[ad_1]

Business travel is the second highest expense for companies, coming in just behind payroll and perks. But how do these travel expenses and experiences differ between businesses? And what trends and behaviors are currently commonplace in business travel?

- How regularly do business travelers travel

- Business travel by company size

- Geographical influences on business travel

- International vs domestic business travel

- How much do companies spend on business travel?

- Which aspects of business travel are most commonly booked by companies?

- Why do employees travel for business?

- Conclusion

- Methodology

- Sources

Booking.com for Business has taken a closer look at the behaviors of business travelers through research and surveys aimed at small to mid-sized companies, in the US, UK and Germany. With this information, we can build a clear picture of prevalent trends in this particular type of corporate travel.

Understanding how and why different businesses embark on travel not only helps to identify future travel predictions, but also uncovers trends in spend, which businesses can compare their own budgets and behaviors to.

According to current trends, despite business travel having been put on pause for a few years, business trips are back on the agenda and as relevant as ever. So what variables enable some businesses to travel more often than others?

How regularly do business travelers travel?

The number of business trips undertaken annually by our sampled small to mid-sized businesses (SMBs) changes depending on a few factors – including firm size, location, and whether the travel is international or domestic.

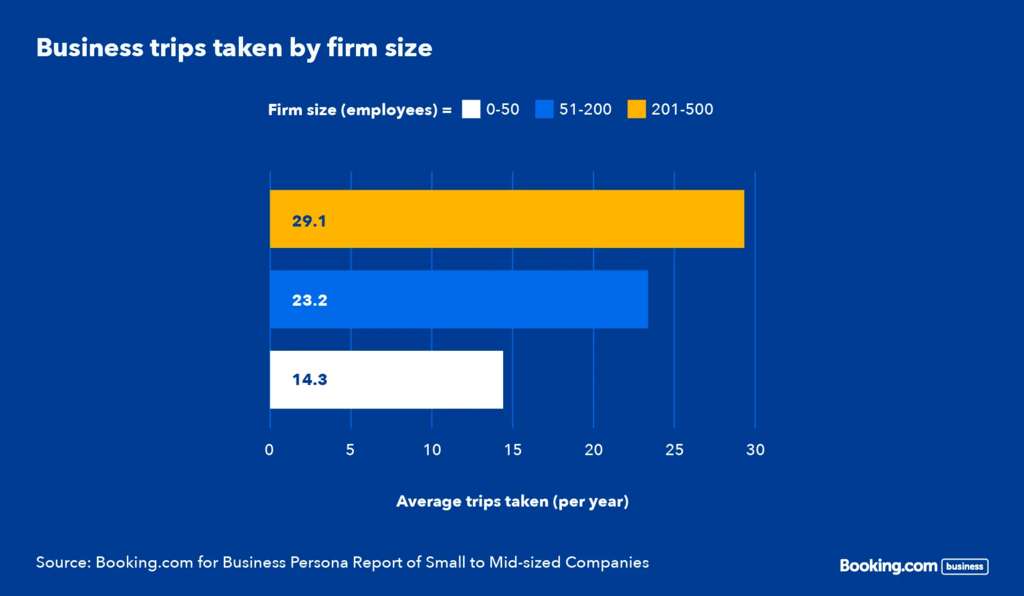

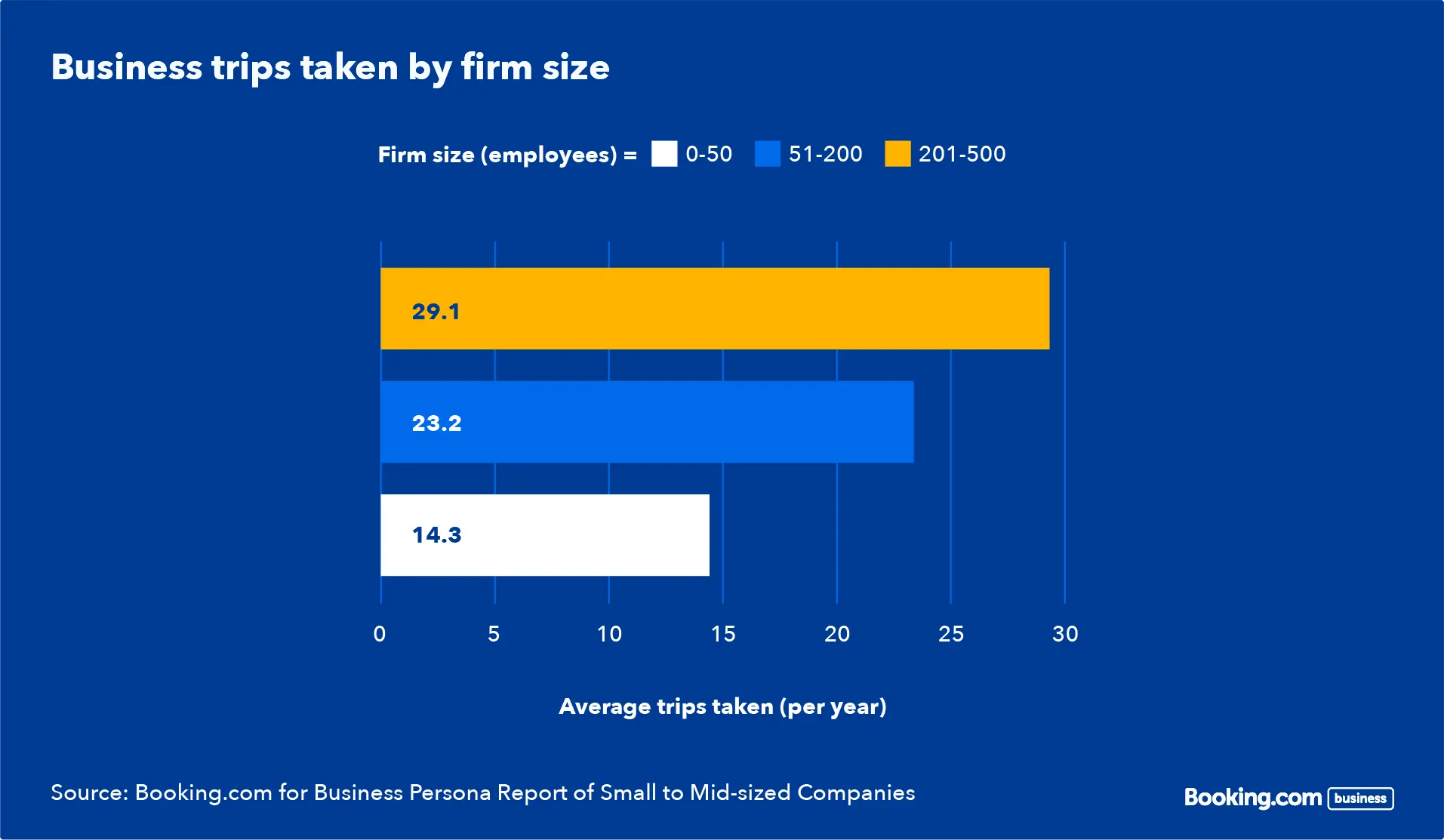

Business travel by company size

The average number of annual trips varies significantly depending on the size of the business. For firms employing between 201 and 500 people, the average number of business trips a year is 29.

At the other end of the scale, small businesses that employ 50 people or less only average 14 business trips a year – this suggests that the larger the firm, the more business trips per year. Reasons for this could include having more of a travel budget to play with, or more prospects that need a high level of attention with a personal, face-to-face touch.

Geographical influences on business travel

Does geographical location play as big a role in the regularity of business travel as business size?

Based on responses to our survey, the UK is traveling the most, with an average of 23 trips a year, and the US isn’t far behind with 22, whereas the average German SMB employee travels less, with an average of 18 trips per year.

While the UK is reported as having 5.5 million private sector businesses, only 0.7% of these have 50-249 employees, and an even smaller 0.1% have 250+ employees. The bulk of these businesses (5.47 million) have 0-49 employees. This means that while the UK is traveling the most, a lot of these business trips could be carried out by a very small number of employees or solopreneurs, as 1.4 million of these SMBs have employees and 4.1 million have no employees.

