[ad_1]

Despite making up just 0.2 per cent of global land mass, Malaysia is one of the world’s richest countries in terms of biodiversity per unit area, second only to Indonesia in Southeast Asia.

Many sectors are sustained by the country’s provision of ecosystem services, like healthy soils, clean water, pollination, and a stable climate. Any disruption in these services can directly impact the financial standing of businesses in highly nature-dependent sectors, like agriculture, fishing and forestry, construction, electricity, and water utilities.

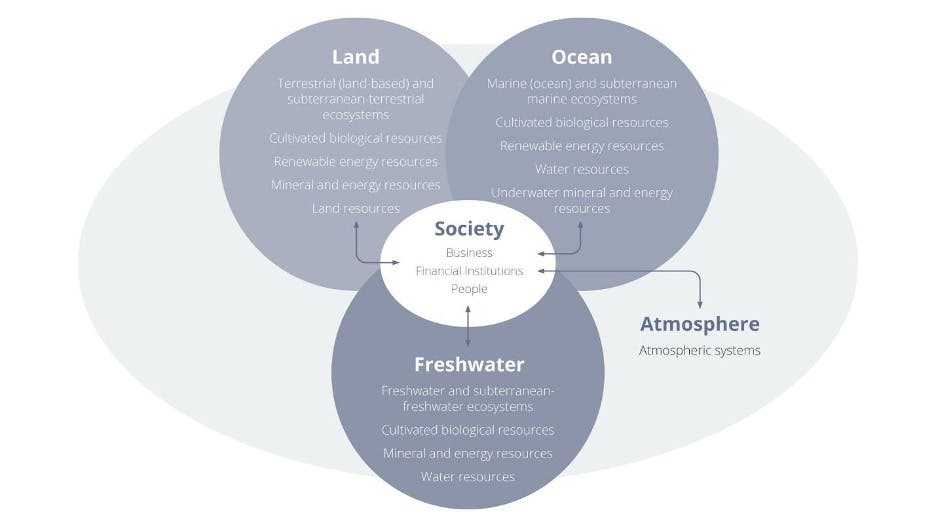

Environmental assets by the four realms of land, ocean, freshwater, and atmosphere, as outlined by the Taskforce on Nature-related Financial Disclosures framework. Source: TNFD, adapted from United Nations (2021) System of Environmental-Economic Accounting – Ecosystem Accounting

According to a World Bank report, Malaysia alone could face a 6 per cent annual loss of gross domestic product by 2030 under a partial ecosystem collapse scenario – which refers to a decline in select ecosystem services such as forests, fisheries, and pollinators – relative to the baseline scenario.

A separate study by the World Bank and Bank Negara Malaysia (BNM) found that Malaysian banks – which as of June 2023, have total assets of RM 3,425 billion – are exposed to a broad range of nature-related physical and transition risks.

More than half of the commercial loans portfolio analysed is exposed to highly nature-dependent sectors, which makes Malaysian banks vulnerable to physical risk from deterioration of ecosystem services. 87 per cent of the commercial loans portfolio is also exposed to sectors that significantly impact ecosystem services, increasing the potential level of transition risk for banks from changes in regulations and policy.

There is growing concern among many Malaysian corporations that the loss of natural ecosystems could destabilise operations that are directly or indirectly dependent on nature and its services.

According to WWF Singapore’s Sustainable Banking Assessment last year, while Malaysian banks recognise nature-related risks in their client activities, this recognition does not translate into the integration of risks into their policies. Examples of these policies include adopting the No Deforestation, No Peat and No Exploitation (NDPE) commitments, avoidance of key biodiversity and protected areas in operations, and performing water stewardship.

Businesses will also need to prepare themselves for the incoming wave of nature-related risk reporting standards.

The Taskforce on Nature-related Financial Disclosures (TNFD) has developed a framework for companies to integrate nature into their business and investment activities. Like its globally used counterpart, the Taskforce on Climate-related Financial Disclosures (TCFD), TNFD is expected to become the baseline standard for the reporting of financially material nature-related risks.

Meanwhile, CDP’s climate questionnaire now includes biodiversity-related questions, and the Global Reporting Initiative (GRI) is set to publish its revamped Biodiversity Standard this year. The International Sustainability Standards Board (ISSB), which launched its inaugural standards in June, has also made integrating biodiversity, ecosystems, and ecosystem services into reporting a key priority for the next two years.

