[ad_1]

martin-dm

Euronext NV (OTCPK:EUXTF) is currently undervalued compared to its own historical average and its closest peer, making it an interesting growth play within the European financial sector.

Company Overview

Euronext is one of Europe’s largest exchange operators, with its business being present across several European exchanges including France, Belgium, Italy, the Netherlands, Portugal, beyond others. Its current market value is about $8.5 billion and trades in the U.S. on the over-the-counter (OTC) market. Euronext is based in the Netherlands and has been listed since 2014, following the carve-out from the Intercontinental Exchange (ICE).

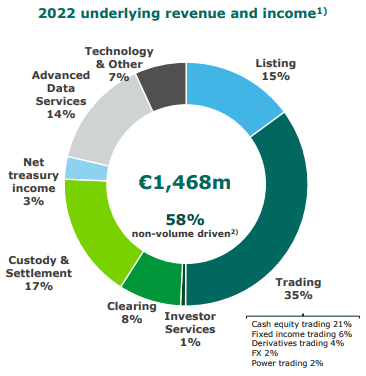

The company is present across the whole value chain of the trading process, including listing of securities, cash & derivatives trading, post-trade clearing, market data, and technology solutions. While in the past it was very exposed to trading and cash equities, it has diversified its business over the past few years, and now about 58% of its revenue is generated by non-trading income.

Revenue (Euronext)

Despite that, its largest business segment remains Trading, representing some 35% of total revenue, of which some 21% comes from cash equity trading. As margins in Trading are smaller than compared to other segments and revenue is more volatile because is dependent on volumes, this means Euronext still has to some extent a cyclical business profile, even though its strategy has been focused on increasing its revenue pool coming from more stable sources over the market cycle.

Indeed, Euronext’s current business profile is now closer to its largest peer Deutsche Börse (OTCPK:DBOEY), which I’ve covered in a previous article, given that Euronext has reduced its reliance on trading revenues, and increased its business diversification like its competitor has done in recent years.

Additionally, its geographical diversification also has increased through acquisitions, as Euronext only operated four local exchanges back in 2014, while currently it operates seven exchanges in different European countries. Its revenue pool was quite concentrated in its main market (France), which represented some 58% of revenue in 2014, while nowadays it represents less than 30% of total revenue.

Growth Prospects

The exchange industry is relatively concentrated in Europe, which bodes well for established players organic growth prospects, while further growth is also possible through small bolt-on acquisitions in selected business segments.

Euronext’s current strategic plan ‘Growth For Impact 2024‘ aims to make Euronext one of the leading market infrastructure players in the European industry, building on the company’s fundamental transformation started some years ago. Its goal is to develop new products and services in growth areas, such as market solutions and technologies, increasing its weight of stable and recurring revenues over the long term.

Its growth history is quite good given that its revenues have more than doubled from 2019 to 2022, supported by organic growth and acquisitions. The last one was the acquisition of Borsa Italiana Group, which have helped to boost revenue and improve margins due to strong cost synergies across the company.

Regarding its main financial targets set in its business plan it has been able to achieve its goals ahead of expected, a good track record regarding its capacity to execute on its business targets. Moreover, it has recently increased its synergies target related to Borsa Italiana to run-rate synergies of €115 million by 2024, €15 million above its previous guidance.

This also shows Euronext’s good execution of integrating acquired companies into its group, which has been a constant in its previous acquisitions, in which Euronext has always been able to achieve higher synergies than targeted.

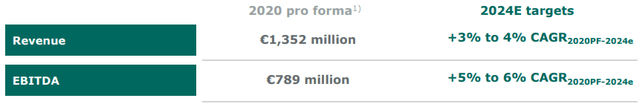

Taking this background into account, Euronext’s main financial targets for 2024 are to achieve organic revenue compounded annual growth rate (CAGR) of between 3-4% from 2020-24, and EBITDA CAGR of 5-6% during the same period. This only accounts for organic growth and excludes any potential M&A that may arise, even though large deals are not expected in the short term. Regarding capex, Euronext expects to invest some 3-5% of annual revenues and distribute about 50% of reported net income to shareholders through dividends.

Financial targets (Euronext)

Financial Overview

Regarding its financial performance, Euronext has delivered good results over the past few years, supported both by organic growth and acquisitions.

In 2022, its revenues amounted to €1.4 billion, an increase of 9.3% from the previous year, a good performance that was supported by most revenue lines, including trading revenue during a difficult period as the equity market has been quite weak over the past few quarters. Despite that, volumes and fees were quite resilient, and even listing saw an increase in revenue which is justified by debt markets while equities IPOs activity reduced significantly during the past year.

Regarding costs, the company has benefited from cost synergies coming from the integration of Borsa Italiana and good overall cost control, leading to an adjusted EBITDA of €861 million in 2022, up by 11.7% YoY. This represents an adjusted EBITDA margin of 58.7% in the past year, while its medium-term target is to have an EBITDA margin above 60%, which seems achievable given its synergies still to be extracted from its most recent acquisition.

However, due to higher taxes and lower income from equity investments, Euronext’s net income amounted to €450 million, up by 5.9% YoY, and its reported EPS was €4.09 (-4.6% YoY) due to a higher number of shares outstanding. Its free cash flow was €577 million, up by 8.6% YoY, showing that is business has a good cash flow generation capacity.

For 2023, the company’s guidance is to grow organic revenue by mid-single digit, while costs are also expected to grow by about 1.6% YoY, due to inflation and business development costs which should be offset to some extent by savings and synergies from the integration of Borsa Italiana.

Going forward, Euronext should continue on a solid growth path, supported by its organic initiatives to diversify its business and offer new products and services to customers. Indeed, according to analysts’ estimates, its revenue is expected to increase to about €1.67 billion by 2025 and its net profit should be about €675 million by the same year. While this aren’t impressive growth rates, it shows that Euronext has positive growth prospects ahead and may beat market estimates if cyclical conditions improve in the capital markets over the next few years.

Regarding its balance sheet, Euronext’s leverage increased following its acquisition of Borsa Italiana and the company is now in a deleveraging process that should take a couple of years. Measured by its net debt-to-EBITDA ratio, its financial leverage increased to about 3.2x in 2021 (from 1.3x in 2020), a ratio which decreased to 2.6x last year due to strong cash flow generated. This means that further M&A is not much likely in the short term as the company continues to use cash generated to decrease balance sheet leverage, while allowing at the same time to distribute a good part of earnings to shareholders.

Indeed, Euronext’s dividend policy is to distribute about 50% of its annual earnings to shareholders, which is an acceptable dividend payout ratio considering the company’s business profile.

Related to its 2022 earnings, Euronext’s dividend was set at €2.22 per share, representing a payout ratio of 54%. This represented an annual increase of 15% YoY, showing strong management confidence on the company’s business prospects ahead, as historically the company has delivered a growing dividend. At its current share price, Euronext offers a dividend yield of about 3.1%, which should be paid by the end of May. Investors should note that, like many European companies, Euronext only pays one dividend per year, reducing to some extent its income appeal.

Conclusion

Euronext is an interesting company within the European financial sector as it have good fundamentals and better growth prospect than other companies in the sector. Moreover, it’s currently trading at only 13.5 forward earnings, at a discount to its own historical average over the past five years (16.5x earnings) and at a discount to Deutsche Börse (trading at more than 18x earnings). This means Euronext seems to be undervalued, making it a good growth play within the European financial sector right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link