[ad_1]

Key points

- Year to date EU production down 8% from last year

- Largest declines in Denmark and Germany, as slaughter levels drop

- Prices have fallen almost 20p from highs in July

- Imports have fallen 16% YTD from 2022, despite drop in domestic production as consumption eases

- Export capacity has dropped, with volumes down 18% from last year

EU production

In the year-to-date (Jan – Jul), pork production in the EU-27 countries totalled 11.9Mt, down over 8% from the same period last year. This marks the second year in a row of declines in production, as production for 2023 is down by over 10% from the five-year average. The EU commissions latest forecast is for pig meat production in 2023 to end the year down 6.6%.

Production in key producing countries has fallen year on year, with the largest declines in Germany of 236,000t (-9%), and Denmark down 202,000t (-21%). Volumes in Spain and the Netherlands fell between 143-144,000t from the same time last year, down 5% and 15% respectively. This stems from drops in slaughter levels following record low pig counts. In the EU 27, throughputs were 126.1m head in the year to date for 2023, with slaughter in key producing countries down similar percentages to production. Supplies in the EU are lower than a year ago, as production and slaughter have fallen.

Prices

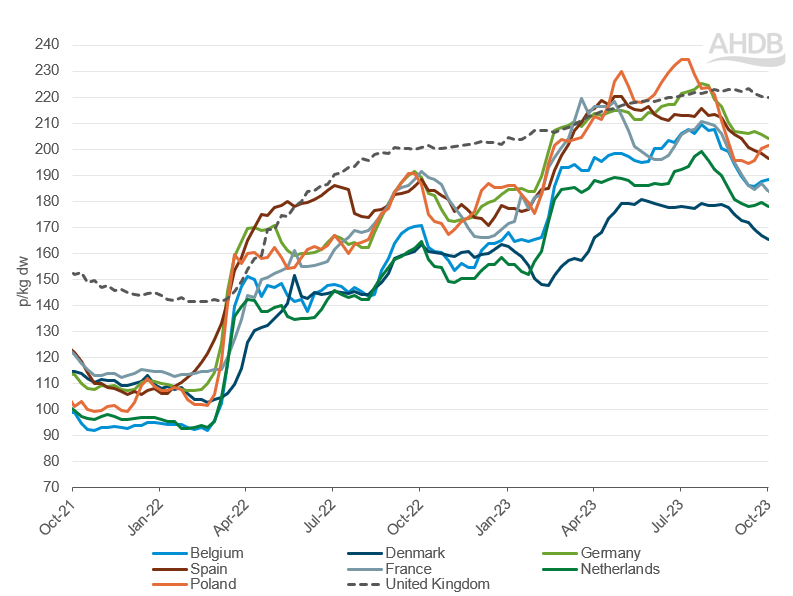

Lower supplies in the EU have led to growth in prices across the EU over the past few months. However, prices have declined from these highs down to an average of 196.4p/kg for the 4 weeks ending 01 October, as demand has eased. This is a fall of 5.8p from the previous four-week period, down nearly 20p from highs seen towards the end of July.

France has seen the greatest decline from its peak, down 27p/kg to end 01 October at 183.8p/kg. Weaker declines have been noted in Germany, Spain, the Netherlands, and Poland, all down around 20-22p from the peak. Denmark has seen the smallest fall, down 14p but had consistently lower prices to begin with.

The price differential between the EU and UK has grown to reach 24p in the week ending 01 October.

Select European reference prices – grade E pigs

Source: Eurostat

Trade

EU imports of pork totalled 84,000t in the year to date (Jan – Jul), a fall of 16,200t (16%) from the same time last year. This is despite a fall in domestic production, which may have necessitated higher imports to meet demand. This indicates that overall demand for pork in the EU has fallen as consumers face cost of living crises. The EU commission forecasts per capita consumption to drop 5% in 2023 to 30.4kg.

Imports from the UK have fallen by over 22,000t (-27%) to just under 60,000t, as lower production in the UK has reduced the amount of product available for export, coupled with prices sitting higher than the EU, reducing the competitiveness of product on the market. However, the UK does remain the most important country for EU imports in terms of volume. As volumes from the UK have fallen, shipments from Switzerland and Chile have grown year-on-year to 11,300t and 5,000t respectively. This is growth of 4,500t for Switzerland and 2,800t from Chile. The EU commission predicts that pig meat imports may end the year down 20%.

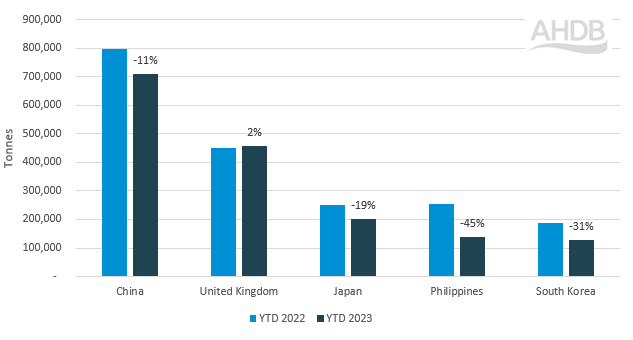

As pig meat production in the EU has fallen, the export capacity of the region has also fallen. Current EU forecasts anticipate pig meat exports to end the year down 16%. Total exports for the year to date (Jan-Jul) were 2.3Mt, down by 18% from 2.8Mt in 2022. The vast majority of the fall in exports came from Asian countries, with the Philippines down 115,000t, China down 85,000t, South Korea down 58,000t, and Japan down 49,000t.

EU pig meat exports to select destinations YTD (Jan-Jul)

Source: European Commission via Trade Data Monitor LLC

[ad_2]

Source link