[ad_1]

Todays podcast

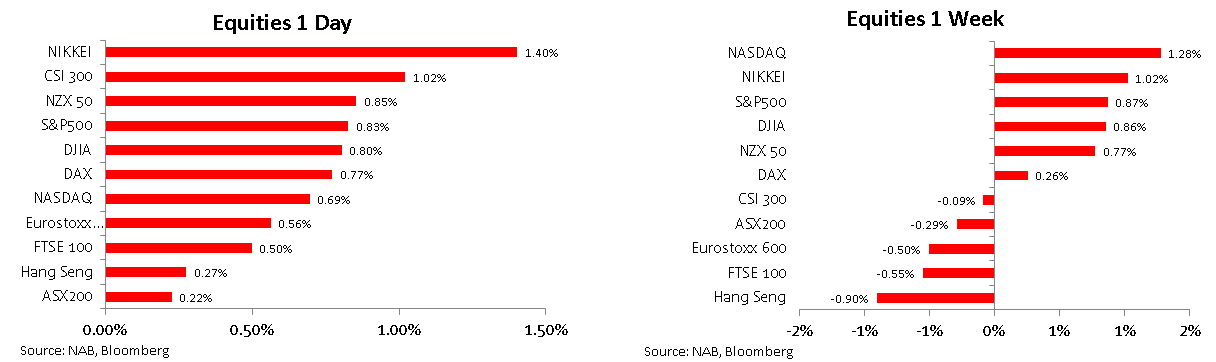

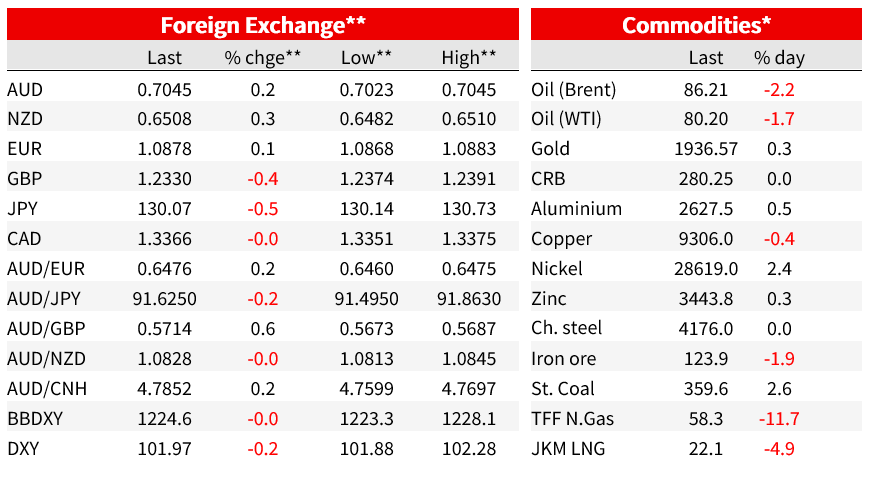

- Global equities close the week on a positive note

- The UK FTSE led gains in April with China and HK the notable underperformers

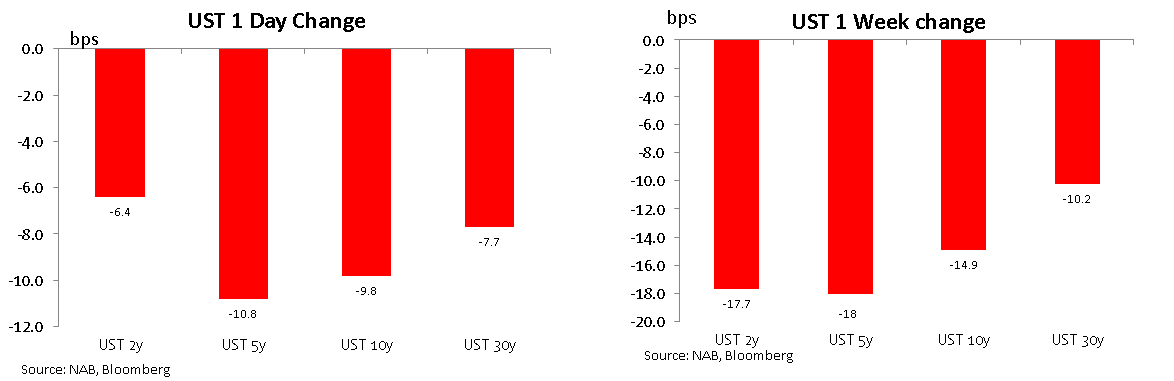

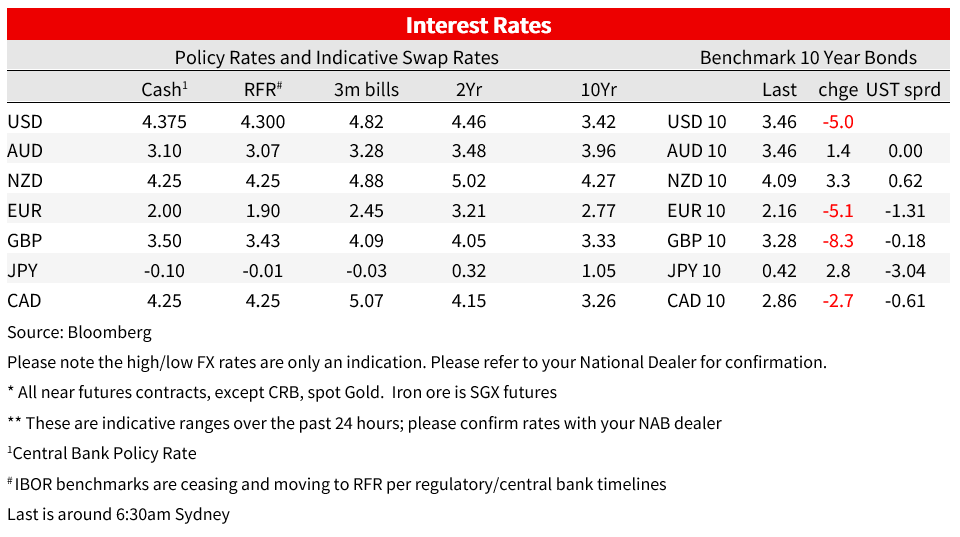