Logistics firms who shared their insights at the workshop said they feel the urgency to better integrate ESG practices, but also emphasised how challenging it is to persuade their staff and internal stakeholders, especially if they are not client or supplier-facing, to be on board the ESG journey. Past studies have also shown that cost reduction continues to remain a key focus of supply chain management strategies.

From climate-related to nature-related risks

While listed issuers have become increasingly adept at assessing climate-related risks and integrating these risks into policies around financing activities, many are still in the early stages of considering nature degradation and biodiversity loss in their risk management frameworks.

Katia Bonga from World Business Council for Sustainability Development (WBCSD), a CEO-led organisation of over 200 international companies, said that in Southeast Asia, the majority of companies are just beginning their nature journey and focusing more on other issues like climate change, energy, and circular economy. But “the ambition is definitely there,” said the manager of the WBCSD’s Redefining Value team, who engages with global food retailers and suppliers to help them embed nature-related considerations into decision-making processes.

In 2022, 40 per cent of WBCSD’s Asia Pacific members increased the scope and ambition of their nature-related goals, said Bonga. “The good news is that companies that are already using or reporting on TCFD are well-prepared and have a head start in reporting on TNFD.”

Marianne Haahr, nature-related finance director of Global Canopy – one of the founding partners of the TNFD – added that the level of maturity in disclosing nature-related risks might be higher in some regulated industries, like mining and aquaculture, where Environmental Impact Assessments are part of licensing.

“For all industries, the readiness is higher for metrics which can be disclosed using repurposed physical climate risks data, which is the case for water-related metrics and water scarcity-related metrics,” said Haahr.

Nature loss and climate change are closely intertwined – nature loss reduces resilience to climate change, while climate change is a driver of nature loss. But measuring the impact of nature loss is more complex than climate change.

Climate change can be measured by and converted into the standard metric of carbon dioxide equivalents, and there exists a unified goal under the Paris Agreement to limit global warming to 1.5 degrees Celsius above pre-industrial levels. Meanwhile, nature loss has no single unit of comparison. TNFD’s recommendations include 15 core metrics and the recently negotiated Global Biodiversity Framework, which is committed to conserving nature, has 23 targets ranging from themes of land and water use to sustainable farming practices.

To make it easier for current TCFD users, the final TNFD guidance has built on many existing TCFD recommendations. For instance, it has retained the four pillars of Governance, Strategy, Risk Management, and Metrics and Targets, with Impact Management incorporated into Risk Management. TNFD has also adapted the notion of “scopes” in emissions reporting to the nature context, where Scope 1 refers to direct operations, and Scope 3 refers to upstream and downstream value chains, as well as financed activities.

Under TNFD’s six general requirements, organisations are required to disclose the timeline for when they aim to disclose on their full supply chain. “This is in recognition of the fact that for most organisations they will not be ready to account for all material nature-related risk in their direct operations, upstream and downstream already from when the framework is launched,” explained Haahr.

Assessing and analysing nature data

TNFD’s discussion paper released in March 2022 found that there is no shortage of nature-related data. Rather, there is a lack of understanding of how data can be used by decision-makers across sectors and geographies.

Unlike greenhouse gas emissions, which contribute equally to global warming regardless of which part of the world they occur in, nature-related impacts can vary significantly by location. Therefore, access to spatial data will be fundamental for an accurate assessment of a company’s nature-related impacts, as well as risks and opportunities.

Bonga shared that Asean businesses that participated in the consultation on the latest TNFD framework expressed concerns over the volume of data needed, challenges with acquiring location-based data, and collecting and disclosing across entire supply chains.

Currently, access to quality data on the state of nature is challenging as not all countries are collecting standardised and comparable data sets on the state of nature metrics such as soil health, primary forest extent, and eutrophication, Haahr said.

“In addition, asset geolocation data is a key challenge, as most companies either only disclose supplier lists or do not disclose any information on upstream suppliers at all. Many companies do not have full visibility of the exact source of origin of all ingredients,” she added.

For these reasons, understanding the spatial location of a company’s assets in context would be a challenge for report preparers and users in the near term, who will still need to rely on real-time data from third-party sources on top of corporate disclosures.

