[ad_1]

A pair of experts swapped notes on how to scaffold and structure an ESG program at Compliance Week’s virtual ESG Summit on Wednesday. Their respective organizations were vastly different: one was a century-old, thriving company; the other, a now-defunct startup. The leaders explored the commonalities in their approaches and the implications of their companies’ maturity on the execution of their respective strategic initiatives.

Becky Haney, program manager for ESG data and reporting at furniture manufacturer Steelcase, said the company’s ESG practice started a year ago. The decision “came about from reading some foresight research, looking at what’s going to be happening down the road, and seeing so much rigor added and compliance expectations increasing,” she explained.

In 2022, Steelcase hired Haney to streamline ESG efforts and reporting, reduce survey fatigue, and support auditable data.

Her counterpart on the panel was Nakis Urfi, a compliance officer and ESG leader formerly of digital health company Babylon. After the company went public in October 2021, Urfi was tasked with building a sustainability program from the ground up.

“Essentially, I was serving as leader of ESG activities, all the way to board reporting; giving investors updates; and making sure we were filling out surveys from our main customers, who were sending increasingly robust questionnaires asking us about various aspects of E, S, and G,” he explained.

However, “We ended up suffering a lot financially and going bankrupt, so the priority of ESG decreased as things became more strained in the company,” Urfi said candidly. Babylon filed for Chapter 7 relief in August.

ESG drivers

Multiple forces are galvanizing the importance of robust ESG programs: investors, board members, regulators, policymakers, customers, and more. Haney and Urfi discussed the different drivers at play and how each of their respective companies ranked them in the context of broader business concerns.

At Babylon, the motivations underpinning ESG work were financial stability and securing a place in the healthcare technology industry. The company’s investors were keen on tracking carbon emissions; plus, it needed to keep up with the competition.

“It’s interesting to hear [Urfi] talk about his experience at a startup and how parallel it is to a 100-year-old company. … It has been a challenge to create an understanding of what these new [ESG] roles and responsibilities should look like.”

Becky Haney, Program Manager for ESG Data and Reporting, Steelcase

“We started to see our main competitors releasing ESG reports, and we were falling behind,” Urfi said.

Steelcase’s ESG efforts were less investor-driven and more internally spurred, Haney asserted. Yet, as in Babylon’s case, keeping a competitive edge played a role.

In the company’s decades of operation, sustainability was one of its “core values,” said Haney. Still, in recent years, the manufacturer set greenhouse gas emissions reduction targets validated through the Science Based Targets initiative, began engaging with supply chain partners to set their own targets, and sharpened its focus on circular design to reduce life cycle embodied carbon.

These objectives “came on board from a desire to differentiate ourselves,” Haney explained.

Both panelists agreed the Securities and Exchange Commission’s proposed rules on climate-related disclosure were not a primary driver of their efforts, but—along with reporting standards set by the Global Reporting Initiative and Sustainability Accounting Standards Board—they have been helpful at making sustainability progress more legible at the board level.

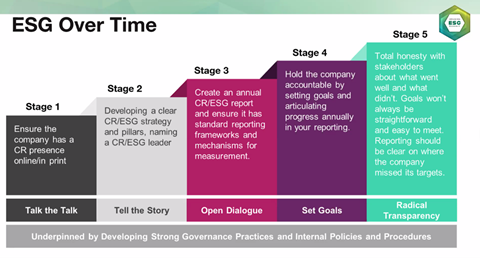

ESG over time

Haney and Urfi each said their programs underwent phased developments. The first step companies should ask themselves is: “Where am I on the maturity curve?”

“Initially, it seemed there were different people in different departments doing ad hoc work on ESG,” Urfi said regarding Babylon, “so it wasn’t very clear what was going on. … I started talking to stakeholders internally and externally and recognized we needed a multistakeholder group to make this happen.”

The digital health company was between Stages 2 and 3, as depicted in the graphic above, before the business went bankrupt, Urfi said.

Haney agreed. “It’s interesting to hear [Urfi] talk about his experience at a startup and how parallel it is to a 100-year-old company. … It has been a challenge to create an understanding of what these new roles and responsibilities should look like. I’d say we’re in the middle of that evolution, to be honest,” she said.

The next step is to conduct a materiality assessment, “which is basically a requirement and will be soon if you operate in the European Union,” Haney noted. Steelcase performed an internal materiality assessment in 2015 and contracted a Big Four consultancy to perform one every three years thereafter.

Likewise, Babylon brought in an external consultant to perform a materiality assessment six months to a year before formalizing its ESG program. From there, the company began benchmarking competitors.

“Competitors will have similar risks and issues to what you have,” he advised. “Understand what they are reporting on, what they are talking about, and then understand your specific issues to address and prioritize.

“Remind yourself that ESG risk is a business risk.”

[ad_2]

Source link