- UST yields close Friday lower with a flattening bias. 10y UST 3.42%

- 10y Bunds rally 14bps on softer German/EU data

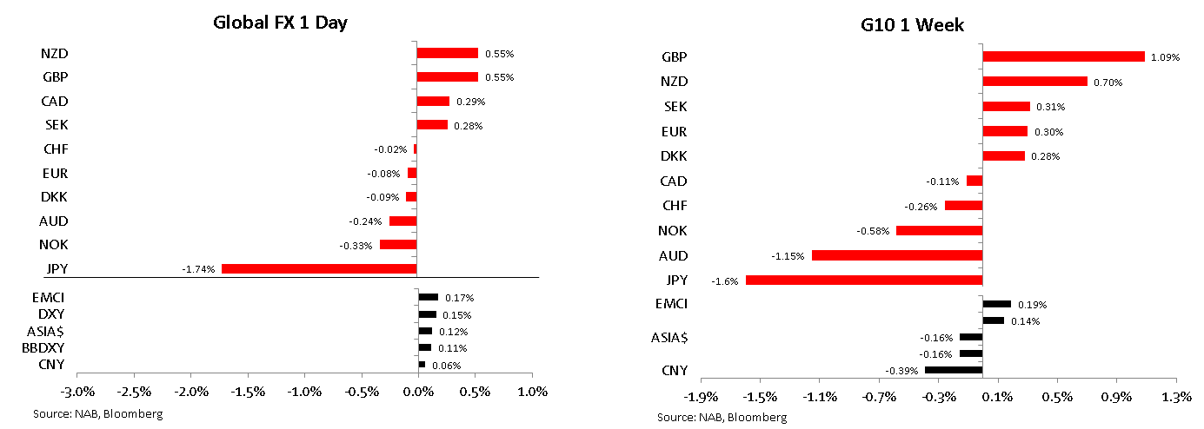

- USD marginally stronger on Friday. JPY the big underperformer after the BoJ

- GBP and NZD outperform on Friday and the week (month end flows?). AUD and JPY the week’s underperformers