Initiatives such as Trase, which uses alternative data sources to map out supply chains of key commodities, and open source satellite data like EU Copernicus satellite data, are seeking to close this state of nature data gap.

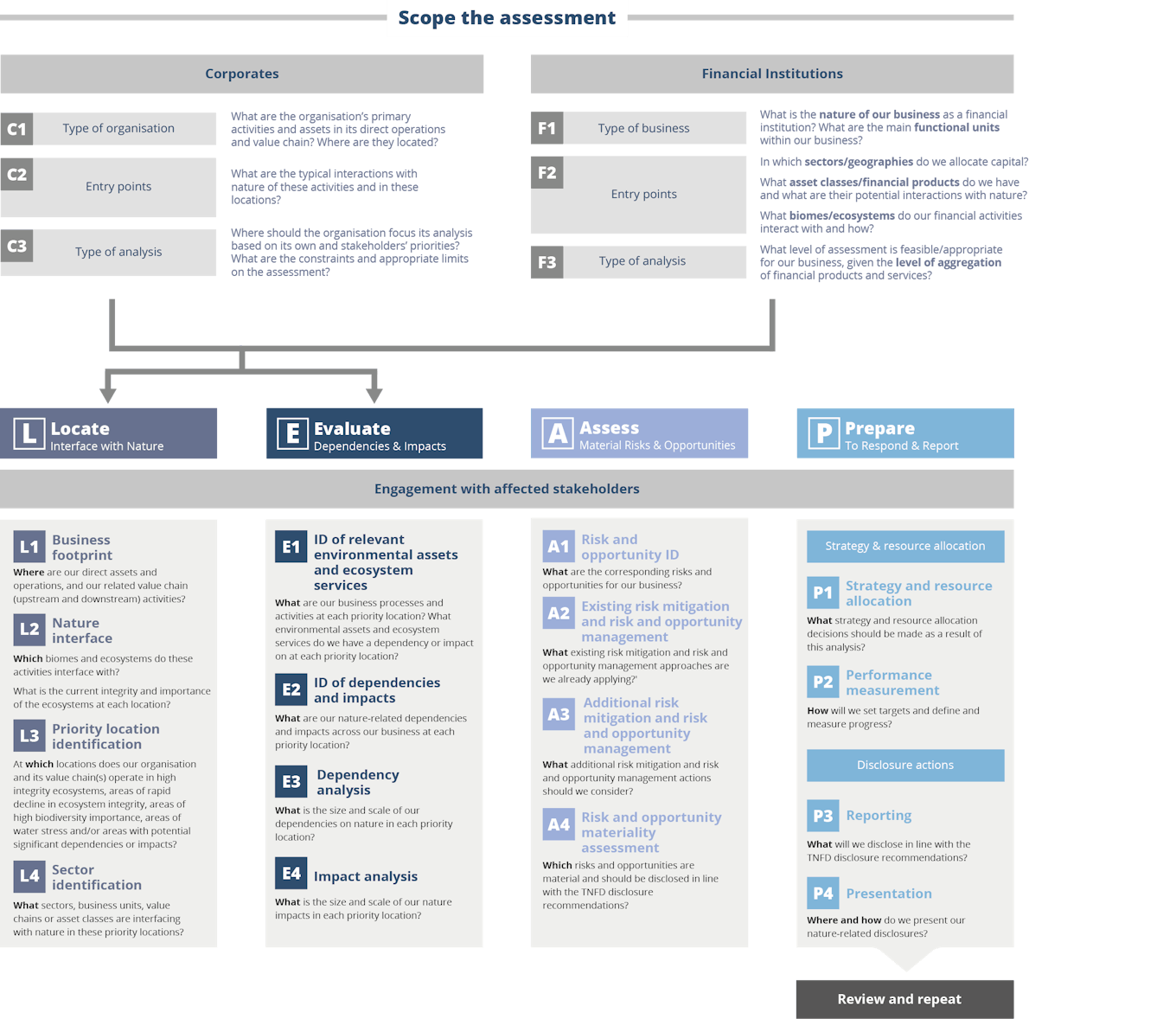

Building on its Nature-related Data Catalyst initiative launched in July 2022, TNFD has created an online catalogue of data and analytics providers that can support companies in the internal nature-related risk and opportunity assessment process. The LEAP (Locate, Evaluate, Assess, Prepare) approach is a step-by-step process for companies to locate interactions with nature, evaluate impacts and dependencies, and assess risks and opportunities, before preparing to manage and report on material risks.