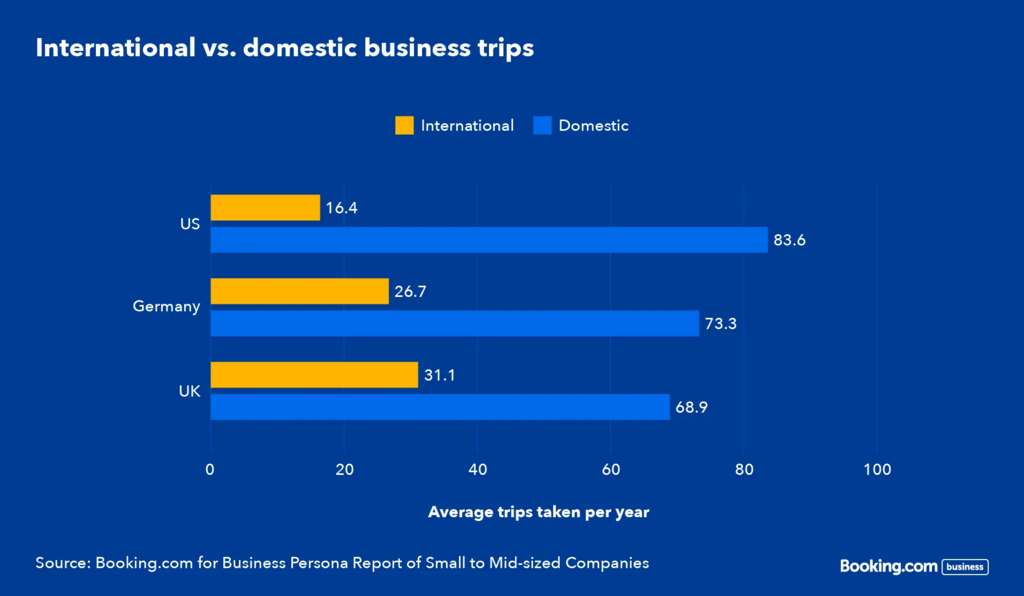

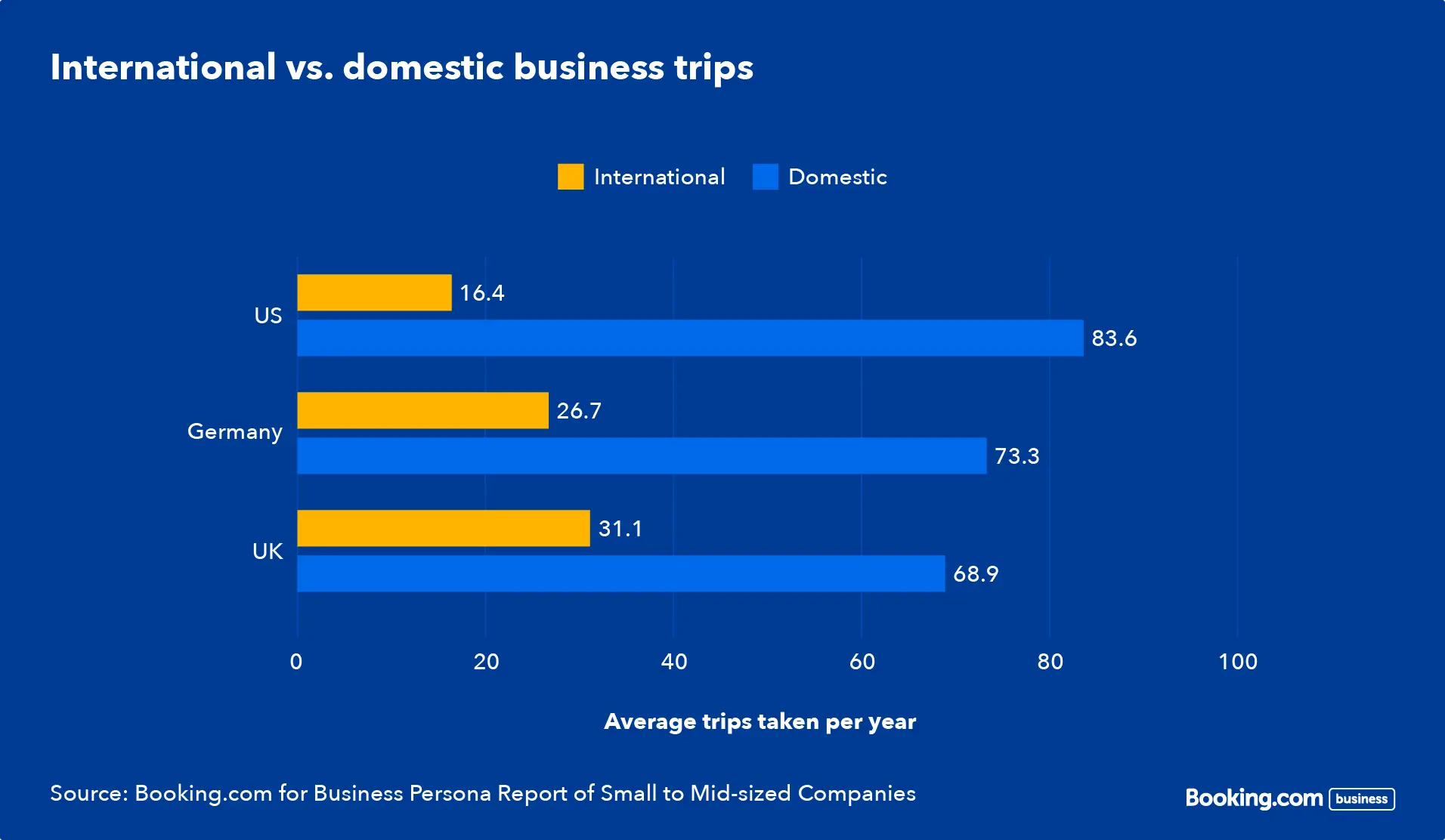

International vs domestic business travel

Looking at how far afield these business travelers are venturing, the responses to our survey show that of the participating firms, UK businesses are taking more international trips (meaning trips that cross national borders) than those in the US and Germany.

Across the US, UK and Germany the majority of annual business trips embarked on by small and mid-sized companies are domestic – though workers from the UK seem to get abroad the most, and travel domestically the least.

The US has the biggest difference in the frequency of international vs domestic trips – with domestic travel five times higher, on average, than international. In general, the business culture in the US tends to be more focused on domestic markets as it is home to a diverse range of industries. When you consider that the US is nearly the same size as the whole of continental Europe, this also reduces the need for traveling outside of the country for business.

With so many countries in close proximity to each other, international travel is not only more accessible in Europe, it is almost essential – a single European country isn’t likely to be home to the variety of businesses and industries that the US is. This is especially true for countries that rely heavily on “pre-internet” industries such as manufacturing. So, working in a UK or Germany-based business might heighten the likelihood of needing to travel internationally for business, compared to a role based in the US, due to the need to look further afield for diverse industry partners.

Overall, the data suggests that when it comes to domestic travel, US businesses at the larger end of the small to mid-sized scale are racking up the most miles. In contrast, when looking at international travel, smaller UK companies are leading the way.

These numbers are likely heavily influenced by not just the size of the businesses, but also the industrial landscape of a business’ country of origin. This detail dictates how far a business may have to travel – whilst the size of a business contributes to how frequently they can afford to make those journeys, based on annual travel budgets.

How much do companies spend on business travel?

When looking at how much is spent on business travel, the idea that the larger the business, the more is spent, is a reasonable assumption to follow – and the data seems to support this.

