[ad_1]

THE rubber glove industry, just three short years ago, was awash with demand that led to a huge windfall and fortune for companies.

Today, that industry is in the doldrums with a bottoming out not yet in sight – not at least for the main rubber glove players in Malaysia.

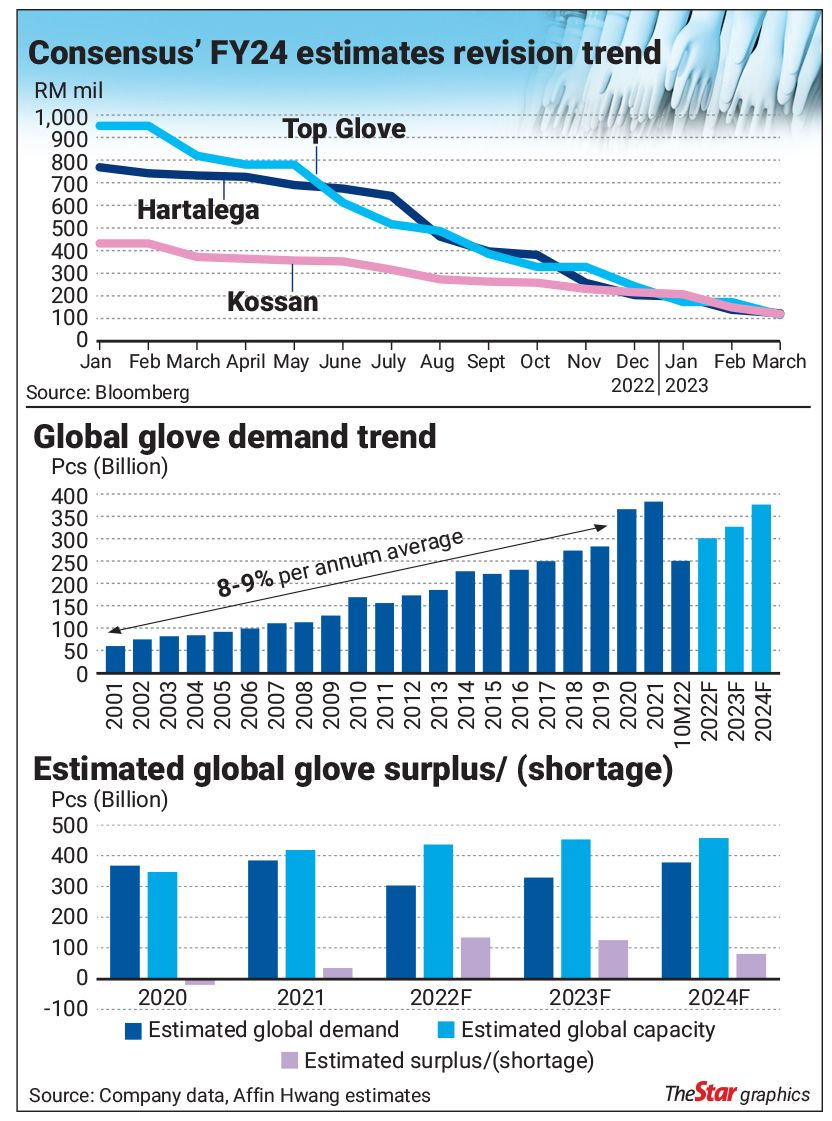

As supply continues to disproportionately outnumber demand, a meaningful recovery for the industry could be farther than thought and analysts do not expect it to materialise in the near to medium term.

In addition to the imbalanced supply-demand state, the rubber glove industry is also suffering from high capital expenditure invested to expand capacity even though some of these have been put on hold given the current situation.

Top Glove Corp Bhd’s recent second quarter financial results booked a net loss of RM164.67mil for the quarter ended Feb 28 as opposed to a net profit of RM87.55mil in the same quarter a year ago.

It is the third consecutive quarter of losses that have rocked the biggest rubber glove maker in the world.

Top Glove had attributed its losses to headwinds which are weighing heavily on the rubber glove industry.

“Destocking activity persisted, driven by excess customer inventory, resulting in a softer order book.

“Aggravating the situation was the ongoing glove oversupply situation combined with a lack of customer urgency to place orders in light of shorter delivery times from lower manufacturer utilisation,” Top Glove says in its financial statement.

