[ad_1]

The latest business news as it happens

Article content

Top headlines

Article content

2:20 p.m.

Manulife cuts 250 jobs in asset management, wealth unit

Manulife Financial Corp. cut 250 jobs in its wealth and asset management unit, trimming staff at offices in the United States, Canada, the UK and Asia.

Advertisement 2

Article content

“Like every other asset manager, we are weathering sustained market volatility and, for the first time in 15 years, a market cycle of higher-for-longer interest rates,” Paul Lorentz, chief executive officer of Manulife Investment Management, said in a memo to employees, first reported by Ignites, a fund industry publication.

Manulife is going ahead with the job cuts after reporting a boost in third-quarter earnings from its business in Asia, where insurance sales in Hong Kong to mainland Chinese visitors continue to improve after the loosening of pandemic travel restrictions.

The Toronto-based insurer and asset manager said core earnings grew by 28 per cent to $1.74 billion, or 92 cents a share, in the third quarter, compared to expected 83 cents, the average of estimates compiled by Bloomberg.

Bloomberg

2:03 p.m.

Poilievre should admit most farm fuels already exempt from carbon price, Guilbeault says

Environment Minister Steven Guilbeault says if Conservative Leader Pierre Poilievre had “any sense of moral decency,” he would “admit” that 97 per cent of fuel used by Canadian farmers is already exempt from the carbon price.

Advertisement 3

Article content

Guilbeault’s comment comes as a new battle over carbon pricing is erupting over a Conservative bill that would take the price on pollution off propane and natural gas used for farming operations.

Gasoline and diesel used for farming is already exempt, but many farmers have complained for several years that the carbon price is costing them a fortune when it comes to heating farm buildings and drying their grain.

Conservative MP Ben Lobb introduced Bill C-234 in 2022 and the Liberals opposed it, but it passed in the House of Commons with the support of the Bloc Québécois and the NDP.

The private member’s bill is now making its way through the Senate, and Poilievre is accusing Guilbeault of telling senators to vote against it.

Guilbeault says he has spoken to about a half dozen senators to explain the government’s position, which includes the fact federal programs are in place to help farmers transition to less-polluting fuel options for their buildings.

The Canadian Press

1:36 p.m.

Amtrak touts proposed Toronto-Chicago rail corridor as Via tempers expectations

Amtrak is making a sales pitch to connect its lines in Detroit to Via Rail Canada Inc. tracks across the border, hoping to lay the ground for passenger service between Toronto and Chicago.

Article content

Advertisement 4

Article content

Drew Dilkens, mayor of Windsor, Ont., is touting the economic benefits of the proposal, which would link two of North America’s biggest cities by 2027 as well as 21 other communities in between — 10 of them in Ontario — according to the pitch.

Via Rail confirmed it is in private discussions with Amtrak and other partners about the possibility of connecting Windsor and Detroit to re-establish the corridor, but says it is premature to discuss the project in public.

While Dilkens said Amtrak and Via would pay for the $44-million project, Via says it has made no funding requests or commitments to finance the undertaking.

Amtrak first sought to restore a connection between Toronto and Michigan via the 113-year-old Detroit River Rail Tunnel in 2019, with the US$1.2-trillion infrastructure bill breathing new life into hopes of revitalized service.

The aging tunnel is owned by Canadian Pacific Kansas City Ltd., which would have to give the green light for any service through the underwater passageway, where passenger trains have not operated since 1967.

The Canadian Press

Advertisement 5

Article content

12:40 p.m.

Nearly 7 million Canadians experienced food insecurity last year: study

A Statistics Canada study says nearly seven million Canadians struggled with hunger last year.

The study says that in 2022, 18 per cent of families reported experiencing food insecurity within the previous 12 months, up from 16 per cent in 2021.

It says food insecurity was the lowest in Quebec at 14 per cent and highest in Newfoundland and Labrador at 23 per cent, followed by New Brunswick and Alberta, which both sat at 22 per cent.

The study authors define food insecurity as the lack of an adequate quality of diet or sufficient quantity of food.

Families where a woman was the main breadwinner were more likely to face food insecurity, and the rate shot up to 41 per cent for homes where women were single parents.