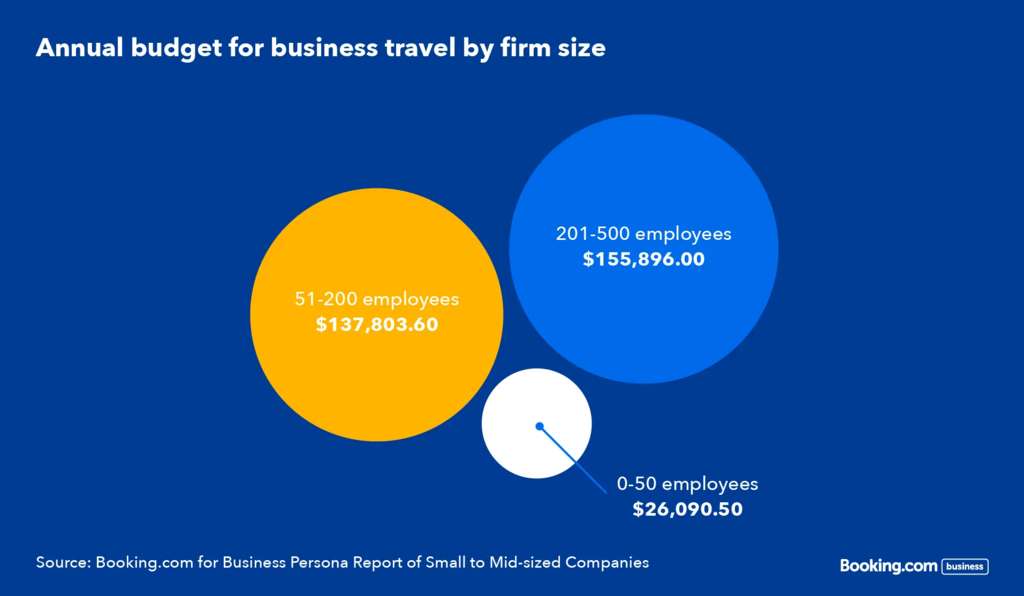

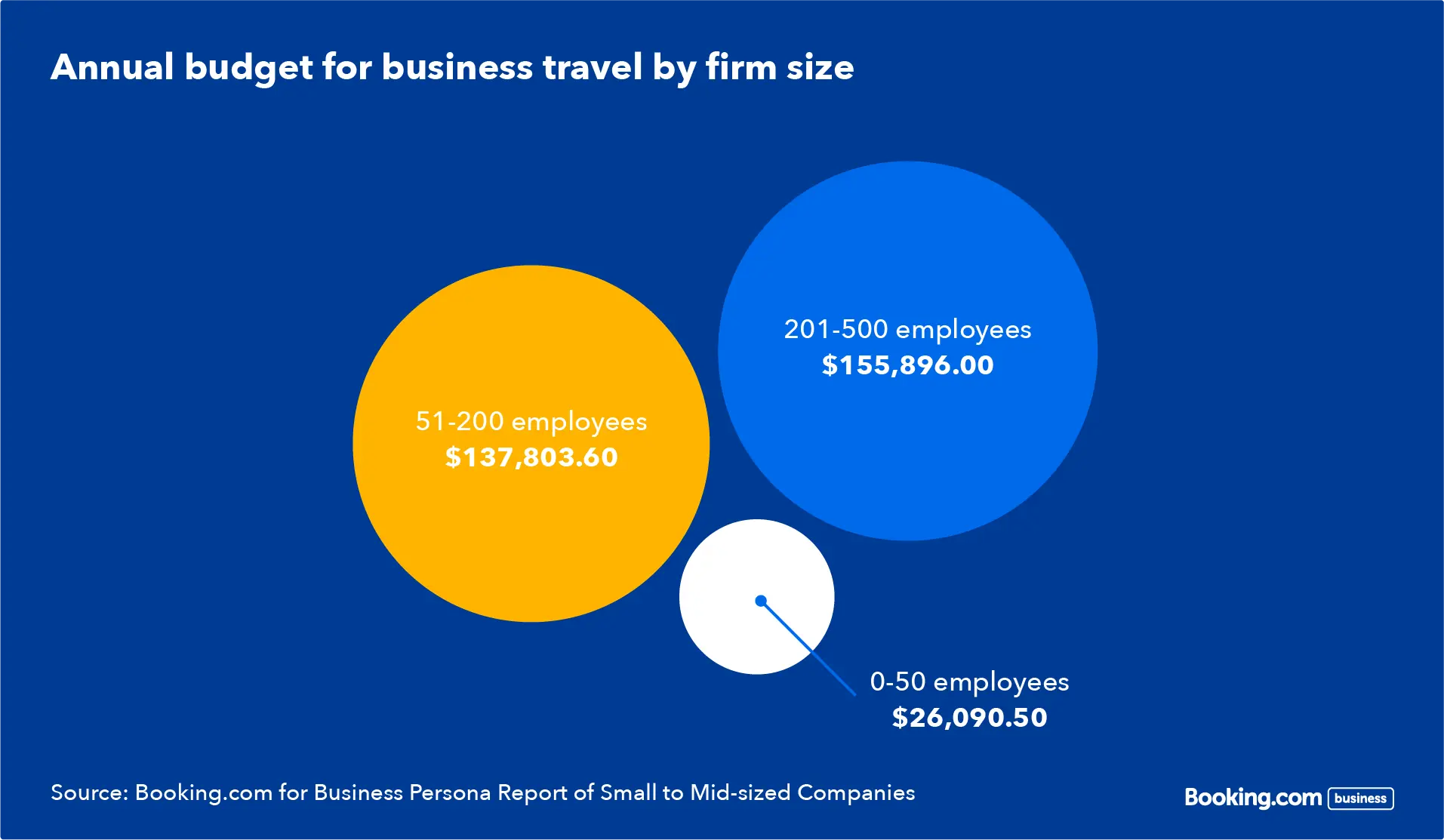

Companies of 51-500 employees reported a rough annual budget of somewhere between $137,803.60 to $155,896 a year for business travel, based on our sample analysis. The smaller companies of 0-50 people are only assuming a budget of just over $26,000 over the same period, over $100,000 less.

With smaller budgets to contend with, small businesses might be likely to find business travel management more complicated. They may lack the funds to travel comfortably by booking better flights and hotels, or be working in a team that is too small for the appropriate amount of stress-alleviating delegation. Small business owners, a large proportion of the 0-50 employee firms, are likely more in need of great deals than other survey participants, based on their smaller annual spend.

