[ad_1]

Pritesh Samuel, Head of Business Intelligence at Dezan Shira & Associates, discusses how China’s Guangdong-Hong Kong-Macao Greater Bay Area (GBA) and Vietnam complement each other in foreign investors’ China+1 strategy.

Navigating Asia’s geopolitical landscape can be difficult for most foreign businesses. This is more so when moving business activity out of China.

Vietnam features high on the radar for foreign businesses scaling up or choosing alternate sites outside China due to its success in creating an adaptable production base – that is geared toward higher-value manufacturing.

While most can agree that Vietnam’s infrastructure and supply chain network cannot match that of China’s, the government has been making strides to bridge that gap. In addition, many manufacturers are using Vietnam to support their China+1 strategy by maintaining key operations in China in areas like the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) and supplementing them with operations in Vietnam.

To illustrate this – we take an in-depth look at the GBA in China, which launched several incentives and cost-cutting measures to offset the impact of the worsening US-China trade war and Vietnam – which has been attracting several foreign investors to set up shop in the country.

An introduction to the GBA

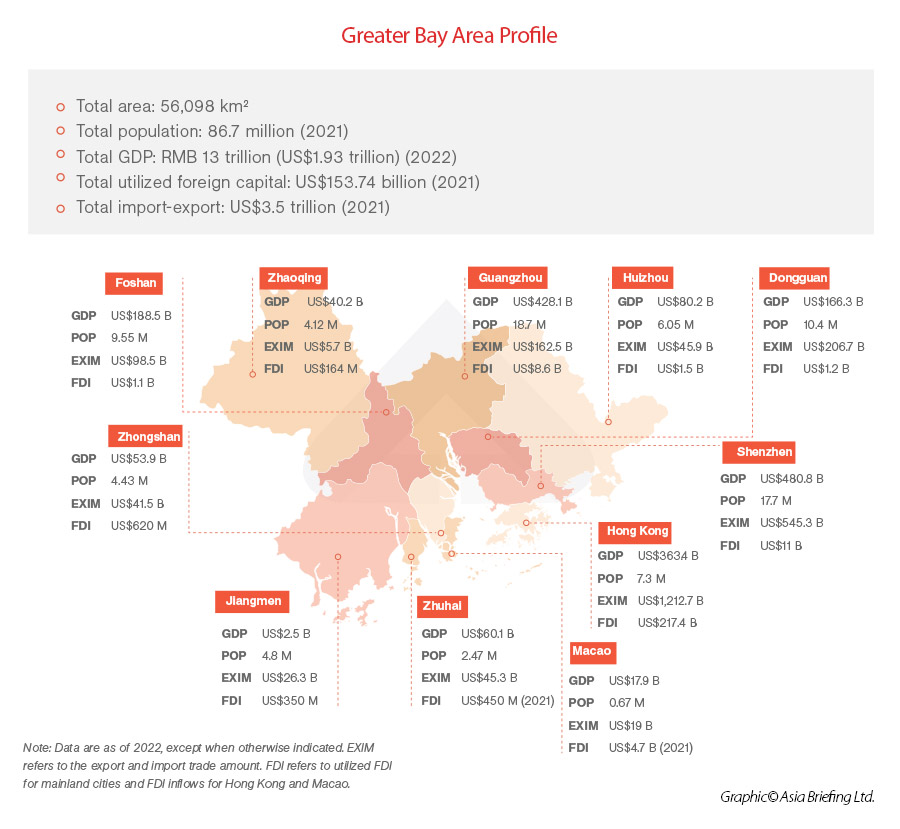

The GBA is a mega-region in southern China that encompasses the two Special Administrative Regions of Hong Kong and Macao, and nine cities in Guangdong Province: Guangzhou, Shenzhen, Zhuhai, Foshan, Dongguan, Huizhou, Zhongshan, Jiangmen, and Zhaoqing. It is one of the most economically developed regions in China, with a GDP of over US$1.95 trillion in 2022.

