[ad_1]

Industry forecasts offer positive outlook for business travel

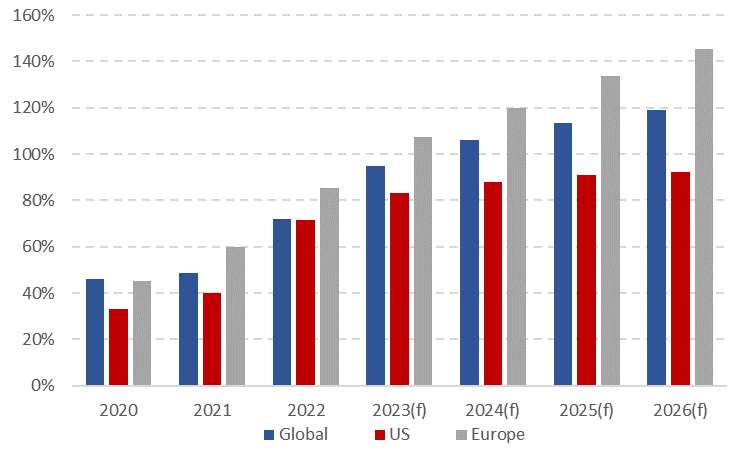

The Global Business Travel Association’s Aug-2023 forecast projects that global business travel spending will grow by nearly a third for 2023, reaching a little under USD1.4 trillion. This would put global spending very close to pre-pandemic levels and on a path to full recovery in 2024.

Regional travel bodies have also generally been confident, although there are substantial variations from region to region.

The US Travel Association forecast in Jun-2023 that US business travel spending would reach around 83% of pre-pandemic levels. Another Jun-2023 forecast made by the European Travel Commission and Trading Economics projected that business travel spending in 2023 would pass pre-pandemic levels.

Asia Pacific is contributing significantly to overall recovery

The return of international travel in the Asia Pacific has also contributed significantly to the overall recovery.

Although most regions had abolished or significantly reduced travel restrictions over late 2021 and 1H2022, a number of markets in the Asia Pacific didn’t reopen until 2H2022, or even the start of 2023.

This has produced a renewed wave of business travel, particularly in the long haul trans-Pacific and Asia-Europe markets. China, the region’s largest market, reopened in early 2023 after near total isolation for three years. However, the recovery of Chinese capacity has been slower than expected, with the market not reaching 50% of pre-pandemic levels until Aug-2023.

Signs that recovery is starting to slow, or to reach a ceiling

Despite the strong overall forecasts and positive momentum, there are signs that recovery is starting to slow, or is possibly reaching a ceiling.