- Solid ECI, PCE and Michigan Survey seal FOMC 25bps hike this week

- FDIC request big banks bids for First Republic

- China Manufacturing PMI contracts in April. Politburo pledges more support

- Coming up Monday: Japan consumer confidence, Final April PMIs, US ISM Manufacturing

- Rest of the Week: RBA (on hold), FOMC & ECB (25bp), EZ CPI, US ISM Services & Payrolls, CH Holidays, Earnings

NZ: ANZ consumer confidence, Apr: 79.3 vs. 77.7 prev.

JN: Tokyo CPI x-fr. food, energy (y/y%), Apr: 3.8 vs. 3.5 exp.

JN: BoJ 10yr yield target (%), Apr: 0.0 vs. 0.0 exp.

GE: Unemployment rate (%), Apr: 5.6 vs. 5.6 exp.

GE: GDP (q/q%), Q1: 0.0 vs. 0.2 exp.

EC: GDP (q/q%), Q1: 0.1 vs. 0.2 exp.

GE: CPI EU harmonised (y/y%), Apr: 7.6 vs. 7.8 exp.

CA: GDP (m/m%), Feb: 0.1 vs. 0.2 exp.

US: Employment cost index (q/q%), Q1: 1.2 vs. 1.1 exp.

US: Personal Income (m/m%), Mar: 0.3 vs. 0.2 exp.

US: Real personal spending (m/m%), Mar: 0.0 vs. -0.1 exp.

US: PCE core deflator (m/m%), Mar: 0.3 vs. 0.3 exp.

US: PCE core deflator (y/y%), Mar: 4.6 vs. 4.6 exp.

US: Chicago PMI, Apr: 48.6 vs. 43.6 exp.

CH: Manufacturing PMI, Apr: 49.2 vs. 51.4 exp.

CH: Non-manufacturing PMI, Apr: 56.4 vs. 57.0 exp.

The last trading day of April had a lot to digest with BoJ policy decision alongside market moving data both in Europe and the US. Equities ended the month on a positive note with earnings reports supporting the price action in the US, weaker than expected German and EU data fuelled a rally in Bunds while solid ECI, PCE and Michigan Survey sealed an FOMC hike this week and likely fuel a tightening bias. 10y UST yields closed the week lower at 3.42%. The USD was marginally stronger with JPY the big underperformer amid a dovish interpretation to the BoJ policy announcement. The AUD was little changed and starts the new week at 0.6601. Over the weekend China’s April PMI came softer than expected suggesting the economic rebound may be losing momentum while in the US the FDIC requested big banks bids for First Republic.

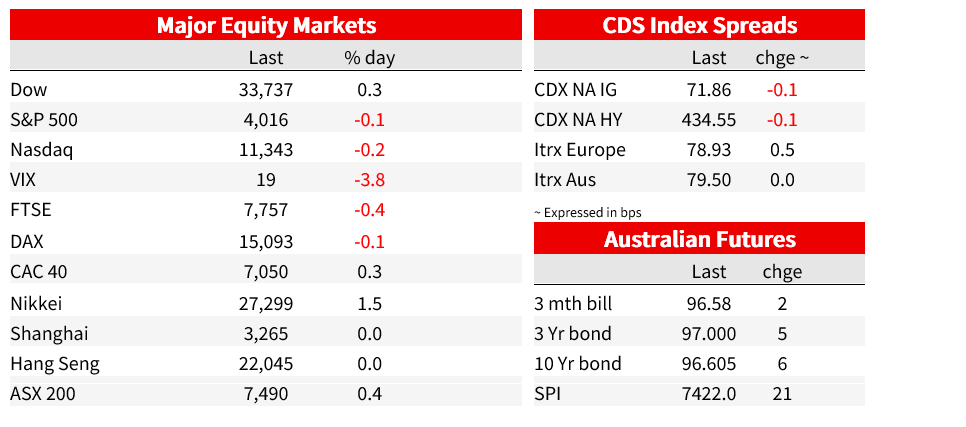

Global equities ended April with a spring in their step with the Nikkei leading the gains in Asia, up 1.4% on BoJ news (more below) with China’s CSI 300 not far behind. Earnings reports (Intel and Exxon of note) supported the positive price action in the US with the S&P 500 closing 0.81% higher on Friday, notwithstanding concerns over the state of regional banks with First Republic enduring yet again another wild trading day, falling 43% in regular trading.