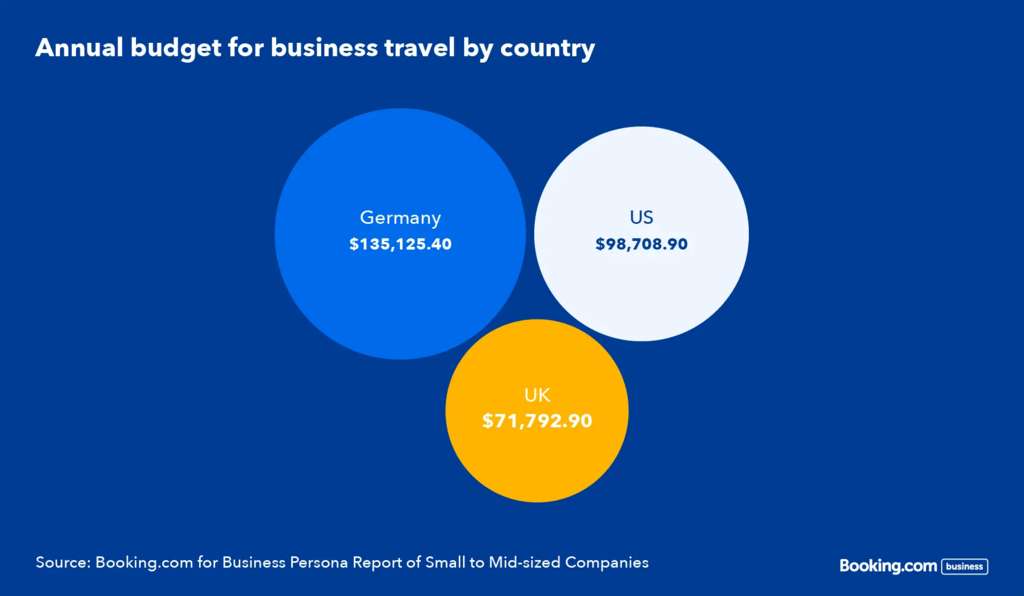

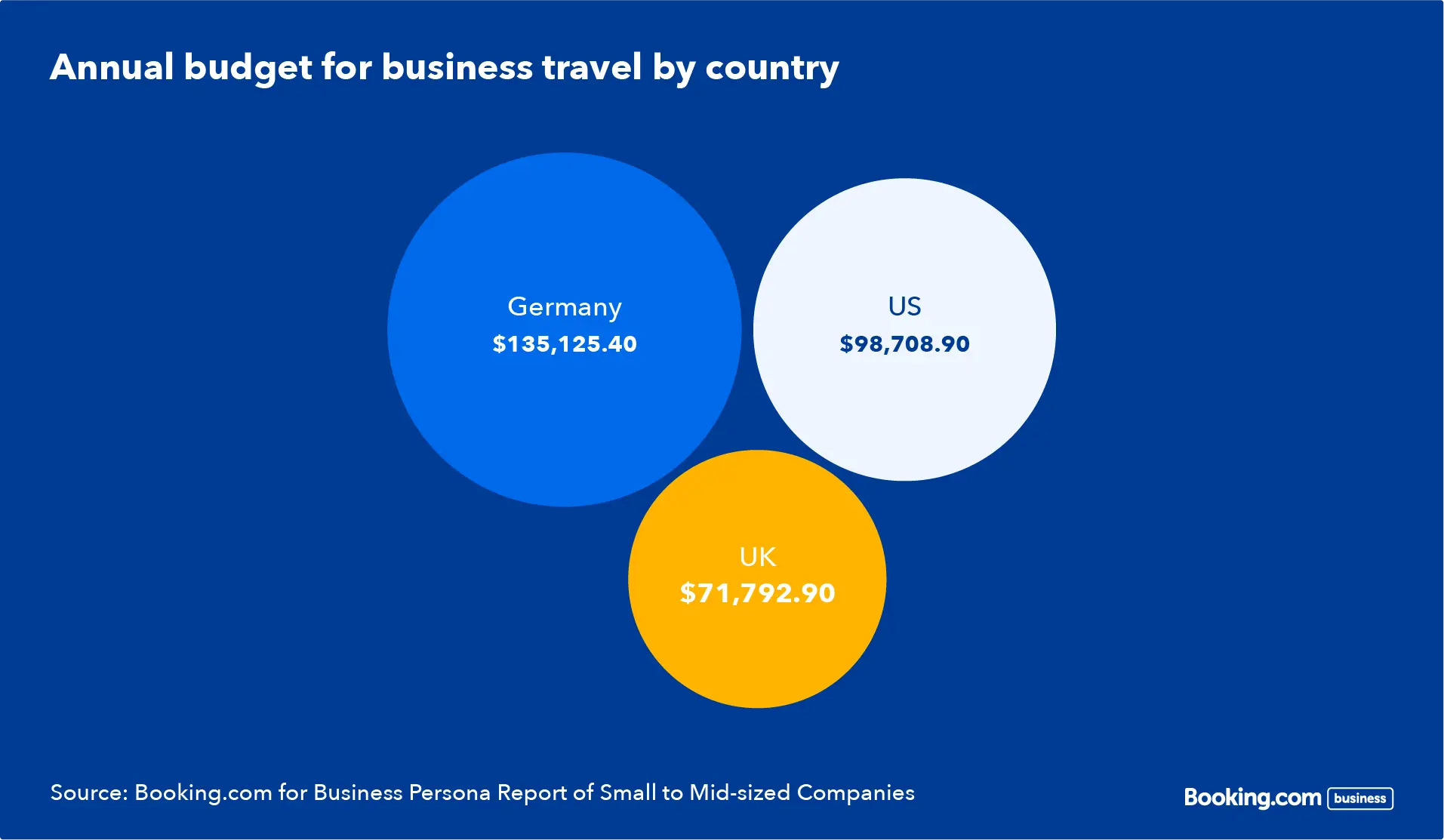

This could also explain why UK SMBs have a smaller average annual budget for business travel than the US and Germany – due to the larger number of smaller firms. In fact, there are significant differences in how small to mid-sized companies from different countries spend money on business travel.