The GBA is a key part of China’s economic development strategy, and the government has invested heavily in infrastructure and connectivity in the region. The goal is to create a world-class economic hub that is competitive with other major global city clusters such as the San Francisco Bay Area and the Tokyo Bay Area.

The area has been a core driver of China’s explosive growth since the economic reform of the 1980s and 90s. The metropolises of Guangzhou and Shenzhen, in particular, have been at the center of China’s manufacturing and innovation power for decades, fostering some of the biggest names in technology, real estate, manufacturing, and more. The Port of Shenzhen is the third busiest in China and the fourth busiest in the world, handling around 278.4 million metric tons of cargo in 2021.

An introduction to Vietnam

Vietnam is superbly located as a gateway to Southeast Asia. Its northern land border connects to China which is a key supplier of raw materials for manufacturing enterprises from electronics to garments and textiles. To the east are Taiwan, Japan, and South Korea, three of the world’s biggest producers of high-tech components.

With 3,269 kilometers of coastline bordering the South China Sea (East Sea in Vietnam), Vietnam is geographically situated at a critical juncture of international trade. It gives Vietnam access to both supporting industries in neighboring countries and sea freight routes to North America and Europe.

Vietnam has established itself as a stable, rapidly developing, and high-growth destination for international business and foreign investment. Its numerous positive business conditions include a stable political system, consistent track record of high-performing economic and market growth, ample workforce of young and skilled laborers, central proximity to East Asia’s top emerging economies, and relatively open FDI environment. Its business-friendly policies stand out among its Southeast Asian country peers and encourages a healthy influx of foreign capital.

Many businesses are turning to Vietnam as a safer or second Asia investment option for certain types of manufacturing, product assembly, and other downstream services. To illustrate, we have highlighted the main industries that complement the GBA area and Vietnam. Though investors can likely find several industries that are suited to their requirements and where both the GBA and Vietnam play vital roles in those supply chains.

The complementary relationship between the GBA and Vietnam by industries

Manufacturing

Despite the increase in the services sector as a proportion of GDP, manufacturing remains a mainstay industry in all nine mainland cities of the GBA. Major fields within the manufacturing industry are mechanical and electrical equipment, including home appliances, automatic data processing equipment and components, automotive and automotive components, high-end machinery, and integrated circuits, to name a few.

Traditional light industries and the production of labor-intensive goods, such as toys, garments, shoes, and furniture, also remain important sectors. The smaller GBA cities, such as Dongguan, Foshan, Zhongshan, Jiangmen, and Huizhou, also have strong manufacturing bases with focuses on various fields.

Compared to other Southeast Asian countries, Vietnam stands out and has become a top destination for investment in manufacturing due to its strategic location and advantages in shipping, competitive labor, and production costs.

The manufacturing industry is driven by several key factors. Firstly, Vietnam is touted as a low-cost manufacturer with competitive labor costs. On average, Vietnam’s labor costs are half as much as China’s labor costs at US$2.99 (VND 68,000) per hour compared to US$6.50 (VND 148,000) per hour respectively. This contributes to Vietnam’s increasing position as a more cost-effective alternative to its regional counterparts.

The GBA is known for its advanced manufacturing capabilities, especially in the high-tech and electronics sectors, while Vietnam is known for its cost-effective manufacturing capabilities. Companies that have a presence in Vietnam can leverage the GBA’s expertise in high-tech manufacturing and R&D for product development, while taking advantage of Vietnam’s cost-effective manufacturing capabilities for labor intensive tasks and assembly. This could also help in streamlining production processes and reduce costs.

In addition, by maintaining manufacturing facilities in both the GBA and Vietnam, companies can diversify their supply chains, reducing the vulnerability to disruptions in one region and ensuring a more resilient production process.

