust client base

- Good value

Bear points

- Acquisition risks

- Marketing budgets under pressure

Next Fifteen Communications (NFC) started life as a fairly traditional PR firm. Over the years, however, it has morphed into a digital consultancy, helping clients to build new websites and apps, use data analytics to connect with customers and improve sales, and change their business models to better suit the online world.

Given the direction most sectors are travelling in, the group’s digital expertise means it is well placed for growth, and its client book is packed with names as big and diverse as Amazon (US:AMZN), BT (BT.A), Procter & Gamble (US:PG), and Disney (US:DIS). Indeed, according to analysts at Numis, 57 of the world’s 100 ‘most loved’ brands are customers. It is also skewed towards North America, with over half of sales and two-thirds of profits coming from the US. If nothing else, this has been handy from a currency perspective, meaning Next Fifteen has enjoyed a considerable foreign exchange tailwind.

This won’t fully protect the group if marketing budgets start to wilt. Next Fifteen’s exposure to big US tech companies, for example, looks like less of a boon with every passing day. However, analysts and fund managers are confident that there is still plenty of scope for growth, and the outlook across the sector is brighter than many expected. WPP (WPP), the world’s largest advertising agency, thinks global ad spend will rise by 5.9 per cent this year, while its French rival Publicis (FR:PUB) is forecasting growth throughout 2023, despite the gloomy economic backdrop.

This is reassuring, particularly given that these companies are more associated with discretionary, creative projects than Next Fifteen. Regardless, institutional investors certainly seem convinced: according to our research, the company is one of the most widely held by top small-cap fund managers.