While we discovered earlier that German employees take fewer international business trips than the UK, and fewer domestic trips than the US, SMBs in Germany are simultaneously spending the most. A German SMB’s annual travel budget averages at $135,125.40 annually, far more than the US ($98,708.90) and UK ($71,792.90).

This could be for a variety of reasons, including each country’s popular business travel destinations and the quality of flights and accommodation booked.

Which aspects of business travel are most commonly booked by companies?

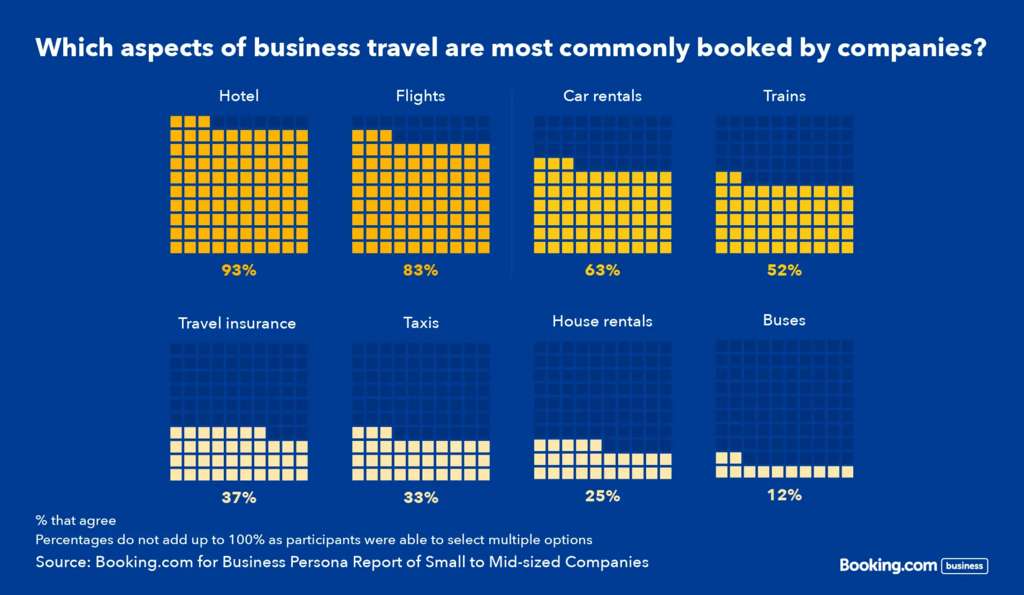

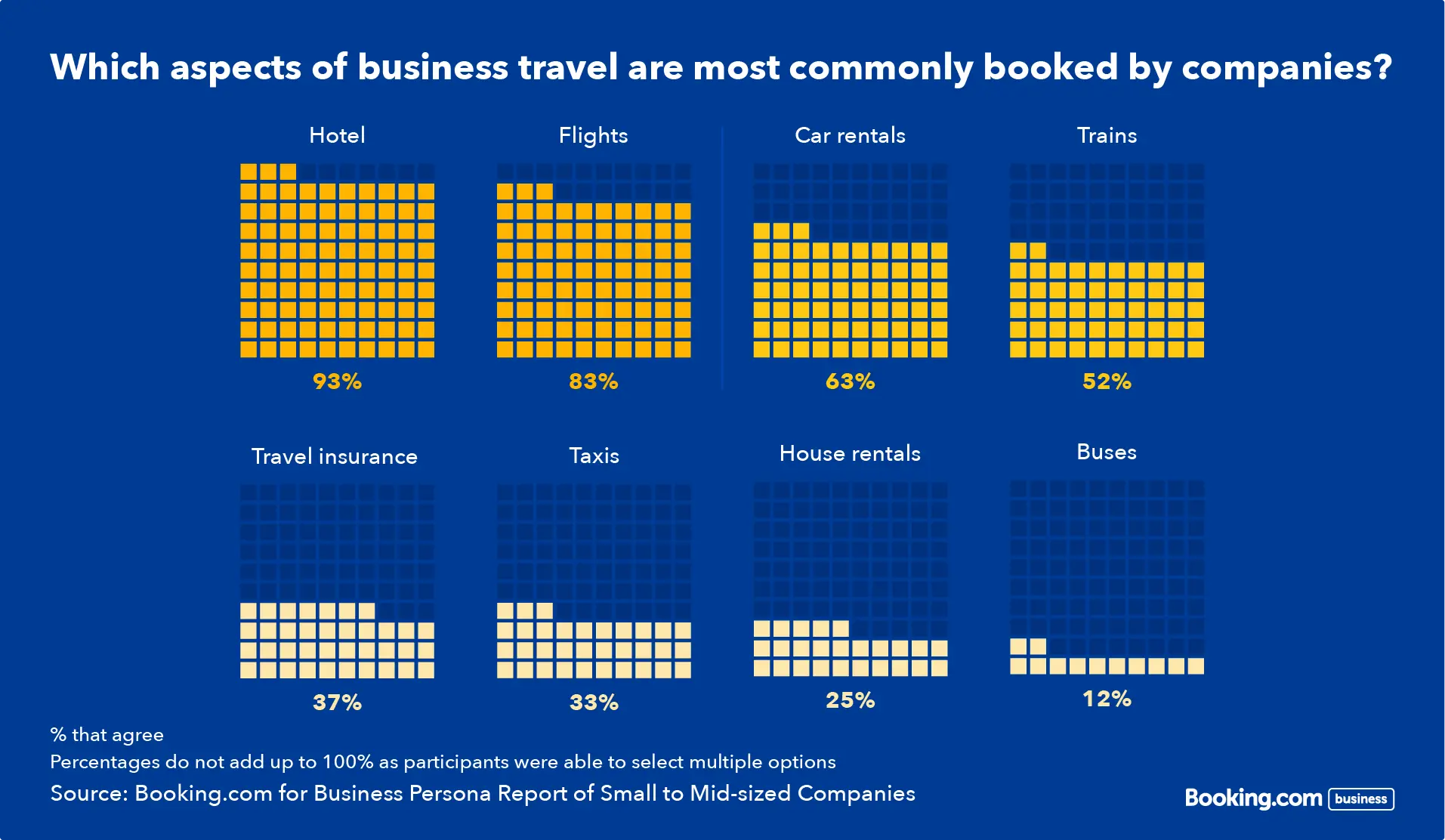

When asked what they spend money on as part of business travel, 93% of small to mid-sized businesses agree to spending on hotels, making them the most common expenditure of business trips.

Flights are agreed on as the second most common expenditure of business travel (83%), followed by car rentals (63%) and trains (52%). Only 12% of small to mid-sized companies spend money on buses as part of their business travel, perhaps needing their transportation to be more direct, reliable and time-efficient. This would explain the higher percentage of these businesses spending money on taxis (33%).

Based on our participants’ responses, an average of $102,495.40 a year, per business, is thought to be spent on business travel. It’s possible that this expense could be reduced with better business travel management tools, to allow for booking early to secure better deals and special business rates on these most common expenditures. But what makes business travel so invaluable that it can justify the expense?

Why do employees travel for business?