The GBA also has access to a wide range of suppliers, including high-quality electronic components and advanced materials. As Vietnam develops it still lacks raw materials to fully manufacture products, especially in the high-tech sector. Thus, companies can source raw materials and components from GBA’s extensive network of suppliers, ensuring access to high-quality inputs. Vietnam can serve as an assembly or secondary manufacturing hub for these materials.

A plethora of free trade agreements (FTAs), such as the EU-Vietnam Free Trade Agreement (EVFTA), the UK-Vietnam Free Trade Agreement (UKVFTA), and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), also strengthens Vietnam’s competitiveness as a low-cost manufacturing export hub providing preferential access to markets worldwide.

Such trade agreements allow Vietnam to take advantage of reduced tariffs, both within the ASEAN Economic Community (AEC) and with the EU and US to attract exporting companies to produce in Vietnam and export to partners outside ASEAN.

Additionally, Vietnam has benefitted from the fallout of the US-China trade war, as higher US tariffs on a wide range of Chinese exports have driven manufacturers to switch production away from China towards alternative manufacturing hubs such as Vietnam.

Electronics

The GBA is a major hub for electronics manufacturing. The region offers a favorable business environment, access to a large pool of skilled labor, and a strategic location for both domestic and international trade. Key industries in the GBA include smartphones, laptops, and medical devices, among others. Many international electronics companies have set up manufacturing operations in the area, taking advantage of the region’s infrastructure, R&D capabilities, and favorable government policies.

Shenzhen, in particular, is known as the “Silicon Valley of Hardware” due to its concentration of tech companies and innovation centers. It offers a vibrant ecosystem for R&D, innovation, and access to cutting-edge technology. GBA provides access to a vast pool of high-caliber R&D talent which is crucial for electronics companies that depend on skilled labor for research, development, and production.

However, despite the myriad of opportunities, the intense competition in the electronics market can be a barrier. The region is populated with numerous electronics manufacturers, making market penetration a challenging task for new entries.

Vietnam’s growing prowess as a manufacturing hub complements GBA’s electronics sector. With its low labor costs and increasingly skilled workforce, Vietnam can offer cost-effective manufacturing solutions while the GBA could focus on innovation and R&D. Electronics firms could tap into Vietnam’s supply chains to lower production costs while leveraging GBA’s resources for product development and innovation. The harmonization of these strengths could lead to a symbiotic relationship benefiting the electronics sector across both regions.

While the GBA is known for high-tech and premium electronics manufacturing, Vietnam specializes in low-cost manufacturing, though this is slowly changing. Companies can choose their location based on the specific niche and product range they target.

Both China and Vietnam offer government incentives to attract foreign investment, but the specific policies may differ, allowing companies to optimize their tax and regulatory advantages.

Thus, while the electronics sector in the GBA offers access to a vast market and a robust innovation ecosystem it comes with challenges such as high costs and competition. Vietnam complements the GBA by offering cost advantages, diversification opportunities, and access to different market niches. Electronics companies can consider a dual strategy, leveraging the strengths of both regions to maximize their competitive advantage and mitigate risks.

Technology

The GBA is home to some of China’s most innovative and successful technology companies, many of which are at the cutting edge of their respective fields. The center of the technology industry in the region is Shenzhen, often dubbed the Silicon Valley of China. The city has fostered some of China’s most famous technology giants, such as Tencent, Huawei, and DJI, to name a few. The presence of tech giants and their advanced digital systems in the GBA sets a strong foundation for the technology sector.

The GBA also attracts significant venture capital and investment, offering technology firms access to funding for research, development, and expansion.

Much like in electronics, Vietnam’s burgeoning tech industry could be leveraged for lower-cost production, while the GBA focuses on R&D and higher-end services. This model can lead to cost-effective production in Vietnam and cutting-edge technological advancement in the GBA, delivering mutual benefits. Vietnam has become one of the leading places for developing IT and software industry. Large companies such as FPT software, Gameloft, LogiGear, Global Cybersoft, and Asnet provide outsourcing services for partner firms in Japan, North America, and Europe.

