[ad_1]

Decarbonisation in aviation hasn’t quite taken off as it has with other parts of the transportation sector. The physical reality of flying high above the earth’s surface at tremendous speeds means that the energy, and therefore fuel, required is much greater than for road vehicles.

Straightforward alternative technologies such as electrification are simply not viable for aviation in their current state.

While the share of global emissions from aviation is relatively small compared to surface transport, at around 3% of global emissions, some estimates indicate that this could increase to 22% by 2050, fuelled by demand growth in developing markets.

Schemes like CORSIA have been developed to make airlines more environmentally sustainable. However, these schemes are based on carbon offsetting which has been widely criticised for not offering significant measurable carbon reductions.

In all industries, but especially aviation, net zero involves massive infrastructure investments, shifts in consumer behaviour and fluctuations in commodity prices.

Most often, the financial risks faced by airlines due to these changes are calculated by what an airline’s profit would be if they had to pay for their carbon emissions.

However, this method falls far short of creating a realistic picture. For investors and industry leaders who want to fully grasp the potential changes in the airline industry, there are three steps to understanding the underlying economic dynamics of the climate transition.

Behaviour change in air travel

First, travel behaviour is going to change across the globe.

In numerous regions, high-speed rail – which is significantly less carbon-intensive than flying – will likely replace short- and medium- haul flights.

However, since high-speed rail is expensive to build and is not suitable for all terrains, it is unrealistic to expect that it will replace all regional airline routes.

Airlines may face other challenges induced by changes in travel behaviour. For example, business travel is likely to be constrained in a net zero scenario as companies opt for more online meetings.

However, as with high-speed rail, it is important to understand the regional discrepancies. Developing economies like India will still experience a demand increase in business travel whilst developed economies are likely to see a decrease in business travel.

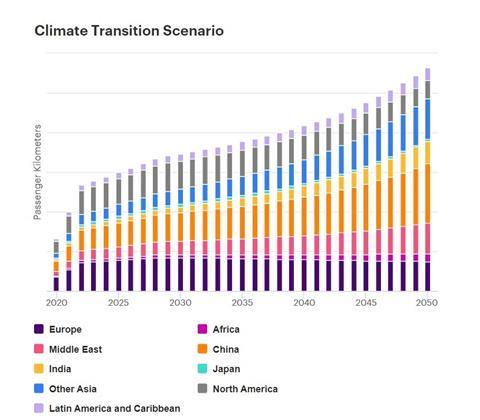

This is because for developing regions it is unrealistic to assume that air travel stays at its very low baseline as the economy grows. The graph below shows which regions will still experience growth as passenger kilometres flown and which regions will experience a decline in passenger kilometres.

Making aviation fuel green

Second, the fuel mix will drive change in the airline industry.

Whilst there are ongoing experiments with battery and hydrogen planes it is unlikely that these planes will see much adoption before 2040 due to a number of engineering difficulties.

Therefore, the only short- to medium-term solution to decarbonise the airline industry is by using Sustainable Aviation Fuels (SAFs). These fuels can be biofuels or synthetic kerosene made from hydrogen and carbon dioxide.

The advantage of using SAF is that it requires little to no modification of the existing airline fleet and a number of policies are already in place to support its uptake like the Inflation Reduction Act and Fit for 55 package.

Several different SAFs are already commercially available. For example, existing commercial jet biofuel refiners refine used cooking oil and other fatty acids.

Scaling these technologies is challenging, however, as potential supply of oil from restaurants and processing plants is not enough to fuel the whole airline industry.

WTW analysis shows that this input can provide less than 1% of airline’s total energy need. Other types of biofuels are available, although these processes have not yet been tested on a commercial scale.

In contrast, synthetic kerosene is in theory more scalable, but it has only been produced on an experimental scale and the first commercial refineries are not expected to come online before 2026. Developing an understanding of the potential supply and cost of these SAFs is vital to comprehend the dynamics of the airline industry in a net zero scenario.

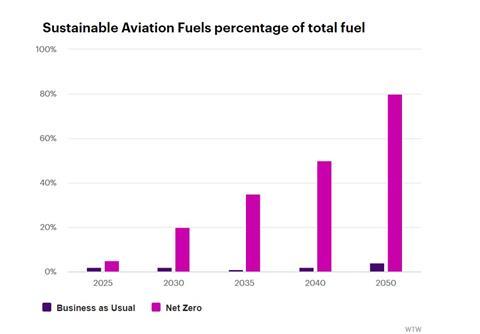

Our analysis has found that it is possible to increase the production of SAFs to fuel 80% of the airline sector by 2050, which will enable global passenger kilometres flown to stabilise whilst reaching net zero emissions goals.

The wider economic impact

The third factor that will influence the airline industry are the spill-over effects. As demand for air travel changes, the dynamics of the industries servicing and supplying airlines will also change.

For example, many airports will experience a decrease in demand for their landing slots. This means that the high fixed costs of airports will have to be spread out over fewer flights, which will negatively affect the profits of airports and the airport charges paid by airliners.

Aircraft manufacturers may experience a similar issue as demand for their planes decreases whilst they continue to face high fixed costs.

In addition to this, manufacturers may be forced to spend more on R&D to develop new types of propulsion systems. These factors will drive up the price of aircraft. Our analysis suggests that the price of an average long-haul aircraft will increase by 26%.

Simply looking at carbon emissions is not enough to understand the transition risks faced by airlines. It is important to comprehend the wider economic transition dynamics to make an effective judgement on the financial future of the airline industry.

Christopher van den Heuvel is an associate in the Climate Transition Analytics team within the Climate and Resilience Hub at WTW

[ad_2]

Source link