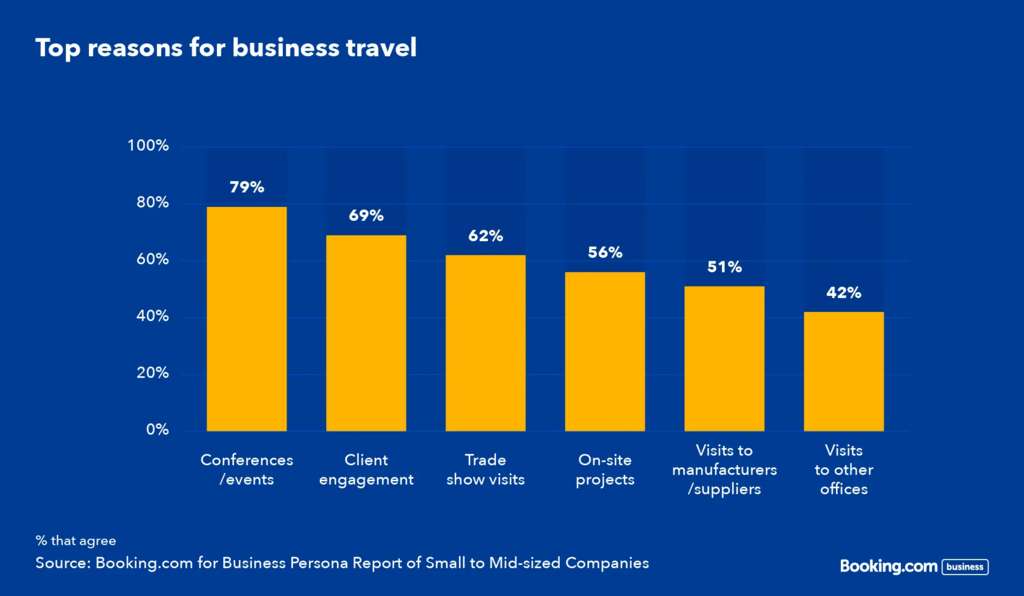

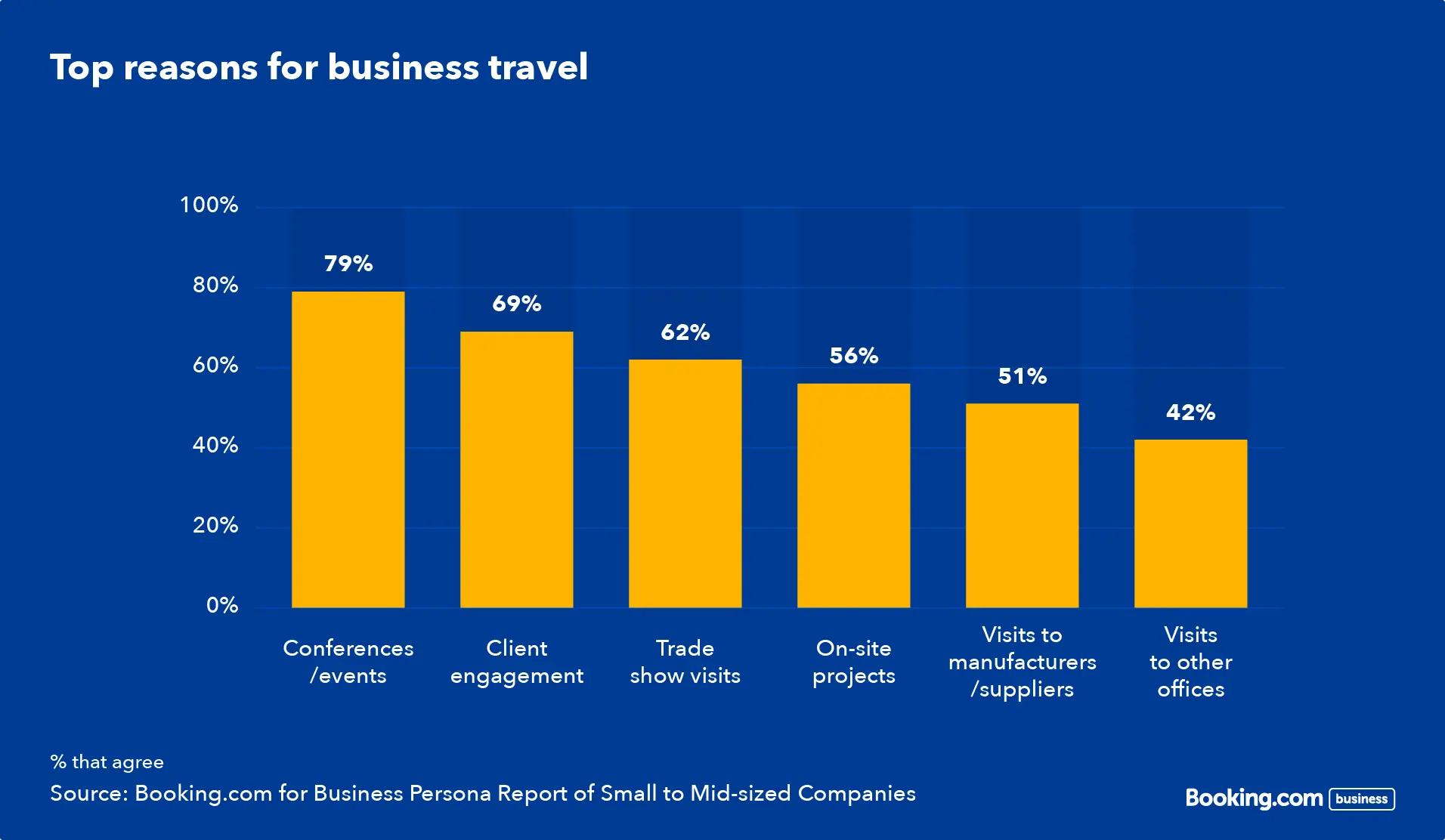

The most popular reason SMBs have for spending on business travel in the US (87%) and the UK (80%) is conferences and similar events, whereas in Germany it’s trade show visits (76%).

However, when looking at the overall breakdown across all countries surveyed, conferences and events are still the leading factor, with 79% of respondents from a small or mid-sized company planning business travel with those gatherings in mind.

Client engagement was the second most popular reason for business travel, with 69% of small to mid-sized businesses agreeing that it’s one of the main reasons for their work trips.

For first impressions and networking, traveling for conferences and trips focused on client engagement are essential. Even following the distance enforced by the pandemic, the importance of face-to-face communication is still clearly felt among businesses worldwide. This is because they allow for more effective and successful communication than online interactions.

However, visiting other offices and interacting in person with fellow employees seems to be less of a priority for small to mid-sized companies – where having other offices may not be applicable – with only 42% of respondents citing it as a reason for business travel.

Conclusion

Business travel continues to prove itself to be both resilient and vital for small and mid-sized companies, with travel costs currently the second-largest expense for businesses, behind only salaries and perks.

Firm size does appear to directly correlate with the number of trips taken per year, and the money spent on them – with larger SMBs travelling more and spending more annually. For UK-based businesses in particular, where there are more small businesses, the ability to travel easily and cost-effectively is likely to be of priority.

However, the correlation between trips taken and money spent isn’t always clear cut, as we saw with the amount the average German SMB is spending per year. This suggests that companies from different countries may have different travel styles and priorities, and that there is a disparity in the amount of money spent on travel components such as flights and hotels.

With the proper support to keep business travel cost-effective and smooth, firms of all sizes might be able to travel more frequently and effectively, and go on to flourish as a result. Corporate travel managers and business travel management platforms and software may be the solution for any businesses struggling to stay on top of their travel requirements.