A solid end to the month helped US equities end the week higher with the Nikkei also performing well on the week, in contrast European and Hong Kong equities loss ground in the past five days. For the whole month, the UK FTSE was the top performer up over 3% with the Nikkei not far behind just below 3%. US and EU equities also managed to record gains for the month with the Eurostoxx 600 up just under 2% while the S&P 500 climbed 1.46%, the NASDAQ was flat at0.004%.

As for US bank news, the Fed ‘s weekly H4.1 data showed that aggregate bank borrowing from the Fed was up again ($9bn) in the week ended on Wed (both short-term discount window, $4bn, borrowing and term funding, $7bn; the FDIC repaid some). Last week, the New York Fed reported that financial conditions in its region had deteriorated sharply. The Senior Loan Officer Opinion Survey is due for release next Monday 8th of May.

Over the weekend Bloomberg reported the FDIC had asked several US banks including JPM, BAML and US Bancorp to submit final bids for First Republic Bank by Sunday. This approach could lead to a tidier clean-up of the troubled bank while receivership is an outcome the FDIC would prefer to avoid given potential cost on its insurance fund.

Equities Performance

The data in Europe triggered a big rally in Bunds, German Q1 GDP disappointed with a flat outcome vs 0.2% expected following the downwardly revised 0.5% contraction in Q4 . Softer German inflation figures further fuelled the move (falling to 7.6% y/y), Spain also saw a downside miss to CPI, while France saw an upside surprise. CPI inflation for the Euro area will be released tomorrow night, with the consensus picking a slight uptick in headline inflation to 7.0% and a slight downtick in core inflation to 5.6%. Like Germany, Euro area GDP growth was slightly weaker than expected at 0.1% q/q in Q1, following the downwardly revised 0.1% contraction in Q4, suggesting a weaker economy than thought but the region still managing to skirt recession.

Ahead of the ECB meeting on Thursday the data trimmed expectations for a 50bps hike, cementing the likelihood of 25bps with the OIS now showing an increase of 27bps, 3bps lower on the day. The data also triggered a solid rally in European sovereign bonds, 2y and 10y Bunds fell around 14bps (latter down to 2.36%) while 10y Italian BTPS fell 17.6bps to 4.091%.

The move lower in European yields played a big part in the move lower in UST yields latter in the session as Bund yields continue fall after US data releases. March personal income rose 0.3%, a tenth above the consensus, 0.2%, Real consumers’ spending was unchanged, also a tenth above the consensus, -0.1%. The core PCE deflator rose 0.3%, in line with consensus, but it also came alongside upward revisions to the January and February numbers. Together, these figures were enough to raise the annualized increase in the core PCE deflator to 4.9%, from the 4.7% expected by most forecasters. The current preferred Fed’s measure of core services ex-housing was a little bit better coming at 0.24% in March its lowest reading since last July.

The Q1 employment costs index rose 1.2%, above the consensus, 1.1% with the all-important private sector wages ex-incentive pay coming at a punchy 1.3%. Pantheon economics notes that after adjusting for seasonality, the private reading comes at an annualized rate of 5.2%. That’s a clear step up from the 4.3% annualized Q4 gain, and it breaks the slowing trend in place across the previous year.

Of note too, the final read for April University of Michigan Survey of Consumers also contained solid inflationary news . One year ahead inflation expectations remained near historical highs at 4.6% (was only 3.6% in March) and the five year ahead inflation expectations increased to 3% from 2.9%/

Friday’s US data sealed the deal for a Fed hike this week with the acceleration in the ECI implying wages growth trend is not heading in the right direction. The market now prices an 84% chance for a 25bps increase in the Funds rate to 5.0%-5.25% and arguably it may also make the case for the FOMC to retain a hawkish bias in the statement.