According to the company, it is unable to pass on rising production costs to its customers due to moderating average selling prices (ASPs). Hartalega Holdings Bhd , the second-biggest maker of rubber gloves, which had just ended its fourth quarter yesterday will soon report the quarter’s financial results.

, the second-biggest maker of rubber gloves, which had just ended its fourth quarter yesterday will soon report the quarter’s financial results.

In its third quarter ended Dec 31, 2022, Hartalega reported a net loss of RM31.91mil due to lower revenue and higher energy costs.

The Malaysian Rubber Glove Manufacturers Association (Margma) anticipates that a recovery may come sooner than most people think.

The association says global glove demand is expected to normalise to pre-pandemic levels later this year.

“A global demand of 300 billion pieces is expected for 2023.

“In 2019, Malaysia exported about 167 billion pieces or about 67%,” its president Supramaniam Shanmugam tells StarBizWeek.

“The overbought and overstock position of importers, distributors, consumers is a benchmark for the market to start replenishment and restocking.

“It is not particularly happening now, but it would surely happen in the next few months and when it happens, it can be like a revenge-buying situation,” he adds.

Supramaniam says the association is optimistic as its members are seeing a resurgence in buying patterns.

“The 300 billion pieces could have been more if not for the overbought position and over-production by both the supply and demand side. “This is based on our study of data from various sources – the Department of Statistics, overseas customers making factory visits, data from the Malaysian Rubber Council, attendance by customers at glove related exhibitions globally and feedback from our 80 manufacturers in terms of customer buying sentiment,” he says.

Margma acknowledges the over-production situation where manufacturers had conscientiously tweaked production lines.

“They have done well to capitalise on the market situation then.

“We expect the world to continue normalising demand and expect the usual growth in demand from the hospitals, clinics, dental practices and the return of the food handlers, airlines, dermatologists and tattooist.

“Most sectors were shut down during the pandemic, hence, the zero consumption of gloves.

“However, many sectors are now poised to become fully operational,” Supramaniam says.

Despite the upbeat outlook by Margma, Tradeview Capital chief investment officer Nixon Wong says the outlook for rubber glove players remains muted.

“They may have reached a bottom, but a bottoming-out process may take a longer time to happen.

“The outlook is challenging in the near term. I understand that their capacity utilisation rates are very low at 30% or 40%.

“They are looking at raising prices to cover the increase in costs of operations and not looking at making a profit yet.

“It’s tough to project their profitability in the next one to two years,” says Wong.

He notes that any attempt to increase prices may backfire as there’s the threat from competitors offering cheaper prices.

The competition might come from within or outside the country such as from China where manufacturers have lower fuel costs by using coal.

“It’s hard to be profitable in such an environment.

“Local players would also need to be mindful of the Competition Act 2010 which seeks to prevent unfair competition practices.

“Bear in mind that supply is still excessive, and any attempts to raise selling prices would see a sacrifice in sales volumes,” Wong says.

He says any consolidation among the rubber glove makers may need about two years to fully play out, given the current weak industry dynamics.

“Only once excess capacity is filled then only would people entertain the thought of a possible consolidation.

“I don’t think players are at a very distressed level yet.

“They have cash, but it is burning at quite a fast rate looking at how things are going,” he says.

The state of the industry is also causing smaller players to close down while the bigger players are taking the opportunity to revamp their plants by incorporating more automation and technology to save costs in the long run.

However, Wong says the moves are having a minimal impact to reduce the excess supply in the market.

“This still cannot turn the situation around but it may help in the medium term to stabilise the cost structure.

“The ones that have closed down are not significant to the total industry capacity,” he says.

Meanwhile, Affin Hwang Investment Bank Research (Affin Research) reiterated its “underweight” stance on the sector, primarily due to the longer-than-expected sector recovery.

“We believe that the recent rally in the sector share price provides an opportune time for investors to take profit given the unfavourable sector fundamentals. We have ‘sell’ ratings across our coverage,” Affin Research says.

“While the upcoming first half 2023 reporting seasons may see the peak of cost pressures before subsequently improving, we see risks of the glove makers registering losses for a longer-than-expected duration given the ongoing weak market demand.

“On average, we are expecting glove makers to only reach operational breakeven closer towards mid-2024, which is much more conservative relative to consensus.

“As such, we expect further downward revisions in consensus estimates moving forward,” it adds.

Notably, the research house also points out that consensus estimates have constantly been pushing back the timeline of the sector finding its true bottom.

[ad_2]

Source link