Comparing the behaviors of your firm to the trends showcased here may highlight areas in need of observation, and even optimization – and ultimately could benefit your profit margins.

Methodology

Booking.com for Business conducted a 15 minute quantitative online survey in 2022 with 604 travel management decision makers across 3 markets (US, UK and Germany), and both managed and unmanaged micro businesses with 2 – 50 employees, small businesses with 51 – 200 employees and medium business with 201-500 employees.

Survey questions included the businesses current processes and challenges for booking business travel, why they book business trips, how much the business (split by market where relevant) spends on business travel, and the features each business size wants and needs in a travel management platform. The responses were then analyzed to showcase the travel frequency of different business sizes and job positions both domestically and internationally, as well as spend across each of the core markets, firm sizes and job positions.

Sources

- INC: Report of business travel expenses

- Booking.com for Business future business travel predictions

- Gov.uk: Composition of the 2022 UK business population

- Forbes: Post-Pandemic: Online Vs. In-Person Networking

About Booking.com

Part of Booking Holdings Inc. (NASDAQ: BKNG), Booking.com’s mission is to make it easier for everyone to experience the world. By investing in the technology that helps take the friction out of travel, Booking.com seamlessly connects millions of travellers with memorable experiences, a range of transportation options and incredible places to stay – from homes to hotels and much more. As one of the world’s largest travel marketplaces for both established brands and entrepreneurs of all sizes, Booking.com enables properties all over the world to reach a global audience and grow their businesses. Booking.com is available in 44 languages and offers more than 28 million total reported accommodation listings, including more than 6.6 million listings of homes, apartments and other unique places to stay. No matter where you want to go or what you want to do, Booking.com makes it easy and backs it all up with 24/7 customer support.

Follow us on TikTok, Instagram and Twitter, like us on Facebook, and for the latest news, data and insights, please visit our global media room.

[ad_2]

Source link