The UST curve closed the week with a bull flattening bias. The 2y rate fell 6.4bps to 4.027% while the 10y Note fell 10bps to 3.47%. Lower yields was also the theme for the week.

US Treasuries over the past week

Moving onto FX, the USD was marginally stronger on Friday with JPY big underperformer amid a dovish interpretation of the BoJ policy announcement . The AUD was little changed and starts the new week at 0.6601. NZD and GBP were the outperformers on Friday both gaining just over 0.5% on the day and now start the new week at 0.6179 and 1.2568 respectively. It is hard to attribute a macro driver to either NZD or GBP gains, suggesting month-end flows may have been at play.

As widely expected, the BoJ kept its ultra-easy policy setting unchanged (policy rate at -0.1%, full commitment to YCC and QE programmes – JGBs and ETFS). The Bank announced a review of past monetary policy with the intention to publish its findings in a year to a year and a half times. The Bank also changed its forward guidance on future interest rate levels, opening the door to a move away from the current ultra-easy policy setting. However, given so many uncertainties noted by the BOJ, it suggests only a very gradual approach to a change in policy is likely, if any. That said inflationary pressures should keep the Bank vigilant, Tokyo core CPI, a leading indicator of the national reading, surprised yet again to the upside, jumping to 3.8%yoy vs 3.5% expected, implying the BoJ FY2023 core inflation forecast of 2.5% is at risk of being too modest.

Move up in USD/JPY on Friday likely reflected disappointment by those who were expecting a stronger signal from Ueda and Co . JPY was the G10 underperformer (-1.7%) with USD/JPY climbing above ¥136 for the first time since March 11. Near term USD/JPY can spend a bit more time in the mid-130s, but the bias remains for lower levels over coming quarters, largely driven by our expectations of a broadly weaker USD, amid a slower US economy and a Fed gearing up for a new easing cycle.

Meanwhile in Canada, preliminary GDP data imply the country’s GDP contracted 0.1% in March, led by decreases in retail, wholesale and mining sectors. However, the data also points to an annualized growth of 2.5% in the first quarter, in line with BoC’s projections. We think recent activity data are likely to keep the BoC on the side-lines over coming months, but stickiness in inflationary pressures alongside a resilient labour market suggest the BoC will retain a tightening bias. CAD was up 0.29% on Friday and little change on the week (USD/CAD closed Friday at 1.3537).