Going for growth

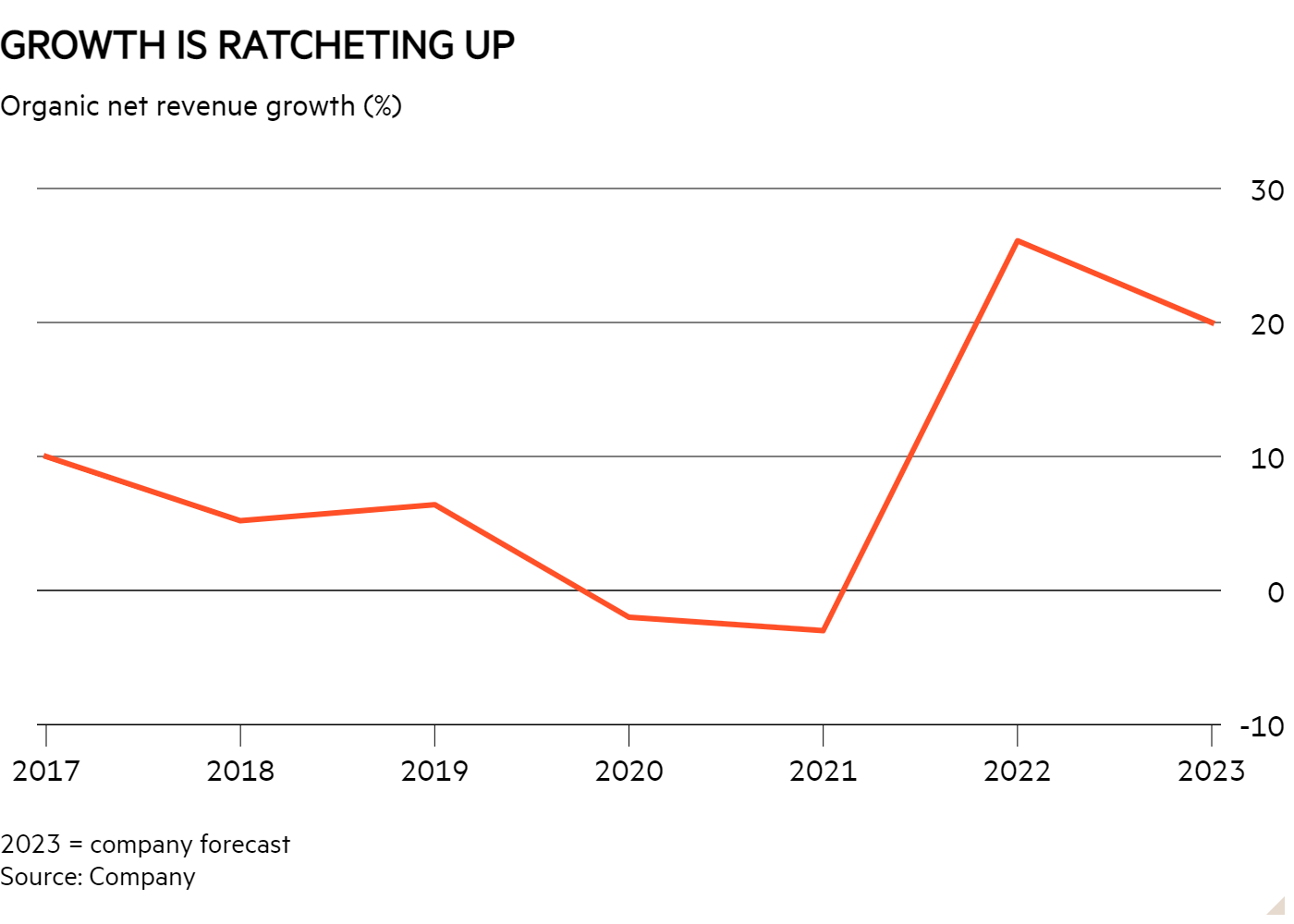

In recent years, business has been good. Organic revenue growth has both ratcheted up a gear and stayed high in the wake of the pandemic, with management forecasting a 20 per cent organic rise in sales in financial year 2023, compared with a 6.4 per cent increase in 2019. This expansion also compares very favourably with industry peers: according to Bernstein, WPP has only averaged 3 per cent of organic growth each year since 2019.

However, despite the step change in its earnings potential, Next Fifteen is getting cheaper. It currently sits on a forward price/earnings ratio of 10.3, compared with a five-year average of 14.4, a development which analysts at Radnor Capital Partners point out is “out of kilter” with its peer group. FactSet data appears to back this up. Pricier peers include S4 Capital (SFOR), with its forward PE of 11.5, while comparable tech-led agency businesses YouGov (YOU) and Ascential (ASCL) trade on 24.4 and 17 times earnings, respectively.

Acquisition risks

Why the pessimism? Deal-making, a cornerstone of the company’s strategy, might offer one explanation, and therefore requires unpacking. While its organic figures are strong, Next Fifteen has historically bought growth, and over the past five years it has purchased more than 20 companies to build its digital expertise. As we discussed in our cover feature on M&A earlier this month, this isn’t always a popular strategy: investors often return to a McKinsey report which claims that 70 per cent of M&A deals end up destroying shareholder value.

“You’ll never know the new businesses as well as you know your own business,” notes fund manager Anthony Cross, whose firm Liontrust collectively owns an 11.7 per cent stake in Next Fifteen across its funds. “There’s a danger of people leaving. And with M&A comes provisions, deferred considerations, and exceptional items. You’re never getting a clean set of numbers. And if you have too many dangling earn-outs and the rest of the business isn’t doing that well and the share price is under pressure, it can become quite dilutive.”

Cross is ultimately bullish about Next Fifteen, however, saying the acquisitions have pushed it in a “strategically exciting” direction.