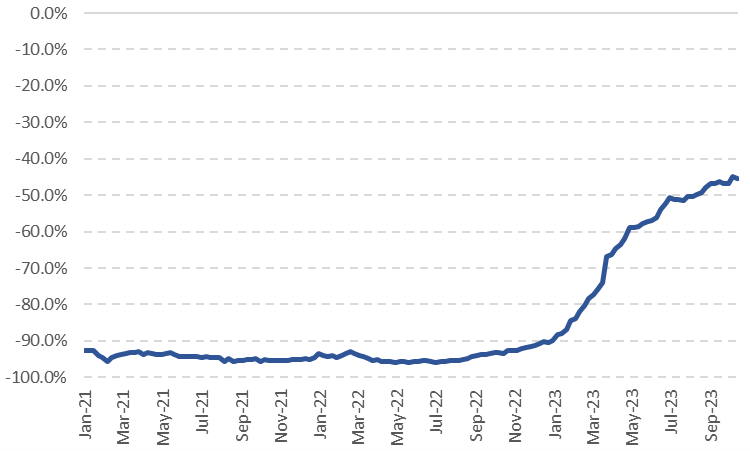

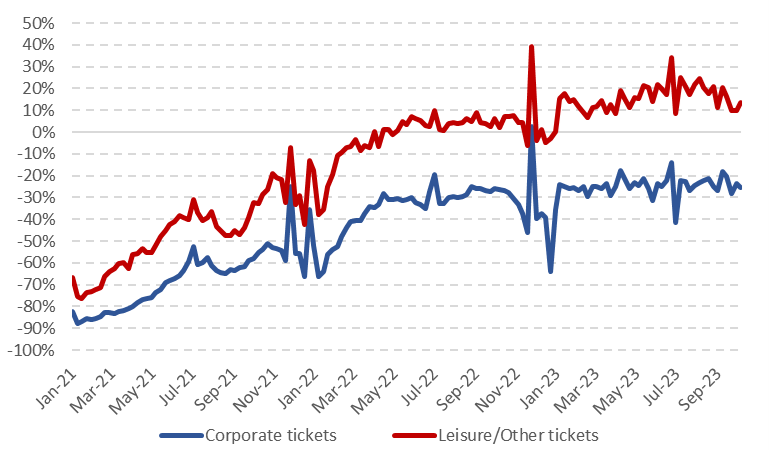

According to data from the Airlines Reporting Corp (ARC), tickets issued by US travel agents for corporate travel itineraries were down 25.7% vs 2019 for the first three weeks of Oct-2023. The recovery of US corporate travel volumes has barely budged since Feb-2023, when tickets issued for corporate travel itineraries were down by around 27%.

There is a similar situation in Europe.

Lufthansa CEO Carsten Spohr reported in Aug-2023 that corporate traffic was only around 60% of pre-pandemic levels at the end of 1H2023. While some segments are performing well – business travel on the lucrative trans Atlantic market is over 70% of 2019 levels – the performance of domestic and short haul markets is still lagging, and volumes levelled off during the summer.

Elements of this slowness are clearly short term…

Global inflation has contributed, both by raising airfares and cooling economic growth as governments seek to tame price increases through raising interest rates and reining in fiscal stimulus.

This has also influenced travel buying – large enterprises have remained cautious around travel and kept a tight rein on budgets. Small and medium firms have been more aggressive around travel and spending, but they have not been able to completely fill the gaps.

…but there are structural impediments to recovery that are becoming more apparent

At the same time, there are structural impediments to the recovery that are becoming more and more apparent.

Video-conferencing has become pervasive and offers a convenient and inexpensive alternative for face-to-face meetings, particularly for those that are internally facing.

At the same time, this technology has also helped a shift towards work-from-home and hybrid working arrangements. This is producing some structural changes of its own, igniting new demand for ‘blended’ travel – with workers combining personal and business travel into (sometimes extended) travel arrangements.

Sustainability and the environmental cost of air travel garnered significant public and corporate attention during the COVID-19 pandemic, and this is also starting to shape the business travel recovery.

In some domestic and short haul markets there has been substitution towards road and rail. For longer trips there are few viable alternatives, but enterprises – large firms in particular – are more sensitive to the emissions cost from this kind of travel, which may be leading them to reduce air travel overall.

Corporate travel’s importance for airlines may be diminished

None of this is particularly good news for airlines.

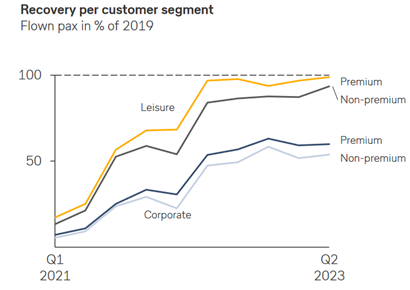

Business travellers have historically been a major profit centre. They’re more likely to book later, seek flexible fares, and travel in premium cabins – all of which adds up to higher fares for airlines. As a result, accommodating the corporate traveller has been a key plank of global airline strategy.

Although business travel spending and volumes are certain to recover to pre-pandemic levels eventually, corporate travel’s relative importance for airlines may end up being diminished. As a result, airlines may need to permanently adjust their strategies and operations to account for a reduction in the global appetite for business travel as the market continues its post-pandemic realignment.

[ad_2]

Source link