FX Performance

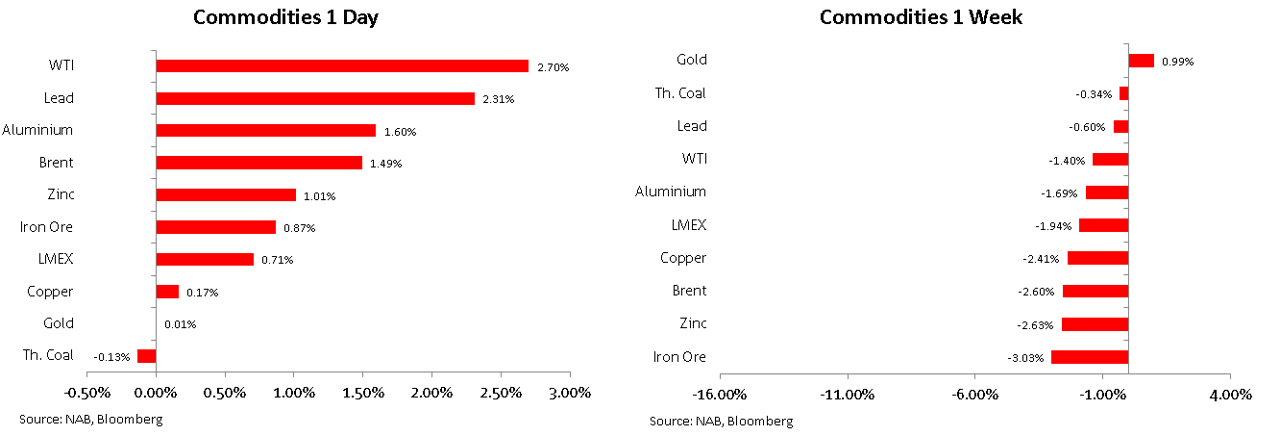

Solid reporting by US oil companies seemingly supported the move up in oil prices on Friday, suggesting US demand remains buoyant. WTI (2.7%) and Brent (1.4%) oil prices led the move up in commodity prices on the day with Aluminium (!.6%) and lead (2.3%) the other outperformers. That said gains on Friday were a small offset for the losses incurred in the previous four days with Gold the only main commodity managing to post gains for the week, up 1%.

Over the weekend China released its official PMI readings for April. The Manufacturing PMI fell to 49.2 in April from 51.9 previously, the reading fell into contraction mode for the first time since December last year and it came well below the 51.4 expected by economists . Meanwhile the non-manufacturing gauge of activity in the services and construction sectors declined to 56.4 from 58.2 in March. Also, a bigger decline relative to the 57 expected by consensus.

The data signals China’s recovery may be losing momentum, but encouragingly amid some speculation the contrary, on Friday the Politburo concluded its April meeting noting the recovery needs continued “forceful” fiscal and monetary support due to insufficient domestic demand.

Commodities Performance

Coming Up

- We have a busy calendar this week which includes RBA (on hold), FOMC & ECB (25bp) as well EZ CPI, US ISMs & Payrolls. China is on holidays until Wednesday and earnings reporting season continues.

- Today Japan gets consumer confidence and the final PMI readings for April. Canada and the US (final) also get manufacturing PMIs with the US also releasing the ISM Manufacturing. The survey headline reading is seen modestly rising to 46.8 from 46.3 with the prices paid index also little changed at 49.

- NAB expects the RBA to be on hold on Tuesday. The data flow over the month has not challenged the RBA’s goal of getting inflation back to 3% by mid 2025 (itself a low bar). Although NAB sees the RBA on hold throughout 2023, risks remain that rates may need to go higher given policy is only in modestly restrictive territory and the RBA is already stretching the flexibility of its 2-3% inflation target. Key for the rates outlook will be the inflation profile, which will be published in full on Friday as part of the SoMP. Governor Lowe though is likely to delve into some of the details when he speaks soon after the Board Meeting at dinner, as too with Assistant Governor Ellis on Wednesday. As for the forecasts, we expect little change to the activity and unemployment tracks, while inflation over 2023 is likely to be revised down a little.

- NZ Q1 Household Labour Force Survey is out Wednesday an our BNZ colleagues expect a steady unemployment rate, at 3.4%, based on quarterly employment growth of 0.4%, and for the private-sector Labour Cost Index to pick up to 4.5% y/y, from 4.3% in Q4. The RBNZ (Feb MPS) anticipated 3.5%, 0.2% and 4.7% respectively. Same morning, the RBNZ publishes its six-monthly Financial Stability Report.

- International: Central banks in focus with the US Fed and ECB both expected to hike rates, in contrast to the RBA. There is also plenty of top-tier data. (1) US FOMC to raise rates by 25bps. The market is 84% priced. More interest will be in the presser for whether Powell explicitly points to the Fed pausing thereafter and how strongly he chooses to push back on market pricing for cuts of -60bps in H2 2023. (2) ECB meets with markets torn between 25 vs. 50bp, with 28bps priced. NAB sees a 25bp hike; (3) US ISMs and Payrolls the pick of the data, especially the Services ISM which fell sharply last month. Payrolls will likely show a still tight labour market; (4) EZ CPI where expectations are for still too high inflation of 7.1% y/y; and (5) Earnings season continues with Apple (Thursday), Berkshire Hathaway (Friday), Pfizer (Tuesday), Stryker (Monday) and ConocoPhillips (Thursday) amongst the highlights.

Market Prices

[ad_2]

Source link