[ad_1]

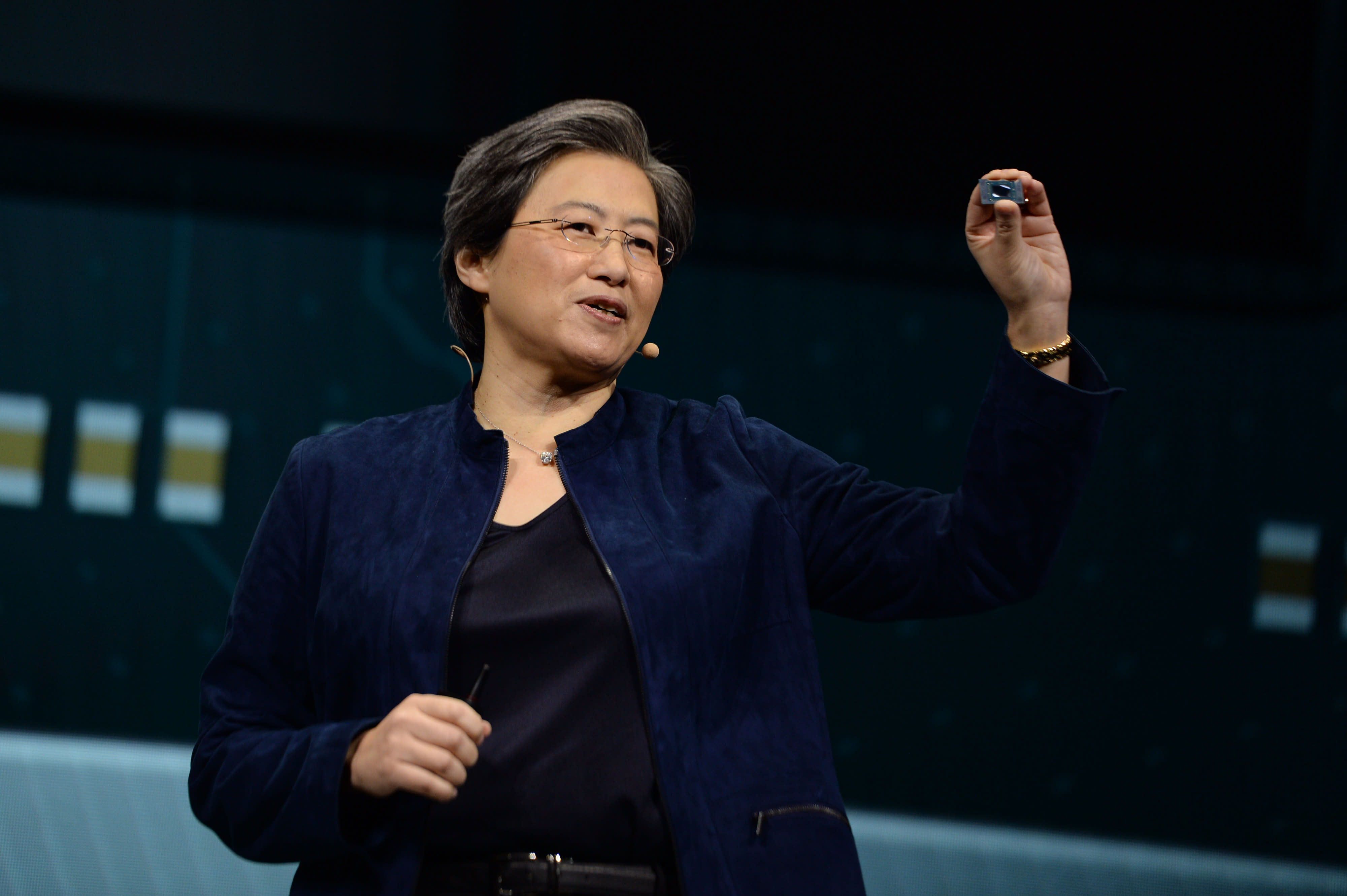

Cristiano Amon, CEO of Qualcomm.

Steve Marcus | Reuters

Qualcomm shares rose by as much as 4% in extended trading on Thursday after the chipmaker reported lower fiscal first-quarter revenue than analysts had predicted and issued weak quarterly guidance. Here’s how the company did:

- Earnings: $2.37 per share, adjusted, vs. $2.34 per share as expected by analysts, according to Refinitiv.

- Revenue: $9.46 billion, vs. $9.60 billion as expected by analysts, according to Refinitiv.

Qualcomm’s overall revenue decreased 12% year over year in the quarter, which ended Dec. 25, according to a statement. Net income fell 34% to $2.24 billion. The macroeconomic environment and higher channel inventory hurt results, the company said.

related investing news

Revenue from Qualcomm’s CDMA Technologies (QCT) segment, which includes smartphone chips, radio frequency front-end components, automotive chips and internet of things devices, generated $7.89 billion in sales for the quarter. That number was down 11% and below the $8.03 billion consensus among analysts polled by StreetAccount.

In that segment, mobile handset revenue reached $5.75 billion, down 18% but higher than the $5.20 billion StreetAccount consensus. Technology industry researcher IDC estimated that smartphone shipments declined 18% in the fourth quarter, the sharpest decline on record.

The Qualcomm Technology Licensing (QTL) segment that includes rights to use the company’s cellular patents delivered $1.52 billion, down 16% and slightly less than the StreetAccount consensus of $1.54 billion.

With respect to guidance, Qualcomm called for adjusted fiscal second-quarter earnings of $2.05 to $2.25 per share on $8.7 billion to $9.5 billion in revenue, which implies a revenue decline of 18.5% at the middle of the range. Analysts surveyed by Refinitiv had expected $2.26 in adjusted earnings per share on $9.55 billion in revenue.

In the quarter Qualcomm and Renault Group announced an extension of their collaboration and said Qualcomm would invest in Ampere, the automaker’s electric and software company.

Qualcomm stock has fallen 28% in the past year when leaving out the after-hours move, compared with a 9% decline for the S&P 500 index in the same period.

Executives will discuss the results with analysts on a conference call starting at 4:45 p.m. ET.

This is breaking news. Please check back for updates.

WATCH: Qualcomm CEO: We’ll need to double total semiconductor manufacturing in the next decade

[ad_2]

Source link