[ad_1]

The legislature’s Insurance and Real Estate Committee acted on a number of bills prior to its reporting deadline that will affect small business health insurance costs and access.

It’s been a busy session for the committee, which earlier this month also approved a wide-ranging measure designed to provide much-needed healthcare insurance relief for struggling Connecticut small businesses.

The bill provides nonprofit groups, trade associations, and their employer members two pathways to obtain more affordable, higher quality health insurance.

The committee approved HB 6710, which provides a pathway for small employers to aggregate buying power and purchase large group health insurance, on a 9-3 bipartisan vote.

Committee members also approved another bill designed to cut health insurance costs, passing HB 6712 on a bipartisan 9-3 vote.

That bill eliminates all assessments and fees charged by the state’s health insurance exchange and cuts the premium tax levied on domestic and foreign insurers from 1.5% to 1%.

Fees, Assessments

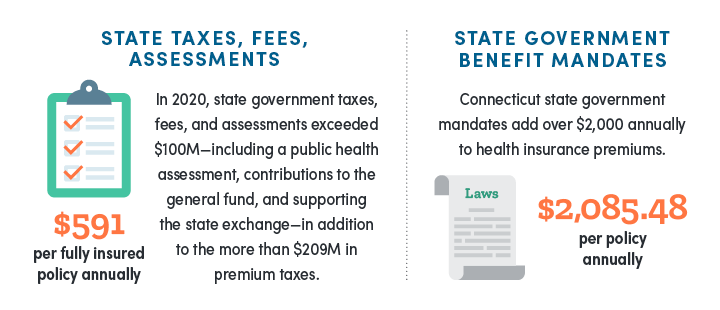

CBIA’s Wyatt Bosworth testified in support of the bill at an earlier public hearing, telling the committee that “state taxes, assessments and fees continue to be major cost drivers for small employers who offer fully insured small group health insurance for their employees.”

Section one would completely eliminate all assessments and fees on the Access Health CT exchange, which exchange covered over 27,000 lives through small group health insurance products last year.

By eliminating this annual assessment, more than $32 million will be returned to small employers and individuals on the exchange.

To put this $32 million in perspective, the average annual cost of the assessment to a family of four is $244.

Sections 4 and 5 reduce the premium tax levied on domestic and foreign insurers from 1.5% to 1.0%.

This benefits more than 106,000 lives enrolled in on-exchange and off-exchange plans, reducing the annual policy premium cost for a family of four policy by approximately $540.

Health Benefit Mandates

A measure requiring that all health benefit mandate proposals be referred to the Connecticut Insurance Department for an in-depth cost-benefit analysis received broad committee support.

Under HB 6711, the committee receives the analysis the following month, essentially ensuring both chambers have important information regarding the mandate’s cost impact on the individual and small group markets.

Bosworth told the committee that “health benefit mandates drive up small business health insurance costs because with each new requirement, insurers must expand coverage to include additional services or devices.”

“This increases the cost of health insurance premiums, and those increases are passed directly onto enrollees,” he said.

“These increases are detrimental to small employers, who are not required to offer health insurance pursuant to the Affordable Care Act, but choose to do so.”

Despite health benefit mandates being a significant cost driver for those enrolled in fully insured plans, the General Assembly continues to pass legislation enabling new mandates despite having no cost-benefit information.

The committee took no action on SB 976, which featured over 20 new health benefit mandates for the individual and small group markets.

CBIA opposed the bill because of its extraordinary cost impact on small business health insurance plans.

SB 976 mandated a number of new benefits, including postpartum care, emergency contraceptive drugs, bariatric surgery, equine therapy, peer support specialists, and more.

Provider Costs

The committee voted 10-2 to advance SB 983, which implements some of Gov. Ned Lamont’s budget proposals.

The bill limits out-of-network costs for inpatient and outpatient hospital services to 150% of the Medicare rate and prohibits the use of anti-competitive contracting terms.

Sections 1 and 2 are similar to HB 6620 and use language based on the National Academy for State Health Policy’s Model to Address Anticompetitive Terms in Health Insurance Contracts.

Both sections prohibit new, amended, or renewed healthcare contracts on or after Jan. 1, 2024 from including (1) anti-tiering clauses; (2) anti-steering clauses; (3) all-or-nothing clauses; and (4) gag clauses.

The bill limits out-of-network costs for inpatient and outpatient hospital services to 150% of the Medicare rate.

Additionally, section 3 limits out-of-network costs for inpatient and outpatient hospital services to 150% of the Medicaid rate (the bill was amended to increase this from 100% of the Medicaid rate).

The Governor’s office told the committee that a “fixed and reasonable out-of-network rate can reduce in-network negotiated rates, encourage in-network participation, and reduce overall spending by limiting the value of the option of staying out-of-network, which providers can use to increase their prices.”

The Connecticut Hospital Association opposed section 3, arguing that the cap would be financially devastating to hospitals and health systems.

The Connecticut Association of Health Plans supported section 3, noting that the establishment of a Medicare reference baseline for out-of-network reimbursement will incentivize providers to go in-network.

For more information, contact CBIA’s Wyatt Bosworth (860.244.1155) | @WyattBosworthCT.

[ad_2]

Source link