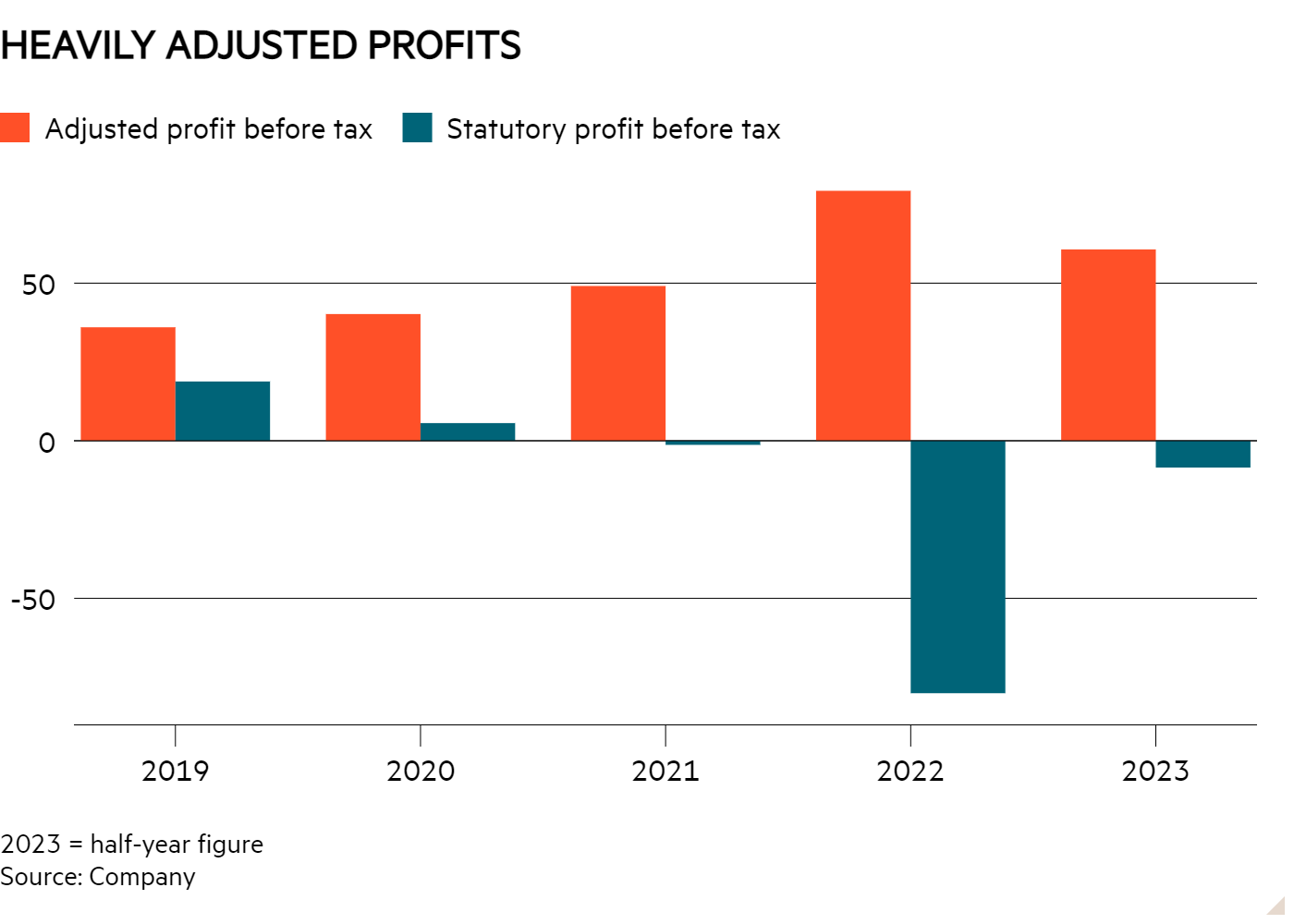

There’s certainly a lot to keep an eye on. Over the past few years, the gap between Next Fifteen’s statutory and adjusted profits has widened, and the group reported statutory losses in the 2021 and 2022 financial years, as well as the first half of FY2023.

As Cross suggests, this is the by-product of a ‘buy-and-build’ strategy. As of 31 January 2022, Next Fifteen had £178mn of acquisition-related liabilities on its balance sheet. By the summer, this figure had risen to £201mn. The lion’s share of these liabilities were ‘contingent consideration’ payments, comprising shares or cash owed to former owners of acquired businesses, to be paid if the businesses meet certain financial goals.

Contingent consideration is not necessarily a bad thing. By deferring full payment, the group encourages founders, principals and relationship gatekeepers to stay put. This is crucial for a people business like Next Fifteen, whose success relies on contact books and expertise, as opposed to physical assets like machinery or warehouses.

Not all people businesses handle this well. Legal services group Knights (KGH), which has been hoovering up regional firms of solicitors for years, is currently struggling to retain its talent. Indeed, analysts at Liberum suggest that half of all partners acquired have already left Knights.

