[ad_1]

Stay informed with free updates

Simply sign up to the Sovereign bonds myFT Digest — delivered directly to your inbox.

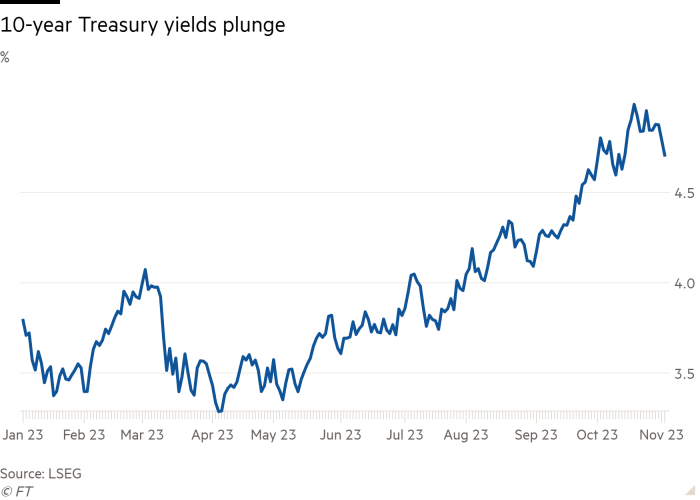

US stocks recorded their best day in six months as bond yields tumbled after the Federal Reserve and other central banks signalled a possible end to the interest rate rise cycle that has hammered financial markets for more than a year.

Thursday’s rally for stocks and bonds — whose prices move inversely to yields — followed what investors viewed as dovish remarks by Fed chair Jay Powell on Wednesday after the US central bank held rates steady for a second consecutive meeting.

The dovish mood produced the biggest two-day fall in 10-year Treasury yields, a benchmark for global asset prices, since the US banking crisis of early March. At their lowest point of 4.63 per cent earlier on Thursday, it marked a 0.19 percentage point decline from Wednesday.

Solita Marcelli, chief investment officer for the Americas at UBS Wealth Management, said: “The meeting underlines our view that the Fed is likely done tightening and that markets had become too aggressive in pricing higher rates for longer.”

The S&P 500 stock index gained 1.9 per cent for its best one-day performance since March, helped by strong earnings from the likes of Starbucks, which ended the day up 9.5 per cent.

Powell emphasised the Fed was “proceeding carefully” with future rate rises, which investors took as a sign bond markets have largely succeeded in slowing down the US economy.

However, he also warned the central bank “was not confident yet” that monetary policy was sufficiently restrictive to bring inflation back to its 2 per cent target. The Fed decided to keep its benchmark funds rate on hold at between 5.25 per cent and 5.5 per cent at its meeting that ended on Wednesday.

On Thursday, the Bank of England also voted 6-3 to hold rates steady at 5.25 per cent while Norway’s central bank left its rates unchanged too.

The scale of the investor reaction to the Fed chair’s comments underlined how anxious many are to see the end of the monetary tightening that have increased borrowing costs for households and businesses across the world.

Previous Fed rate rises and a big expansion in the US government’s borrowing plans had contributed to the prolonged sell-off that last month pushed 10-year yields above 5 per cent for the first time in 16 years.

If the shift lower in yields is sustained, it could have profound implications for governments’ and companies’ cost of capital after a long sell-off that has hit bondholders.

Investors have been wrongfooted in the past by prematurely calling an end to the Fed’s rate rise cycle.

But Tiffany Wilding, managing director at bond investment house Pimco, argued Powell’s comments did not appear to be preparing the market for a possible rate rise in December, “and as a result you are getting some loosening in financial conditions”.

The Treasury department announced on Wednesday it would slow the pace at which it issues longer-dated debt, which also pulled US government bond yields lower.

Government bond markets also rallied across Europe on Thursday. Two-year UK gilt yields, which reflect interest rates expectations, fell 0.09 percentage points to 4.70 per cent, the lowest level since June. Benchmark 10-year gilt yields fell 0.15 percentage points to 4.35 per cent.

Ten-year German bond yields — the benchmark for the eurozone — slipped 0.05 percentage points to 2.7 per cent after jobs data suggested the country’s economy was stagnating.

[ad_2]

Source link