[ad_1]

Wall Street was hit by a renewed sell-off in bank shares on Wednesday, as investor fears about bond portfolios held by US lenders weighed on sentiment after the collapse of Silicon Valley Bank and new turbulence in the European financial sector.

The drop in bank stocks helped drag the US blue-chip S&P 500 down 0.7 per cent, while the tech-heavy Nasdaq Composite finished flat.

JPMorgan Chase, the world’s largest bank by assets, ceded 4.7 per cent, while Citibank and Morgan Stanley both ended more than 5 per cent lower. The KBW Nasdaq Bank index was 3.6 per cent lower.

First Republic Bank, the San Francisco-based regional bank that has been hit hardest by the fallout from SVB, was down 21.4 per cent — or 68 per cent lower since SVB was shuttered on Friday.

Fitch downgraded the bank’s rating to BB from A- and placed it on negative watch, saying that its funding and liquidity profile represents a “weakest link”.

“Investors are a fickle bunch and the unknowns are taking a toll on sentiment . . . but this is not a Lehman Brothers moment, it is isolated to regional banks that are a small share of investment grade corporate bonds and small share of employment,” said Ryan Sweet, chief US economist at Oxford Economics. “The Federal Reserve can step in and use the discount window and be a lender of last resort.”

The return of bearish sentiment in US banks were triggered, in part, by fears over Credit Suisse. The Euro Stoxx Banks index dropped 8.4 per cent after the Swiss lender’s largest shareholder said it would not provide it with any more capital.

The troubled European lender’s shares lost 24.2 per cent, dragging down its peers in France and Germany. Société Générale lost 12.1 per cent, Deutsche Bank shed 9.3 per cent and BNP Paribas fell 10.1 per cent.

“Credit Suisse is an isolated case. But banks in Europe, because of regulatory pressure, had to load up on negative-yielding long-duration bonds at the worst time and now they are facing major unrealised losses on the balance sheet and the market is questioning whether Europe could see the same issue as the US,” said Charles-Henry Monchau, chief investment officer at Syz Bank.

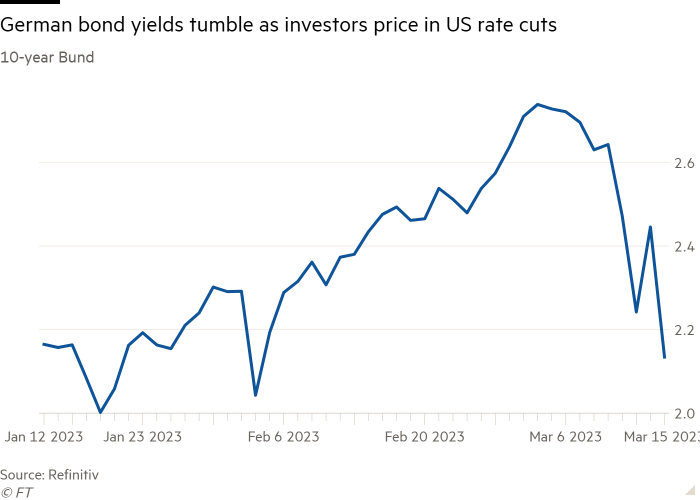

Fears over the banking sector bled into the sovereign debt market, where traders bet that a struggling financial sector would prompt the Federal Reserve to back off its aggressive strategy of rate increases aimed at slowing the overheated US economy.

The yield on the two-year US Treasury note, which closely tracks interest rate expectations and moves inversely to price, fell 0.31 percentage points to 3.91 per cent. The yield on the 10-year note, which underpins global borrowing costs, fell 0.14 percentage points to 3.47 per cent.

The Fed is balancing the demise of three US banks, which has increased speculation that it will have to pause its interest rate increases earlier than expected, and a series of data releases that point to stubbornly high inflation and a hot economy.

Investors have ramped up bets that the Fed will cut interest rates later this year. Markets are now pricing in, at most, a single 0.25 percentage point increase, followed by rate cuts of about 1 percentage point by the end of the year.

Wednesday’s retail sales data showed that consumer spending declined by 0.4 per cent in February, more than economists’ forecast of 0.2 per cent but “not enough to signal a major deterioration in consumers’ willingness to spend”, said analysts at Oxford Economics in a note. On Tuesday, the consumer price index rose 6 per cent year on year.

The Fed’s policymaking open markets committee will meet next week, and the European Central Bank meets on Thursday to decide its next interest rate move. Investors are divided over whether the ECB will agree a 25 or 50 basis point rise.

Europe’s stocks slumped, with the benchmark Stoxx 600 closing down 3 per cent, the UK’s bank-heavy FTSE 100 falling 3.8 per cent and France’s CAC 40 down 3.8 per cent as investor jitters extended for a third day.

Bond yields also fell, with yields on 10-year German Bunds falling 0.27 percentage points at 2.18 per cent, their biggest single-day drop since 1990. The yield on the German two-year note lost 0.4 percentage points to 2.5 per cent.

“I think central banks not tightening further would be seen as a sign of panic. Given that inflation is still very high, they need to stay the course,” said Emmanuel Cau, head of European equity strategy at Barclays.

Earlier in the day, equities in Asia had rebounded as traders bought financial stocks following heavy selling at the start of the week.

Japan’s Topix added 0.7 per cent and South Korea’s Kospi added 1.2 per cent. The Topix Banks index in Japan gained 3.3 per cent after suffering its steepest decline in three years on Tuesday.

[ad_2]

Source link