[ad_1]

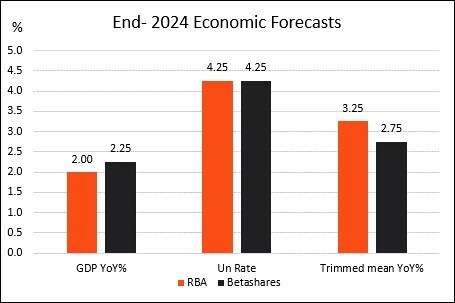

Compared to the RBA’s latest economic forecasts, Betashares chief economist, David Bassanese predicts the coming year will see stronger economic growth, lower inflation, and a “modest lift” in the unemployment rate.

He suggests the RBA will cut rates by 0.6 per cent, more than the market currently expects.

“A lower-than-expected inflation path and increase in unemployment will allow the RBA to cut interest rates in 2024, with my base case being cuts at the August and November policy meetings,” he writes in an economic note.

“The first move in August is expected to a larger 0.35 per cent cut to 4 per cent (bringing the cash rate back to quarter percentage point levels), with one further 0.25 per cent cut in November.”

He notes that disinflation trends we are seeing in the global goods sector will increasingly filter through to Australia, while service sector price increases will also slow as cost pressures ease.

“Lower inflation will, in turn, help boost real household incomes, while along with RBA rates cuts will support a send half rebound in consumer spending,” he says.

“A soft landing for the global economy will also help.”

He forecasts the economy will grow by 2.25 per cent over the year to end-2024 (RBA 2 per cent), but that the unemployment rate will still edge higher to 4.25 per cent in line with RBA expectations.

“Perhaps the biggest difference, annual trimmed mean inflation is expected to end the year within the target band at 2.75 per cent (RBA 3.25 per cent) – more than a year earlier than RBA expects.

While RBA rate cuts should support house prices, “an easing in immigrations flows, lift in unemployment and already poor affordability should constrain further house price gains in 2024”.

“National house prices are expected decline by 3 per cent next year after a 10 per cent rise in 2023,” he said.

Mr Bassanese says the Aussie dollar will rise to $US75cents, and that US$80c is in sight by mid-2025.

“Despite RBA rate cuts, the Australian dollar should also strengthen, reflecting earlier and more aggressive US interest rate cuts and an improving global economic outlook in the second half of the year which will reduce the safe haven demand for the US dollar,” he says.

Firmer global growth in the latter half of the year, especially a strengthening in the Chinese economy, is expected to result in further ion-ore price gains to $US 150/tonne.

While the S&P/ASX 200 will, he says, reach 8,000 by year end

“Although the Australian corporate earnings have been going through a soft patch due to a weakened consumer and easing commodity prices, forward earnings should start to recover this year as they begin to factor in the earnings recovery expected in FY’25 and FY’26,” he says.

[ad_2]

Source link