The study found homes with a racialized breadwinner reported higher food insecurity compared with a non-racialized, non-Indigenous earner, and this was especially true for Black Canadians.

The Canadian Press

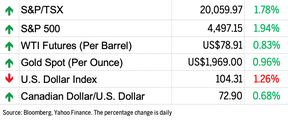

Midday markets: TSX up almost 2%

Stocks climbed while bond yields sank as an

Advertisement 6

Article content

unexpected inflation slowdown

bolstered bets the Federal Reserve’s aggressive hiking cycle is now over — and its next move will be a cut in mid-2024.

More than 95 per cent of the S&P 500 companies rose, with the gauge at one point up two per cent. Tesla Inc. led gains in megacaps and Nvidia Corp. extended its rally into a 10th straight session.

Treasury two-year yields plunged about 20 basis points to 4.85 per cent. The U.S. dollar fell one per cent, the most since January. Fed swaps priced in 50 basis points of easing to the benchmark lending rate in July.

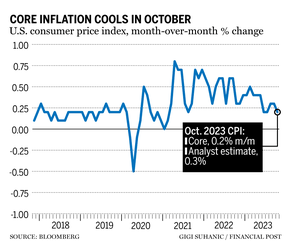

The inflation report added to the “Goldilocks narrative,” with the economy remaining resilient and disinflation allowing the Fed to ease policy in 2024. The core consumer price index, which excludes food and energy costs, increased 0.2 per cent from September. Economists favour the gauge as a better indicator of underlying inflation than the overall CPI. That measure was little changed, restrained by cheaper gasoline.

On Wall Street, the S&P 500 was up 1.94 per cent to 4,497.15. The Dow Jones industrial average rose 1.42 per cent while the Nasdaq composite climbed 2.07 per cent to 14,052.80.

Advertisement 7

Article content

In Toronto, the S&P/TSX composite index was up 1.78 per cent at 20,059.97 with Canada’s main stock index rising on strength in base metal, financial and utility stocks.

The Canadian dollar traded for 72.90 cents U.S. compared with 72.36 cents U.S. on Monday.

The December crude contract was up 0.83 per cent at US$78.91 per barrel and the December natural gas contract was down five cents at US$3.15 per mmBTU.

The December gold contract was up 0.96 per cent at US$1,969.00 an ounce and the December copper contract was up four cents at US$3.70 a pound.

Bloomberg, The Canadian Press

10 a.m.

Markets open: U.S. inflation data is ‘soft-landing nirvana’ for stocks

In a broad-based advance, markets rose as U.S. data showed inflation cooling. Treasury two-year yields, which are more sensitive to imminent Fed moves plunged 20 basis points to below 4.85 per cent. The dollar retreated almost one per cent. Fed swaps priced in 50 basis points of rate cuts in July.

The core consumer price index, which excludes food and energy costs, increased 0.2 per cent from September, Bureau of Labor Statistics data indicated Tuesday. The drop in inflation suggests that recent monetary policy has been doing its job and make the prospect of a soft landing ever more likely, according to Richard Flynn at Charles Schwab UK.

Advertisement 8

Article content

“This good news reinforces the likelihood that central bankers will hold off from further rate hikes in this cycle, which is the direction they seem to be leaning in any case.”

“With the U.S. economy holding up, the inflation data are ‘soft-landing nirvana’ for the equity markets,” said Neil Dutta, head of economics at Renaissance Macro Research.

On Wall Street, the S&P 500 rose 1.62 per cent to 4,482.76. The Dow Jones industrial average climbed 1.39 per cent to 34,810.45 while the Nasdaq composite rose 2.23 per cent to 14,071.49.

In Toronto, the S&P/TSX composite index jumped 1.35 per cent to 19,973.56.

Bloomberg, Financial Post

8:30 a.m.

U.S. inflation slows more than expected in sign rate hikes are working

United States inflation broadly slowed in October, an encouraging sign of progress for the U.S. Federal Reserve in the long path to taming price pressures.

The core consumer price index, which excludes food and energy costs, increased 0.2 per cent from September, Bureau of Labor Statistics data showed Tuesday. Economists favour the core gauge as a better indicator of underlying inflation than the overall CPI. That measure stalled, restrained by cheaper gasoline.