“

The Leap approach for corporates involves four core phases of analytic activity:

- Locate your interface with nature (e.g. location of water extraction plants by a beverage manufacturer that operates water extraction plants drawing water from two different watersheds);

- Evaluate your dependencies and impacts (e.g. process of extracting water from a watershed impacts the health and resilience of the ecosystems in that watershed);

- Assess your risks and opportunities; and

- Prepare to respond to nature-related risks and opportunities and report

How to prepare for TNFD

While learning to measure and manage nature-related risks might feel overwhelming, the recommendation is for businesses to not let perfection be the enemy of good. There are high-level actions any company can already take, say experts familiar with the TNFD framework.

For example, based on learnings from the WBCSD-led TNFD pilot that 23 companies in high impact sectors took part in, entities can reference the LEAP approach, build on their existing work on nature and frameworks like TCFD and GRI, as well as ensure internal buy-in from C-suite executives to accelerate action.

The first step an organisation can take is to build nature literacy among executive leadership to understand the connection between business and nature, and the importance of embedding nature into its long-term strategy and decision-making. This includes a basic comprehension of the core nature-related terms and how they relate to impacts, dependencies, risks, and opportunities.

Secondly, companies should also begin to take stock of existing nature-related business activities.

“Start to look at data the organisation is already collecting for TCFD disclosures, mainly physical climate risks data and assess whether and how this can be repurposed for nature-related disclosures,” said Haahr. Examples of relevant data sets include water-related risks, carbon dioxide, nitrogen oxides and sulphur oxides emissions, as well as land use change emissions.

Companies should review existing nature-related policies, strategies, and commitments, and how well they align with the Global Biodiversity Framework, as well as identifying pre-existing risk assessments across the value chain that can be built on to assess nature-related financial risks and opportunities.

Thirdly, companies should utilise TNFD’s LEAP framework to identify where their assets and processes interface with nature in specific locations. To do so, companies can begin to develop a register of the key business activities and asset locations for both their direct operations as well as key upstream suppliers where possible. The more location-specific information companies have, the more accurate and informative the assessment of material nature-related issues will be.

Companies can develop and communicate their roadmaps for how the business will identify, disclose, and address nature-related risks and opportunities across the value chain as a core part of corporate strategy and operations going forward.

Organisations can evaluate their main impacts and dependencies by using tools like ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure), an open-sourced database launched as a collaborative effort between the UN Environment Finance Initiative and Global Canopy. After doing so, organisations can apply scenario analysis to translate these impacts and dependencies into physical and transition risks, before identifying their responses to the risks.

“

Case Study: Swiss Re

One of the world’s largest reinsurers Swiss Re began assessing biodiversity and nature-related risks through its environmental, social and governance (ESG) Risk Framework as early as 2014.Since 2014, Swiss Re started excluding businesses operating in UNESCO World Heritage Sites and protected areas, which include High Conservation Value forests, High Carbon Stock forests, wetlands protected by the Ramsar Convention, as well as IUCN list of protected areas and habitats for species on the IUCN Red List.

Nora Ernst, senior sustainability risk manager of Swiss Re, which is also a member of the TNFD, said that the reinsurer continues to be engaged in several ongoing activities, including the research and development in the nature front.

For instance, Swiss Re Institute developed the Biodiversity and Ecosystem Services (BES) Index in 2020 to assess which economic sectors and countries are most reliant on nature. This index has also been integrated into tools and solutions for Swiss Re’s clients, including CatNet, Impact+, and Swiss Re corporate Solutions’ Risk Data & Services Platform.

