[ad_1]

China is still appealing to investors as the cheap valuation and secular growth could provide better returns relative to other equity markets, head of research Shaun Cochran said. It is time for Beijing to address “absolutely reasonable” concerns and real risks in the economy, he added.

“For my mind, the bulk of the selling pressure has passed its strongest point because most people are already underweight,” he said in a Post interview. “I have never seen investors so negative on the outlook for China. I would rather have my money in a Chinese index than a US index” over the long term, he added.

Foreign investors sold about US$600 million worth of onshore stocks last week after another set of weak external trade data and a weakening yuan. They dumped US$12 billion worth of Chinese stocks in August, a record since the Stock Connect inception in 2014, according to official data.

“When faced with broad-based pessimism about China, some of which are absolutely reasonable, there are real risks and concerns that China has to address,” Cochran said. China’s core engines – exports, infrastructure and property – are all reaching “a point of maturity” and the transition to new sources of growth “could be slow and lead to more volatility”, he added.

Given the sell-off in recent months, investors will have to assess not only China’s fundamental outlook but also whether the downside is in the price. “The single greatest determinant of your returns is the price you pay for what you buy.”

China stocks lack earnings power, investors seek ‘substantive’ measures: BofA

China stocks lack earnings power, investors seek ‘substantive’ measures: BofA

The MSCI China is now trading at a price-earnings multiple of 10.5 times current earnings, according to data compiled by Goldman Sachs. The PE ratio is the lowest since 2018, and compares with a five-year average of 13.4 times. Stocks in India, the current emerging-market favourite, trade at about 23.8 times.

“The market looks forward to this and says, well, India is the next great story of Asia, and in many respects it is absolutely right,” Cochran said. “However, India is famous for trading at high multiples, because everyone knows, understands and loves this story.”

China’s timid stimulus hurts stocks as funds flee to India, Japan, US assets

China’s timid stimulus hurts stocks as funds flee to India, Japan, US assets

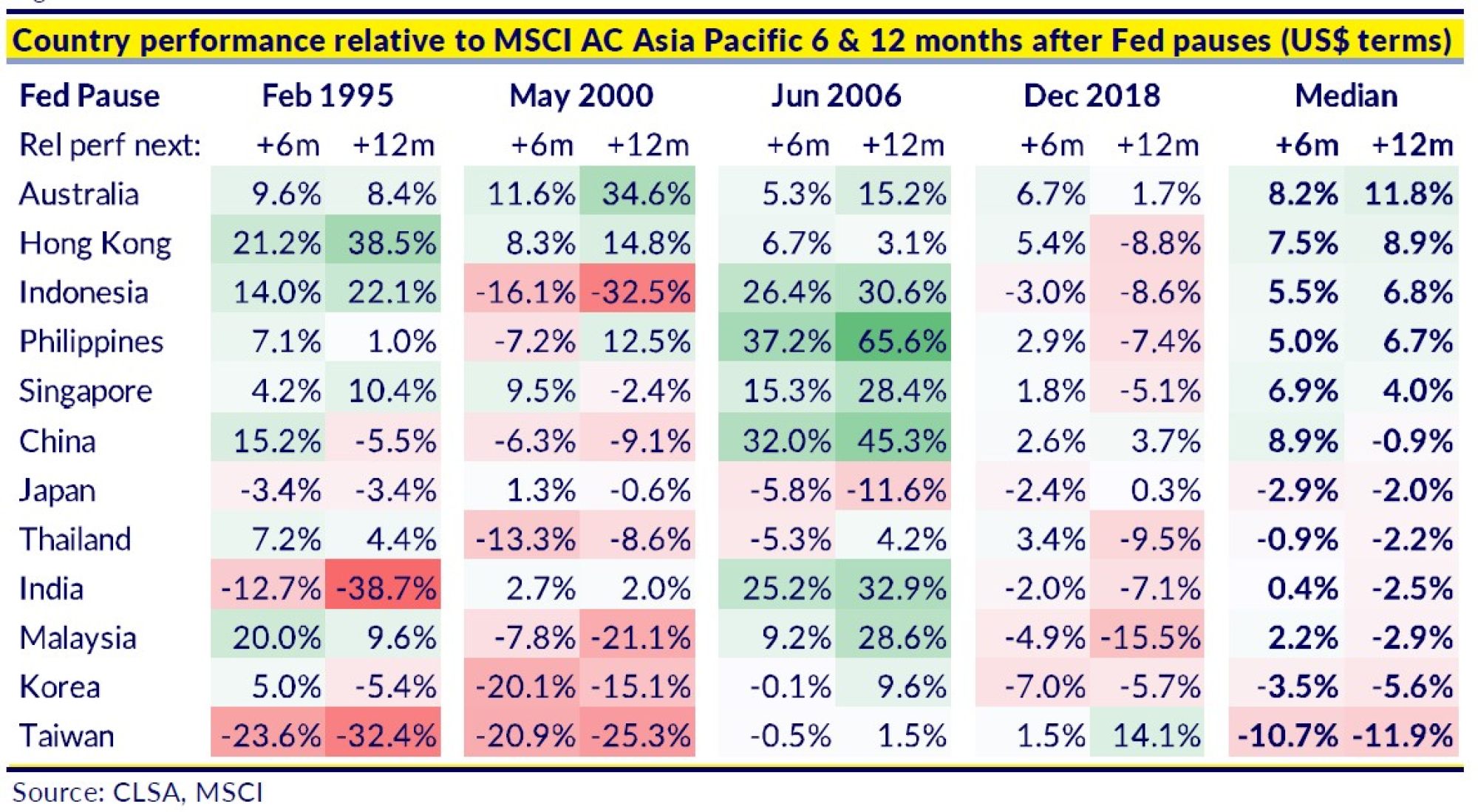

Mainland stocks rose by 8.9 per cent six months after Fed policy pauses, based on median returns over four such occasions in February 1995, May 2000, February 2006 and December 2018, according to CLSA. Stocks in Hong Kong climbed 7.5 per cent over the same time.

Cochran said China does not necessarily need to lead the next emerging-market cycle to participate in it as “we have to separate leadership of a cycle from whether or not something is an attractive investment”.

China is still a current account surplus economy, which means the massive savings need to find a place to be deployed.

“Safe and sophisticated products, fintech, new insurance products – there’s all sorts of financial services innovation that can come to compete for that pool of savings,” Cochran said. “Healthcare is a massive opportunity for China with its rapidly ageing population. Even the dreaded semiconductor challenge is also an opportunity.”

[ad_2]

Source link