Advertisement 9

Article content

Stock futures rose and Treasury yields declined significantly as traders assessed a smaller probability of another rate hike in December. They also moved up bets of when the Fed will first cut rates to June, compared to July before the report.

Shelter prices, which make up about a third of the overall CPI index, climbed 0.3 per cent, half the prior month’s pace. Economists see a sustained moderation in this category as key to bring core inflation down to the Fed’s target. A key measure of rent as well as hotel stays stepped down.

Excluding housing and energy, services prices climbed 0.2 per cent from September and 3.7 per cent from a year ago — the lowest in nearly two years — according to Bloomberg calculations.

“The October CPI data should calm concerns that inflation was reaccelerating after an upside surprise a month ago,” Nathan Janzen, an economist at Royal Bank of Canada, said in a note, adding the bank now expects the Federal Reserve to begin cutting rates in the second quarter of 2024.

Bloomberg, Financial Post

7:30 a.m.

EVs only bright spot in world’s failing fight against climate change: study

Advertisement 10

Article content

Global efforts to reach net-zero carbon emissions are failing in almost every way, with one exception: the boom in electric vehicles.

That’s the conclusion of a study that was jointly conducted by the Bezos Earth Fund and other non-profits which assessed 42 different measures key for the world hitting net zero by 2050. They cover electricity, industry, transport and land as well as the need to scale up nascent carbon-removal technologies and climate finance.

The study shows six areas of the economy are going in completely the wrong direction, including the need to phase out government financing of fossil fuels, making steel production greener and reducing the share of passenger car journeys. Other areas — like reforestation and curbing beef output — are heading the right way but too slow, with EV sales the only metric on track.

EV sales are the only area moving at the right speed, according to the study, which was also published by bodies including Climate Action Tracker. The share of light duty EV sales grew from 1.6 per cent in 2018 to 10 per cent in 2022, representing an annual growth rate of 65 per cent.

Advertisement 11

Article content

Bloomberg

Read the full story here.

Before the opening bell: Stocks edge up ahead of U.S. inflation data

Global stocks and bonds edged higher ahead on speculation that a crucial United States inflation report will show that price pressures slowed last month, cementing the view that interest rates have peaked.

Europe’s Stoxx 600 index added 0.2 per cent, with mining stocks led by a four per cent gain in Glencore PLC after it agreed to buy a majority stake in Teck Resources Ltd.’s coal business for almost US$7 billion.

Equity futures also rose, with contracts on Nasdaq 100 advancing 0.3 per cent. Treasury yields slipped two basis points to 4.61 per cent. West Texas Intermediate futures climbed.

In Canada, the S&P/TSX composite index closed up 54.68 points at 19,709.15 on Monday.

Bloomberg

What to watch today

New inflation data is coming from the United States this morning, with the release of the consumer price index for October.

John Graham, chief executive of CPP Investments, will deliver an update on the performance of the Canada Pension Plan Fund at the Calgary Chamber of Commerce. Following prepared remarks, Graham will participate in a fireside chat with Deborah Yedlin, CEO of the Calgary Chamber of Commerce.

Advertisement 12

Article content

Innovation Minister François-Philippe Champagne will participate in an armchair discussion hosted by the Greater Vancouver Board of Trade, and discuss federal initiatives to foster a growing, competitive and knowledge-based economy.

The Portfolio Management Association of Canada (PMAC) holds its annual National Conference. This year’s theme is “Hard Truths & Soft Landings,” and keynote speakers include Manulife Investment Management global chief economist Frances Donald and AI and Advanced Technology director Gregory Allen, along with a fireside chat with former federal finance minister Bill Morneau.

Labour Minister Seamus O’Regan Jr. hosts a town hall with union members to discuss the recent introduction of legislation to ban replacement workers and improve the maintenance of activities process in Windsor, Ont.

The Royal Canadian Mint holds an event in Winnipeg to present the effigy of King Charles that will appear on all Canadian coins and strike the first circulation coin bearing the new image.

Expect earnings reports from The Home Depot Inc., CAE Inc. and Canaccord Genuity Group Inc.

Related Stories

-

None

-

Does your tax adviser know the rules? Probably not

-

7 ways to find investment compounders and avoid ‘Dunder Mifflins’

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

[ad_2]

Source link

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.