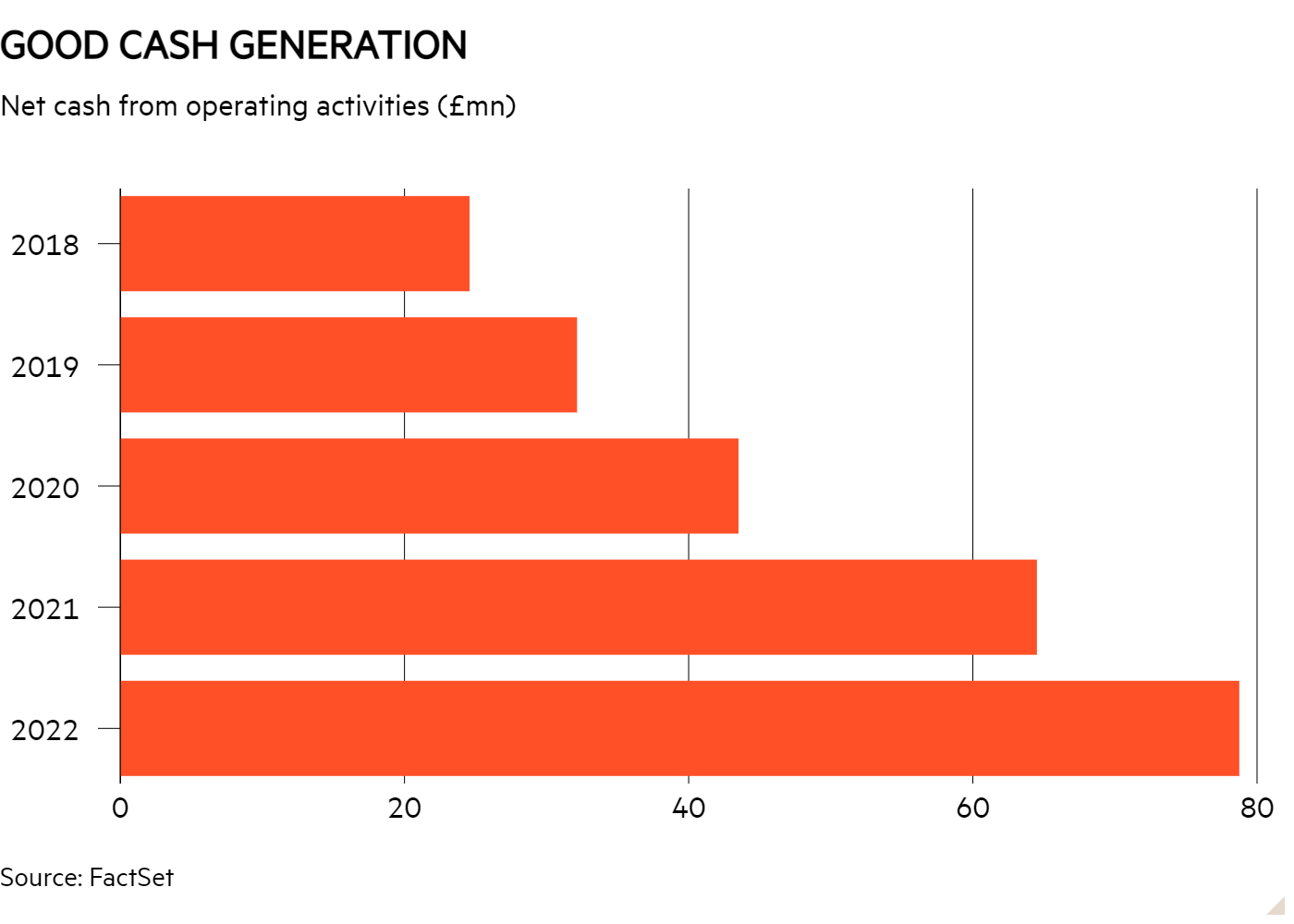

The signs are far more positive at Next Fifteen, and not just from an organic revenue perspective. Despite all its adjustments, the group is still very good at getting paid, having generated over £90mn of cash from operating activities in the year to 31 January 2022. Things were less impressive in the six months to 31 July last year, but this was down to a wave of new business which caused trade receivables to surge.

Meanwhile, although contingent consideration is dilutive in the sense that more shares get issued, it shouldn’t (in theory at least) be a big problem for external investors because more shares are predicated on bigger profits.

Skin in the game

Indeed, Cross argues that the culture of equity ownership at Next Fifteen is an important bull point. “It’s a nice thing to have, particularly in a people business. Skin in the game, long-term thinking, a desire to succeed – there’s a hunger that comes from that. And [such companies] tend to be a bit more conservative generally with regards to gearing the balance sheet and shareholder value.”

This has held true so far. Chief executive Tim Dyson – who has a 4.8 per cent stake in Next Fifteen – joined the company fresh from Loughborough University in 1984, was appointed chief executive in 1992, oversaw the Aim listing in 1999, and has since overseen the share price more than quadruple.

A marketing business might look like an unlikely bet in the current environment. Still, investors on the hunt for long-term growth, solid management, digital opportunities and acquisitive flair – all at a decent price – might be pleasantly surprised.

| Company Details | Name | Mkt Cap | Price | 52-Wk Hi/Lo |

| Next Fifteen Communications (NFC) | £879m | 892p | 1,476p / 741p | |

| Size/Debt | NAV per share* | Net Cash / Debt(-) | Net Debt / Ebitda | Op Cash/ Ebitda |

| 62p | -£67.6m | – | 61% |

| Valuation | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | P/Sales |

| 10 | 1.8% | 10.5% | 2.4 | |

| Quality/ Growth | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR |

| 14.5% | 40.7% | 22.4% | – | |

| Forecasts/ Momentum | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS change% |

| 11% | 8% | -10.3% | 1.3% |

| Year End 31 Jan | Sales (£mn) | Profit before tax (£mn) | EPS (p) | DPS (p) |

| 2020 | 248 | 40 | 34.8 | 3.8 |

| 2021 | 267 | 49 | 40.7 | 5.9 |

| 2022 | 362 | 79 | 59.7 | 12.0 |

| f’cst 2023 | 561 | 111 | 79.8 | 13.4 |

| f’cst 2024 | 631 | 127 | 88.8 | 16.2 |

| chg (%) | +12 | +14 | +11 | +21 |

| source: FactSet, adjusted PTP and EPS figures | ||||

| NTM = Next Twelve Months | ||||

| STM = Second Twelve Months (i.e. one year from now) | ||||

| * includes intangibles of £183mn or 186p per share | ||||

[ad_2]

Source link