Vietnam has also emerged as a hub for software development, attracting investment from global tech giants such as Google, Amazon, and Intel. The sector is also seeing increasing investment in areas such as e-commerce, fintech, and cybersecurity. Vietnam’s technology sector is expected to continue to thrive in the coming years, with a forecasted annual growth rate of 20-25 percent until 2026.

Healthcare

China’s healthcare market is one of the most attractive in the world for foreign investors, driven by factors including extended life expectancy, an aging population, as well as economic growth. The GBA is a major hub for the pharmaceutical and medical device industry. It enjoys distinct industrial agglomeration advantages and a complete upstream and downstream industrial chain.

Government initiatives like the “Healthy China 2030” plan aim to boost the development of the sector. There are thus opportunities across various segments including pharmaceuticals, medical devices and equipment, and healthcare services.

Vietnam’s healthcare sector differs from China’s but there are areas of complementarity. Vietnam has largely focused on preventive care and primary health services, with an emphasis on public health initiatives. This approach complements China’s focus on more specialized and high-quality healthcare goods and services.

Moreover, Vietnam’s lower costs, both in terms of labor and infrastructure, present opportunities for cost-effective production of medical devices and equipment. As such, pharmaceutical firms could consider a strategy where R&D and innovation are focused on China’s GBA, while production is based in Vietnam to lower overall costs, benefiting the healthcare industry in both regions.

The government has implemented various reforms to modernize the sector and promote private sector participation. This has created a favorable environment for foreign investors. Vietnam and China have already witnessed a growing number of partnerships and investments in the healthcare sector, reflecting the shared interests and opportunities for collaboration between the two countries. These initiatives have resulted in mutual benefits, contributing to the advancement of healthcare services and technologies in Vietnam.

Some of these include the manufacturing and supply of medical equipment, telemedicine and digital health solutions, as well as R&D.

|

Factors comparing the GBA and Vietnam |

|||

| GBA | Vietnam | Complementarity | |

| Market | Vast consumer market with high purchasing power | Growing consumer market with lower costs | Access both for premium and budget segments |

| Innovation ecosystem | Silicon Valley of Hardware; Tech innovation hub | Emerging tech ecosystem; software development | Hardware production in GBA, software in Vietnam |

| Manufacturing capabilities | Advanced hardware manufacturing and supply chains | Growing manufacturing capabilities; cost-efficient | Hardware production in GBA, assembly in Vietnam |

| Labor cost | Higher labor costs | Lower labor costs | Labor-intensive tasks in Vietnam, high-skill processes in GBA |

| Costs | Comparatively high cost of living and operating | Cost-efficient labor and office space | Cost optimization; leverage low costs in Vietnam |

| Competition | Intense competition for talent and market share | Growing competition but less intense | Specialization and market-specific strategies |

| Investment opportunities | Attracts significant venture capital and investment | Attracts some investment; cost-efficient | Access capital in GBA, optimize costs in Vietnam |

| Government support | Supportive policies for technology and innovation | Government incentives for tech firms | Maximize tax and regulatory advantages in both regions |

| Trade agreements | Access to international markets through trade agreements | Preferential access to global markets | Diversify supply chains, leverage trade agreements |

Takeaways

China’s GBA and Vietnam both have immense potential and opportunities to work together and expand on business deals. Both regions can complement each other by sharing resources, technology and expertise. Chinese tech companies are already investing in Vietnam. For example, Alibaba has built a cloud computer data center in Vietnam, while Tencent is investing in Vietnamese gaming companies. This has helped create opportunities for Vietnamese businesses to gain access to Chinese technology and expertise.

Vietnam’s government has implemented several reforms and has strived to create an investment-friendly environment. As the country continues to push for investment, investors in the GBA area have several opportunities to participate in several industries including the ones mentioned above to maximize potential.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

[ad_2]

Source link