[ad_1]

It was another fairly volatile day following the weekend deal for UBS to buy Credit Suisse, though overall the deal seems to have found some cautious acceptance.

Todays podcast

- Some volatility after the UBS buyout of Credit Suisse

- But equities and yields are both higher

- US 2yr up 10bp after reversing earlier large declines

- The wipeout of AT1 note holders has been a focus

- Coming up: RBA Minutes, Canada CPI

“’Cause if it’s over let it go and come tomorrow it will seem so yesterday, so yesterday, I’m just a bird that’s already flown away” – Hilary Duff

It was another day of volatility to begin the week following the weekend deal for UBS to buy Credit Suisse. An initial positive note for risk appetite was dented into early European trading before recovering. The US 2-year rate has traded a 40bps range, but over the day yields and equities are both higher.

In some focus was the complete wipe-out of holders of Credit Suisse’s additional tier 1 (AT1) notes (with a face value of $17b). That came as a surprise to most in that the notes came out worse off than the equity holders, who at least receive some UBS stock. The move put pressure on other AT1 debt, which was down in the order of 5-15% for newly issued European AT1 bonds, amid concern they could be wiped out more readily than previously assumed. Regulators moved to clarify their treatment, with the ECB, SRB and EBA issuing a joint statement which said that “in particular, common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier 1 be required to be written down” while the Bank of England said “the UK’s bank resolution framework has a clear statutory order in which shareholders and creditors would bear losses in a resolution or insolvency scenario”

Elsewhere, there were few key headlines of note as the dust settled and risk appetite returned. The FT reported a US official saying “bank deposits in the US had stabilised, with outflows from the most vulnerable institutions slowing, stopping and in some cases reversing”. The WSJ reports JP Morgan CEO Dimon is leading discussions with the CEOs of other big banks about fresh efforts to stabilise First Republic Bank. And after some anxiety over the announcement on the enhancement of the Fed’s USD swap lines , with all parties (BoC, BoE, BoJ, ECB and SNB) agreeing to increase the frequency of their operations to daily from weekly, the take up made clear it was preemptive rather than reflecting some special concern. The Bank of England and Bank of Japan received zero bids, while the European Central Bank allotted just $5 million to a single bidder.

On the US side of the banking developments, it was a more discriminating session. First Republic remained in sharp focus despite last week’s transfer of $30b in deposits to the bank, falling close to 40%. In contrast, the KBW bank index is up close to 1%, though has pared earlier larger gains, with most of its constituent banks in positive territory, and all but one of those that were not seeing declines of less than 1%.

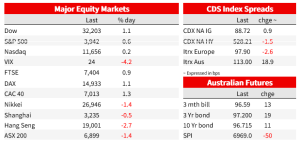

UBS shares at first led European Banks lower with UBS shares down as much as 16% at one point before swinging positive to close 1.3% higher, with other European banks also paring early losses. Beyond the banks, equities were positive more broadly. The Euro Stoxx 50 was 1.3% higher, while in the US the S&P 500 is currently around 0.8% higher, led by materials and energy but with all 11 sectors in positive territory.

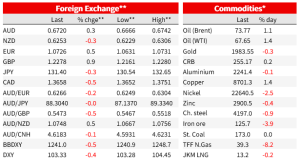

Currency markets were less volatile. The AUD was middle of the pack against a weaker US dollar, gaining 0.3% to 0.6720. the US dollar lost 0.4% on the DXY. The NZD was the worst G10 performer, down 0.3% to 0.6253. Large ranges in US treasuries have been somewhat mirrored in the JPY, trading a range of 2 big figures and currently down 0.3% to 131.40

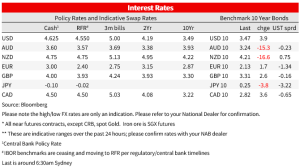

In rates markets, US 2yr yields fell as much as 22bp to a low of 3.63% before reversing course with 2yr yields now 10bp higher on the day to 3.95%. The 10-year rate down to 3.29% before recovering to 3.47%. Fed pricing for the March meeting shifted a little higher, to price a 70% chance of 25bp this week. The peak in May is now priced at 4.89% from 4.79% on Friday, with cuts to 3.99% by years end from 3.83% on Friday. The WSJ’s Timiraos penned an article outlining the ‘tough decision’ facing the Fed this week. He notes that “ the decision … is likely to hinge in part on how markets digest the forced marriage Sunday of two Swiss banking giants, UBS and Credit Suisse, and other steps to calm fears of contagion in the banking system.” (See WSJ).

In terms of what it all means for central banks, we also heard again from Christine Lagarde, who repeated here message from last week that “Price stability goes with financial stability, and they are both present and come together — but there is no trade off,” adding “they are two different stabilities addressed by different tools.” That doesn’t mean that what is happening in the banking sector won’t affect the outlook for the policy rate: “ Financial stability to the extent that it impacts the economic situation, to the extent that it impacts our projections, has an impact on how we see the situation from a macroeconomic point of view.”

A couple of her ECB colleagues offered different assessments on the path forward. Latvian central-bank chief Kazaks told Bloomberg that borrowing costs must rise further “if the baseline scenario holds and market volatility calms down and does not derail the scenario.” While Stournaras said the ECB was now “close to the end of the tightening cycle” and that “rate hikes are mostly now a story of the past.”

As for the RBA, ahead of the March Minutes today we heard from RBA Assistant Governor Chris Kent in a speech yesterday morning on the ‘Long and Variable Monetary Policy Lags’. Kent concluded that a higher fixed rate share means the cash flow channel is likely operating more slowly in Australia at the moment, but other channels appear to be operating in the usual way. He gave little away on the immediate outlook for policy, simply concluding that “the Board will respond as necessary to bring inflation back to target in a reasonable time, ” but in the Q&A did not sound overly concerned about the implications of bank problems offshore. Kent said “what we’re talking about here is a few institutions that were poorly managed” and that while there were some stresses and extra volatility, many of the changes are more modest in Australia than offshore. “It’s just one of many things the board will be taking into account when it makes its decision next month”

Coming Up

- Focus once again remains on the banking sector and funding markets in what is a quiet day for data outside the Canadian CPI. Offshore events include the NZ trade balance, German ZEW Survey, ECB’s Lagarde and Villeroy, and US existing home sales.

- Domestically, the RBA Minutes are the main event in a quiet day . with Governor Lowe having already expanded on the RBA’s March thinking in a speech last week and the meeting having predated the sharp shifts in rates markets following the SVB and Credit Suisse developments, they will read as a somewhat historical document. The February Minutes took 0bp off the list of options on the table, after it was introduced in December. If a pause was back on the menu of options it would add weight to the RBA’s communication that the time for a pause is near, while if 50bp remains it says there was a high bar for an April pause despite Governor Lowe’s ‘open mind’

- Canadian CPI data for February is expected to fall to 5.4% y/y from 5.9% on a 0.6% m/m gain. The core measures are expected to continue their recent favourable run when compared across countries, with trimmed mean and median CPI both seen around 0.3% m/m and falling a tenth in y/y terms to 4.8% and 4.9% respectively.

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

[ad_2]

Source link