In 2021, the reinsurer started to systemically manage biodiversity and nature-related risks via its Agriculture, Food and Forestry policy. This means that Swiss Re will not provide business support to entities of projects that:

-Show a highly negative corporate biodiversity impact

-Operate in particularly exposed sub-sectors (e.g. palm oil or forestry operations) and do not comply with its sustianability certificate requirements

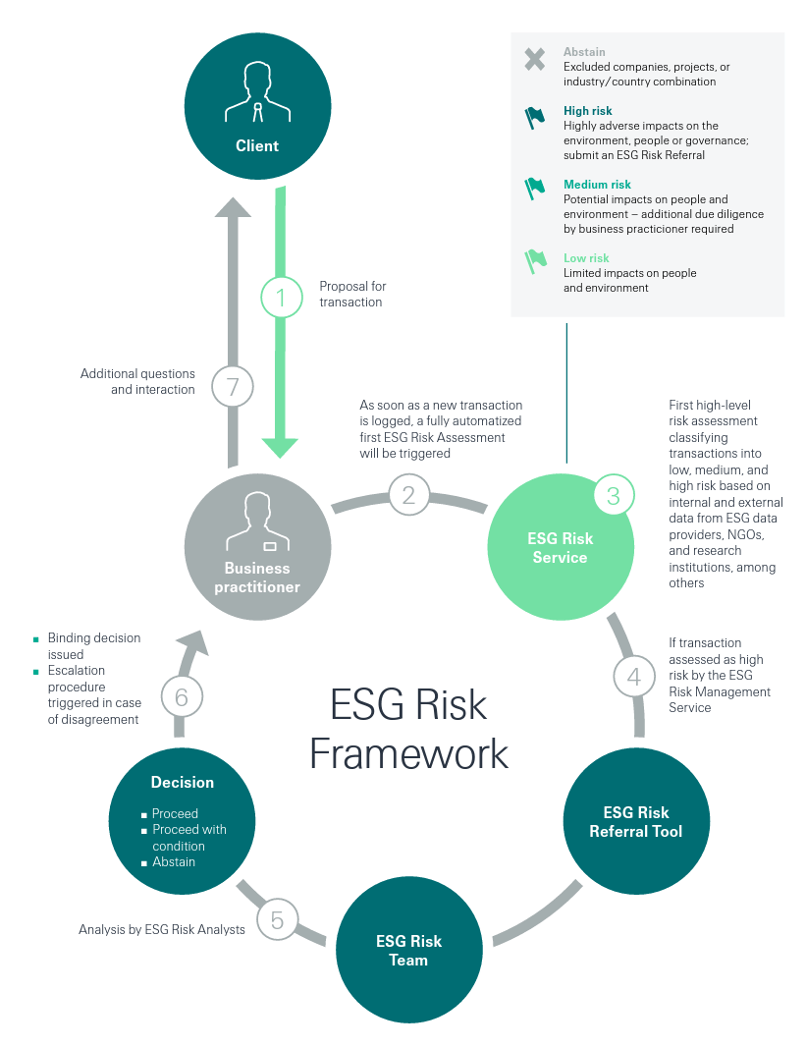

This flowchart shows how Swiss Re applies its ESG Risk Framework in practice.

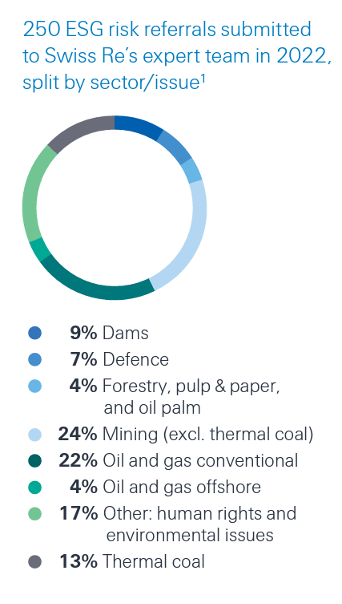

ESG risks referred to Swiss Re’s expert team in 2022, by sector and issue.

Swiss Re applies its ESG Risk Process through a due diligence process consisting of three elements:

- ESG Risk Service: As soon as a transaction is logged, a fully automated first high-level risk assessment will be triggered, classifying transactions into high, medium, and low risk.

- ESG Risk Referral Tool: Potentially high-risk transactions will be transferred to an in-house team of ESG risk experts to analyse and issue binding recommendations: to proceed, to proceed only with certain conditions, or to abstain.

- Appeals Procedure: In the event of disagreements, these recommendations can be appealed and escalated to the next management level, ultimately to the group chief risk officer and the group executive committee.

This article was first published on Bursa Sustain, Bursa Malaysia’s one-stop knowledge hub that promotes and supports development in sustainability, corporate governance and responsible investment among public-listed companies.

[ad_2]

Source link